An important yet counterintuitive issue recently is that long-term interest rates have risen in recent weeks despite the Fed’s latest cuts. The question is: Why Are Interest Rates Rising Amid Fed Cuts?

The 10-year U.S. Treasury yield, for instance, has jumped from a low of 3.62% to as high as 4.40%. This is due to strong economic data and inflation expectations around the election, both of which push longer-term rates higher. At the same time, rates have swung in either direction for much of the past few years, often without notice. Looking ahead, how might uncertainty around interest rates impact investors?

Interest rates affect many parts of our lives, both directly and indirectly. Households are directly impacted when the cost of borrowing increases, which affects mortgages, credit cards, auto loans, and more. Many consumers experienced whiplash when borrowing costs jumped suddenly in 2022, after growing accustomed to ultra-low rates over the prior decade. On the flip side, rising interest rates can result in higher yields on bonds, savings accounts, certificates of deposit, money market funds, and more.

The economy continues to grow at a steady pace

When it comes to the broader economy and financial markets, the effects can be more subtle. Higher rates increase the “cost of capital” for businesses, which can slow hiring, impede expansion plans, and reduce profitability. For the stock market, rising rates can theoretically reduce the value of future cash flows, reducing stock prices today. Higher rates can also make existing bonds less valuable, since newly issued bonds will offer higher yields. Thus, for investors, interest rates can have wide-ranging effects on portfolios.

What’s driving rates today? Unlike short-term rates which are influenced primarily by Federal Reserve policy, long-term interest rates are sensitive to economic trends. Fortunately, recent economic figures suggest the economy continues to grow at a steady pace. The latest GDP report showed that the economy grew 2.8% in the third quarter. While this was slightly below expectations, consumer spending remained exceptionally strong. Some economists worry this could reverse as consumers spend down their excess savings and debt levels rise.

Recent jobs data have been more mixed. The jobs report immediately following the Fed’s September rate cut showed that 254,000 jobs were created that month, a blowout figure. This is one reason rates began to rise since a strong job market means the Fed may not need to cut rates as quickly to support the economy. In other words, the Fed could be achieving a so-called “soft landing” even with higher rates.

Job growth has slowed from a historically strong pace

However, the latest jobs numbers for October show that only 12,000 jobs were added last month – the lowest monthly figure since 2020. There were also significant downward revisions to prior months, lowering the September figure to 223,000. The Bureau of Labor Statistics cited strikes among manufacturing workers and the recent hurricanes in Florida as likely dampeners in the report, although the exact impact is difficult to determine from the survey data. For this reason, the market’s initial reaction was to look beyond this single data point.

The jobs numbers matter because they are of growing importance for Fed decision making. As inflation rates continue to fall back to more normal levels, hiring activity is what will affect households and everyday individuals.

Despite the recent poor data, the reality is that the job market has been exceptionally strong. Not only has the economy added 2.2 million new jobs over the past year, but the unemployment rate is only 4.1%. So, even if the economy does slow from here, it would be from an unusually healthy level.

Thus, rising long-term rates are not unusual if they are due to a stronger economy. In fact, it can be normal for short-term rates to fall as the Fed cuts rates even as long-term rates climb higher. In technical terms, this results in a “steepening yield curve,” which typically occurs in the early stages of economic cycles. While it’s unclear if this will continue this time, it’s best not to overreact to these patterns.

Bonds still support portfolios despite higher rates

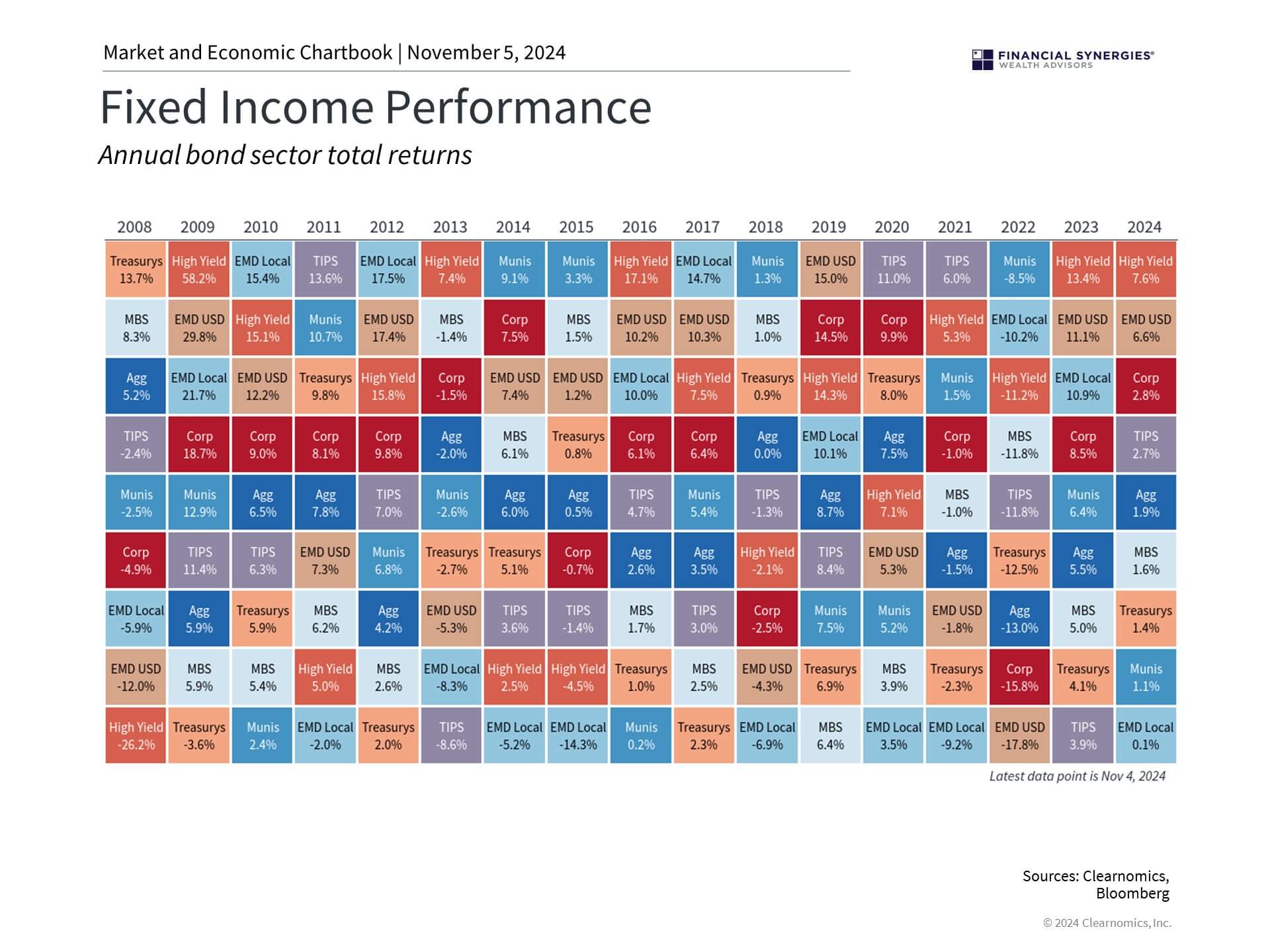

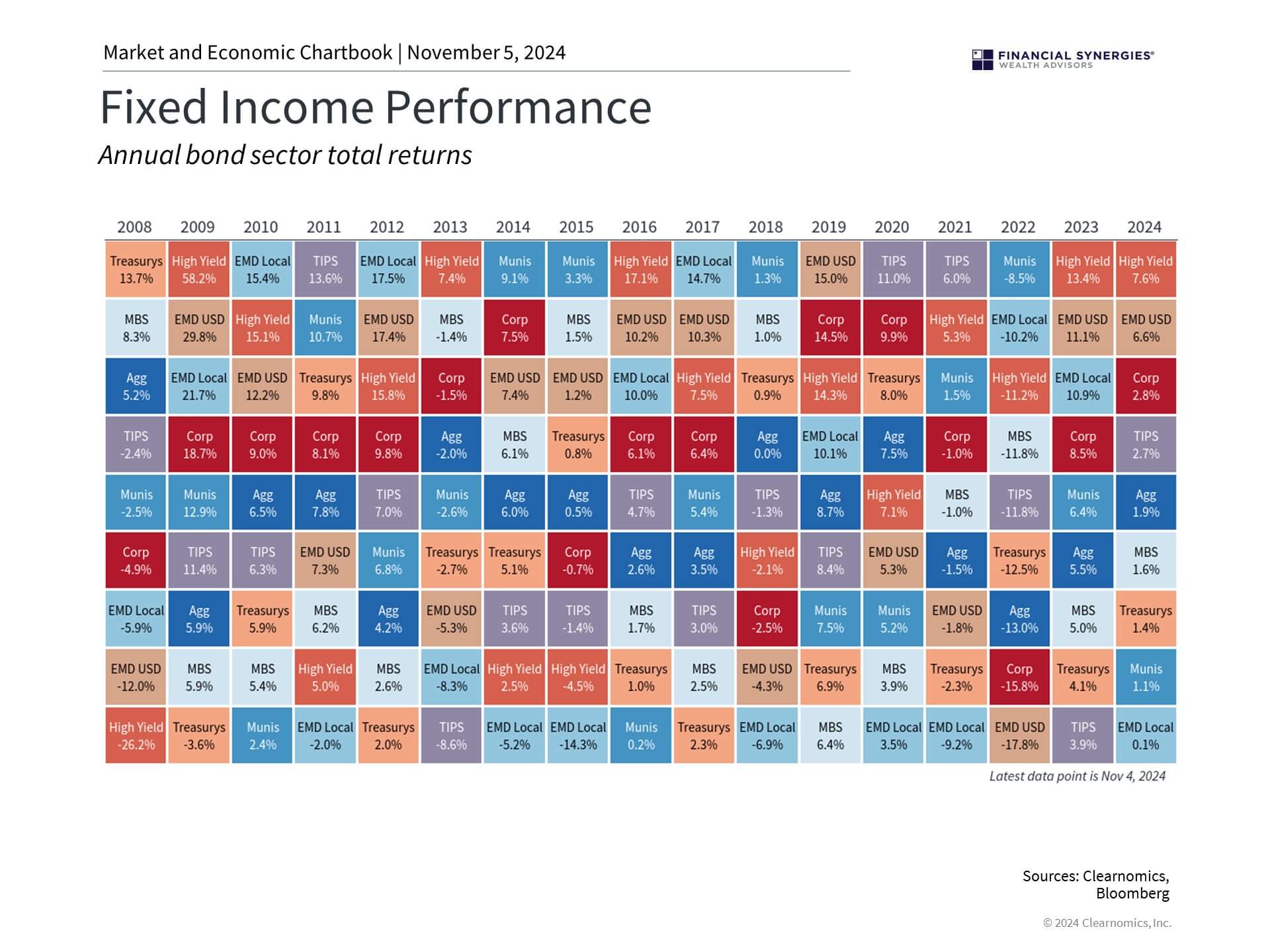

Interest rate uncertainty has affected bond prices with the Bloomberg U.S. Aggregate index gaining only 1.4% year-to-date. Returns across sectors this year range from 7.5% for high yield bonds to only 0.8% for munis. This is because the prices of existing bonds fall as yields rise since newly issued bonds with higher yields become more attractive to investors.

However, these swings have taken place multiple times this year as markets have adjusted to different economic trends. Additionally, many of these bond sectors are offering yields well above their long run averages. The yields on Treasury bonds are 4.3%, well above the 2.0% average since 2009, and investment grade corporate bonds are yielding 5.2%.

For all investors, bonds still play an important role in not only diversifying portfolios during periods of uncertainty, but in providing income. As the chart above shows, returns by different types of bonds can vary greatly from year to year. While it’s not clear exactly where rates may go next, investors should maintain a longer-term perspective. It’s important to diversify properly across a variety of fixed income sectors to help weather market volatility.

Concerns or questions about how your investment portfolio will hold up in the current market environment? Contact Financial Synergies today.

We are a boutique, financial advisory and total wealth management firm with over 35 years helping clients navigate turbulent markets. To learn more about our approach to investment management please reach out to us. One of our seasoned advisors would be happy to help you build a custom financial plan to help ensure you accomplish your financial goals and objectives. Schedule a conversation with us today.

More relevant articles by Financial Synergies:

Blog Disclosures

This content, which may contain security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own financial advisors as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blogs, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Financial Synergies Wealth Advisors, Inc. employees providing such comments, and should not be regarded as the views of Financial Synergies Wealth Advisors, Inc. or its respective affiliates or as a description of advisory services provided by Financial Synergies Wealth Advisors, Inc. or performance returns of any Financial Synergies Wealth Advisors, Inc. client.

Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Financial Synergies Wealth Advisors, Inc. or its employees. The views reflected in the commentary are subject to change at any time without notice.

Nothing on this website or Blog constitutes investment or financial planning advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. It also should not be construed as an offer soliciting the purchase or sale of any security mentioned. Nor should it be construed as an offer to provide investment advisory services by Financial Synergies Wealth Advisors, Inc.

Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Financial Synergies Wealth Advisors, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Any charts provided here or on any related Financial Synergies Wealth Advisors, Inc. personnel content outlets are for informational purposes only, and should also not be relied upon when making any investment decision. Any indices referenced for comparison are unmanaged and cannot be invested into directly. As always please remember investing involves risk and possible loss of principal capital; please seek advice from a licensed professional. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Information in charts have been obtained from third-party sources and data, and may include those from portfolio securities of funds managed by Financial Synergies Wealth Advisors, Inc. While taken from sources believed to be reliable, Financial Synergies Wealth Advisors, Inc. has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. All content speaks only as of the date indicated.

Financial Synergies Wealth Advisors, Inc. is a registered investment adviser. Advisory services are only offered to clients or prospective clients where Financial Synergies Wealth Advisors, Inc. and its representatives are properly licensed or exempt from licensure. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

See Full Disclosures Page Here

Why Are Interest Rates Rising Amid Fed Cuts?

An important yet counterintuitive issue recently is that long-term interest rates have risen in recent weeks despite the Fed’s latest cuts. The question is: Why Are Interest Rates Rising Amid Fed Cuts?

The 10-year U.S. Treasury yield, for instance, has jumped from a low of 3.62% to as high as 4.40%. This is due to strong economic data and inflation expectations around the election, both of which push longer-term rates higher. At the same time, rates have swung in either direction for much of the past few years, often without notice. Looking ahead, how might uncertainty around interest rates impact investors?

Interest rates affect many parts of our lives, both directly and indirectly. Households are directly impacted when the cost of borrowing increases, which affects mortgages, credit cards, auto loans, and more. Many consumers experienced whiplash when borrowing costs jumped suddenly in 2022, after growing accustomed to ultra-low rates over the prior decade. On the flip side, rising interest rates can result in higher yields on bonds, savings accounts, certificates of deposit, money market funds, and more.

The economy continues to grow at a steady pace

When it comes to the broader economy and financial markets, the effects can be more subtle. Higher rates increase the “cost of capital” for businesses, which can slow hiring, impede expansion plans, and reduce profitability. For the stock market, rising rates can theoretically reduce the value of future cash flows, reducing stock prices today. Higher rates can also make existing bonds less valuable, since newly issued bonds will offer higher yields. Thus, for investors, interest rates can have wide-ranging effects on portfolios.

What’s driving rates today? Unlike short-term rates which are influenced primarily by Federal Reserve policy, long-term interest rates are sensitive to economic trends. Fortunately, recent economic figures suggest the economy continues to grow at a steady pace. The latest GDP report showed that the economy grew 2.8% in the third quarter. While this was slightly below expectations, consumer spending remained exceptionally strong. Some economists worry this could reverse as consumers spend down their excess savings and debt levels rise.

Recent jobs data have been more mixed. The jobs report immediately following the Fed’s September rate cut showed that 254,000 jobs were created that month, a blowout figure. This is one reason rates began to rise since a strong job market means the Fed may not need to cut rates as quickly to support the economy. In other words, the Fed could be achieving a so-called “soft landing” even with higher rates.

Job growth has slowed from a historically strong pace

However, the latest jobs numbers for October show that only 12,000 jobs were added last month – the lowest monthly figure since 2020. There were also significant downward revisions to prior months, lowering the September figure to 223,000. The Bureau of Labor Statistics cited strikes among manufacturing workers and the recent hurricanes in Florida as likely dampeners in the report, although the exact impact is difficult to determine from the survey data. For this reason, the market’s initial reaction was to look beyond this single data point.

The jobs numbers matter because they are of growing importance for Fed decision making. As inflation rates continue to fall back to more normal levels, hiring activity is what will affect households and everyday individuals.

Despite the recent poor data, the reality is that the job market has been exceptionally strong. Not only has the economy added 2.2 million new jobs over the past year, but the unemployment rate is only 4.1%. So, even if the economy does slow from here, it would be from an unusually healthy level.

Thus, rising long-term rates are not unusual if they are due to a stronger economy. In fact, it can be normal for short-term rates to fall as the Fed cuts rates even as long-term rates climb higher. In technical terms, this results in a “steepening yield curve,” which typically occurs in the early stages of economic cycles. While it’s unclear if this will continue this time, it’s best not to overreact to these patterns.

Bonds still support portfolios despite higher rates

Interest rate uncertainty has affected bond prices with the Bloomberg U.S. Aggregate index gaining only 1.4% year-to-date. Returns across sectors this year range from 7.5% for high yield bonds to only 0.8% for munis. This is because the prices of existing bonds fall as yields rise since newly issued bonds with higher yields become more attractive to investors.

However, these swings have taken place multiple times this year as markets have adjusted to different economic trends. Additionally, many of these bond sectors are offering yields well above their long run averages. The yields on Treasury bonds are 4.3%, well above the 2.0% average since 2009, and investment grade corporate bonds are yielding 5.2%.

For all investors, bonds still play an important role in not only diversifying portfolios during periods of uncertainty, but in providing income. As the chart above shows, returns by different types of bonds can vary greatly from year to year. While it’s not clear exactly where rates may go next, investors should maintain a longer-term perspective. It’s important to diversify properly across a variety of fixed income sectors to help weather market volatility.

Concerns or questions about how your investment portfolio will hold up in the current market environment? Contact Financial Synergies today.

We are a boutique, financial advisory and total wealth management firm with over 35 years helping clients navigate turbulent markets. To learn more about our approach to investment management please reach out to us. One of our seasoned advisors would be happy to help you build a custom financial plan to help ensure you accomplish your financial goals and objectives. Schedule a conversation with us today.

More relevant articles by Financial Synergies:

Blog Disclosures

This content, which may contain security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own financial advisors as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blogs, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Financial Synergies Wealth Advisors, Inc. employees providing such comments, and should not be regarded as the views of Financial Synergies Wealth Advisors, Inc. or its respective affiliates or as a description of advisory services provided by Financial Synergies Wealth Advisors, Inc. or performance returns of any Financial Synergies Wealth Advisors, Inc. client.

Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Financial Synergies Wealth Advisors, Inc. or its employees. The views reflected in the commentary are subject to change at any time without notice.

Nothing on this website or Blog constitutes investment or financial planning advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. It also should not be construed as an offer soliciting the purchase or sale of any security mentioned. Nor should it be construed as an offer to provide investment advisory services by Financial Synergies Wealth Advisors, Inc.

Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Financial Synergies Wealth Advisors, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Any charts provided here or on any related Financial Synergies Wealth Advisors, Inc. personnel content outlets are for informational purposes only, and should also not be relied upon when making any investment decision. Any indices referenced for comparison are unmanaged and cannot be invested into directly. As always please remember investing involves risk and possible loss of principal capital; please seek advice from a licensed professional. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Information in charts have been obtained from third-party sources and data, and may include those from portfolio securities of funds managed by Financial Synergies Wealth Advisors, Inc. While taken from sources believed to be reliable, Financial Synergies Wealth Advisors, Inc. has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. All content speaks only as of the date indicated.

Financial Synergies Wealth Advisors, Inc. is a registered investment adviser. Advisory services are only offered to clients or prospective clients where Financial Synergies Wealth Advisors, Inc. and its representatives are properly licensed or exempt from licensure. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

See Full Disclosures Page Here

Recent Posts

Missing Just ONE Day in the Market Can Derail Your Year [Video]

Debt, Deficits, and the Moody’s Downgrade

Last Week on Wall Street: U.S.-China Tariff Truce? [May. 19-2025]

Subscribe to Our Blog

Shareholder | Chief Investment Officer