The U.S. is beginning to roll out the first doses of the COVID-19 vaccine this week just days after it was approved by the FDA. This vaccine, produced by Pfizer, could soon be joined by ones developed by Moderna and others. Government officials estimate that 100 million Americans could be vaccinated by the early months of 2021, or about one-third of the country. Other countries have already begun to distribute vaccines as well. This is very positive news just one year after the new coronavirus was identified. Still, we should continue to maintain realistic expectations and stay disciplined in the coming months for a few reasons.

First, while the efficacy of these vaccines appears to be high, there are logistical challenges with their production and distribution. Hundreds of millions of doses – and eventually billions – will need to be produced quickly and safely. These vaccines must be kept at extremely low temperatures and thus require special equipment. Patients must receive two doses a few weeks apart thus requiring scheduling and coordination. These challenges will no doubt be worked out as distribution increases but it may take time.

It’s also unclear how long these vaccines confer immunity or what their full range of side effects may be. For some, there is also a sense of mistrust of these vaccines and other strong personal beliefs. From the perspective of the economy and markets, however, continued growth only requires that enough Americans are vaccinated for herd immunity – and also those that are most at risk, on the front lines, etc. After all, it was only a few months ago that it was uncertain whether a vaccine was theoretically possible.

Second, while there is now some hope that life could slowly return to “normal” later in 2021, this hope comes amid a surge in cases in many parts of the country and world. And while the death rate has not risen significantly alongside new cases, many national and local governments have been forced to enact restrictions just as they did at the start of the pandemic.

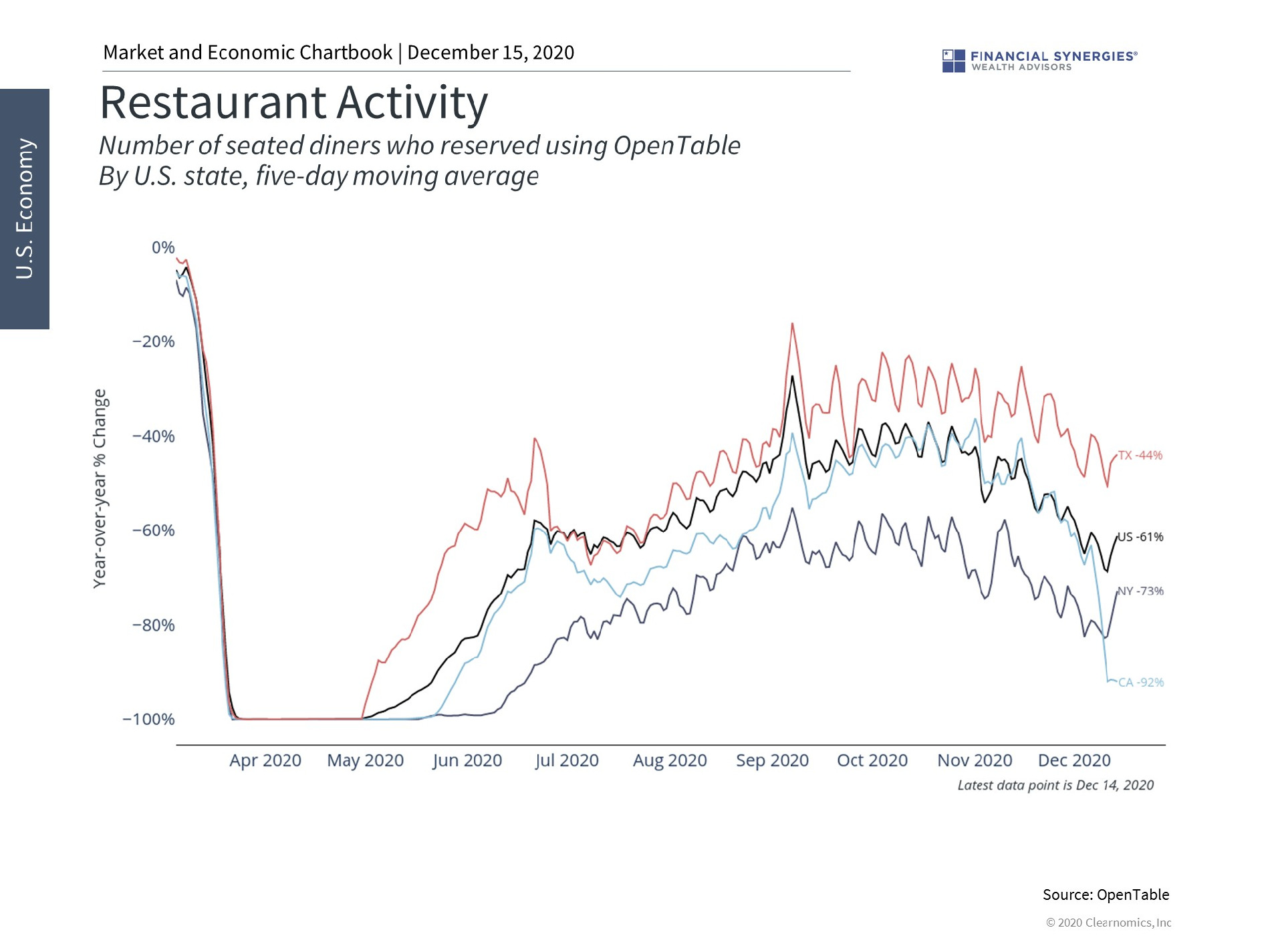

For instance, high-frequency economic data such as dining activity show a steep decline in all parts of the country as lockdowns are enforced and the weather grows colder. This only adds to the financial stress that many industries have been facing. This is perhaps the area where vaccines and immunity will have the greatest effect as consumers begin to feel safe once again, whether or not another stimulus bill is passed by Congress.

Finally, remember that not even a vaccine can prevent the stock market from behaving in a volatile manner from time to time. Those who stayed invested and diversified this year were rewarded as the economy recovered and the financial system stabilized. Although there is now a clear light at the end of the tunnel after the most uncertain stock market period since 2008, there are still many unknowns related to the coronavirus and other economic, financial and political factors. Investors have withstood a dozen large market swings this year and should remain disciplined in the coming years.

The deployment of COVID-19 vaccines is no doubt positive. However, if 2020 leaves investors with a single lesson, it is that staying invested is the best course of action, even in the face of a once-in-a-century pandemic.

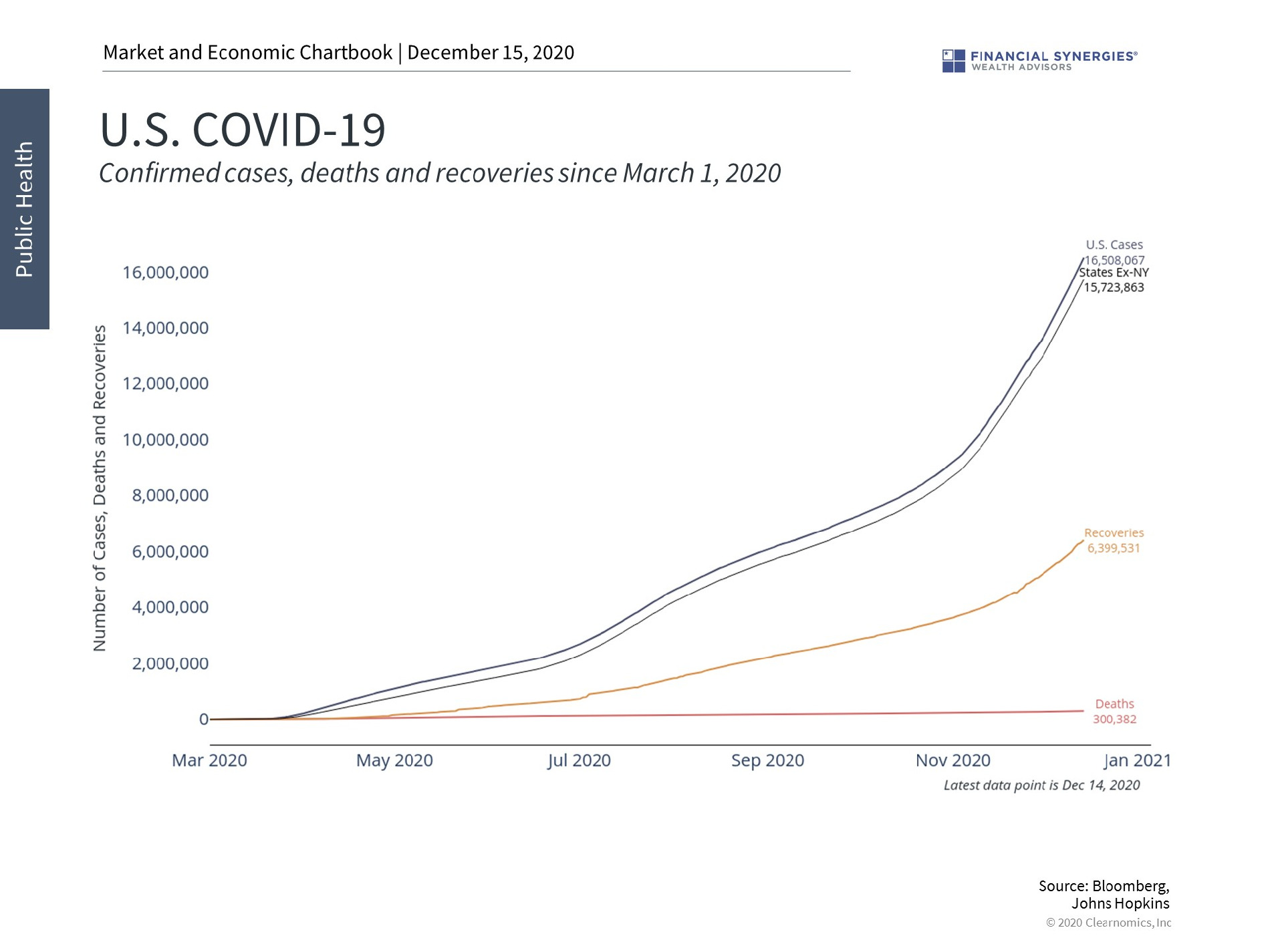

1. COVID-19 cases continue to rise

New COVID-19 cases continue to rise in many parts of the country and around the world. Globally, there have been over 70 million cases. Over 15 million of those cases have been in the U.S. since at least March. It’s possible that the true number is much higher due to undetected cases earlier in the crisis. Fortunately, deaths have not risen alongside cases since the first wave.

2. Dining and other retail activity have fallen

While the overall economy has been resilient, many industries continue to struggle. New restrictions have hit the dining, retail and hospitality industries yet again. Only widespread distribution of a vaccine and eventual immunity can help to restore business activity in these sectors.

3. Investors should continue to expect short-term market volatility

2020 experienced the most market pullbacks since 2008. Although there is a light at the end of the tunnel, we should probably expect significant market uncertainty for some time.

Source: Clearnomics

What Vaccines Could Mean For 2021

The U.S. is beginning to roll out the first doses of the COVID-19 vaccine this week just days after it was approved by the FDA. This vaccine, produced by Pfizer, could soon be joined by ones developed by Moderna and others. Government officials estimate that 100 million Americans could be vaccinated by the early months of 2021, or about one-third of the country. Other countries have already begun to distribute vaccines as well. This is very positive news just one year after the new coronavirus was identified. Still, we should continue to maintain realistic expectations and stay disciplined in the coming months for a few reasons.

First, while the efficacy of these vaccines appears to be high, there are logistical challenges with their production and distribution. Hundreds of millions of doses – and eventually billions – will need to be produced quickly and safely. These vaccines must be kept at extremely low temperatures and thus require special equipment. Patients must receive two doses a few weeks apart thus requiring scheduling and coordination. These challenges will no doubt be worked out as distribution increases but it may take time.

It’s also unclear how long these vaccines confer immunity or what their full range of side effects may be. For some, there is also a sense of mistrust of these vaccines and other strong personal beliefs. From the perspective of the economy and markets, however, continued growth only requires that enough Americans are vaccinated for herd immunity – and also those that are most at risk, on the front lines, etc. After all, it was only a few months ago that it was uncertain whether a vaccine was theoretically possible.

Second, while there is now some hope that life could slowly return to “normal” later in 2021, this hope comes amid a surge in cases in many parts of the country and world. And while the death rate has not risen significantly alongside new cases, many national and local governments have been forced to enact restrictions just as they did at the start of the pandemic.

For instance, high-frequency economic data such as dining activity show a steep decline in all parts of the country as lockdowns are enforced and the weather grows colder. This only adds to the financial stress that many industries have been facing. This is perhaps the area where vaccines and immunity will have the greatest effect as consumers begin to feel safe once again, whether or not another stimulus bill is passed by Congress.

Finally, remember that not even a vaccine can prevent the stock market from behaving in a volatile manner from time to time. Those who stayed invested and diversified this year were rewarded as the economy recovered and the financial system stabilized. Although there is now a clear light at the end of the tunnel after the most uncertain stock market period since 2008, there are still many unknowns related to the coronavirus and other economic, financial and political factors. Investors have withstood a dozen large market swings this year and should remain disciplined in the coming years.

The deployment of COVID-19 vaccines is no doubt positive. However, if 2020 leaves investors with a single lesson, it is that staying invested is the best course of action, even in the face of a once-in-a-century pandemic.

1. COVID-19 cases continue to rise

New COVID-19 cases continue to rise in many parts of the country and around the world. Globally, there have been over 70 million cases. Over 15 million of those cases have been in the U.S. since at least March. It’s possible that the true number is much higher due to undetected cases earlier in the crisis. Fortunately, deaths have not risen alongside cases since the first wave.

2. Dining and other retail activity have fallen

While the overall economy has been resilient, many industries continue to struggle. New restrictions have hit the dining, retail and hospitality industries yet again. Only widespread distribution of a vaccine and eventual immunity can help to restore business activity in these sectors.

3. Investors should continue to expect short-term market volatility

2020 experienced the most market pullbacks since 2008. Although there is a light at the end of the tunnel, we should probably expect significant market uncertainty for some time.

Source: Clearnomics

Recent Posts

Your “Magic” Retirement Number?

The Market Pullback, Geopolitical Risks, Inflation, and More

Week in Perspective: Stocks Startled by Inflation, Conflict [Apr. 15-2024] – VIDEO

Subscribe to Our Blog

Shareholder | Chief Investment Officer