With a couple of weeks until the presidential election, the policy platforms for President Donald Trump and Vice President Kamala Harris are gradually forming. Through speeches and debates, each candidate is laying out what they stand for and how they would change existing policies.

For investors, perhaps the most scrutinized area is taxes, and there are concerns over how changes to tax rates could impact both Wall Street and Main Street. How can investors maintain perspective as we approach November 5?

Tax policy is an extremely complex subject, so it’s always important to work with a trusted advisor. In addition, both candidates’ platforms are still subject to change despite the short timeline until election day. While it’s impossible to cover all the details here, many of the key differences on taxes between the candidates and their parties come down to the future of the Tax Cuts and Jobs Act (TCJA).

It’s important to maintain perspective this election season

Before discussing the details, it’s important to maintain perspective around tax policy since these issues can be politically heated. Taxes are intertwined with politics and reflect our polarized political climate. Regardless of which side of the aisle we might be on and what our personal preferences may be, it’s important to stay objective so we can clearly focus on our financial goals.

Candidates often make promises based on their political leanings that may not fully materialize once in office.

While taxes have a direct impact on households and companies, they do not always have a straightforward effect on the overall economy and stock market. This is because taxes are only one of the factors that influence growth and returns, there are many deductions, credits, and strategies that can reduce the statutory tax rate, and spending and investment patterns often adjust to work around taxes. In other words, lower taxes do not automatically result in an economic boom and higher tax rates do not necessarily result in a crash.

Additionally, election rhetoric and actual policies can be quite different. Candidates often make promises based on their political leanings that may not fully materialize once in office. Even once a candidate is elected, Congressional partnership and approval is still required to pass new tax laws. Historically, the president’s party tends to lose seats in Congress in their second term, and their approval rating tends to decline. This process can alter or water down initial proposals.

For example, during the 2016 presidential campaign, President Trump promised a complete overhaul of the tax system. While the Tax Cuts and Jobs Act was a significant change to the tax code, it also retained many existing elements. Similarly, President Biden criticized the TCJA during the 2020 election cycle and discussed raising taxes on high income earners and corporations. While the Inflation Reduction Act of 2022 did impose a 15% minimum corporate tax rate, this is far from the sweeping changes discussed during the election.

The future of the Tax Cuts and Jobs Act and national debt is uncertain

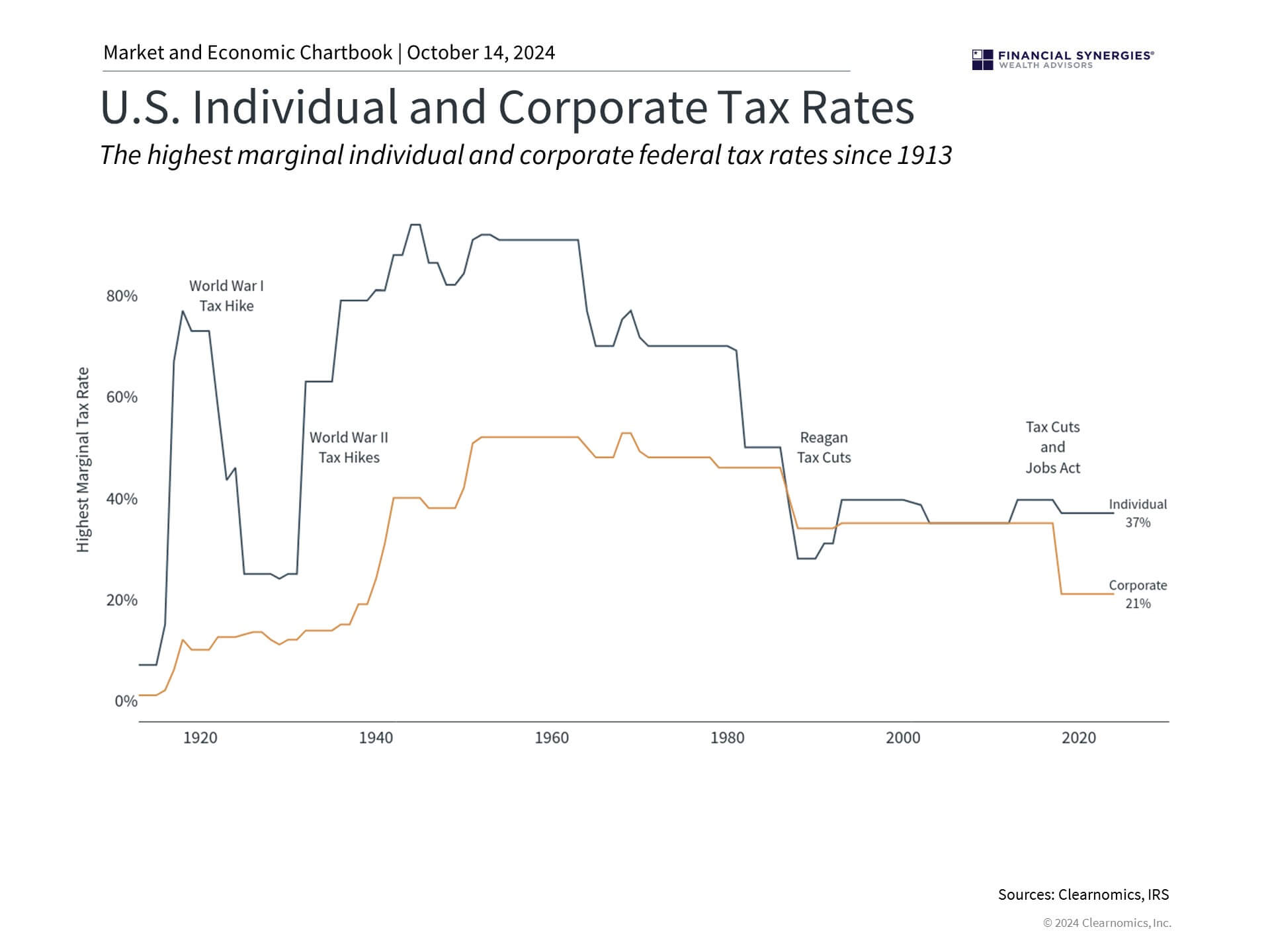

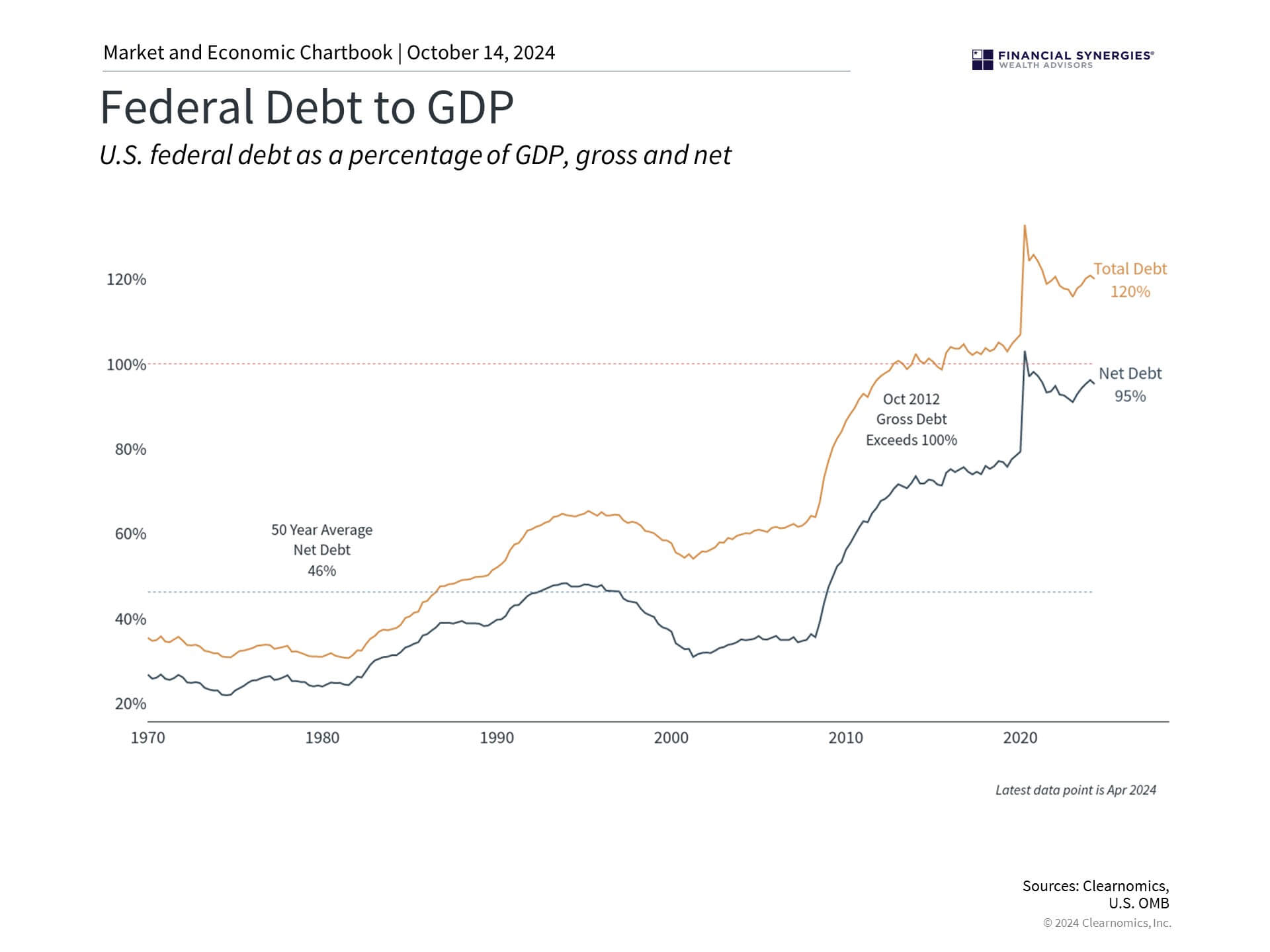

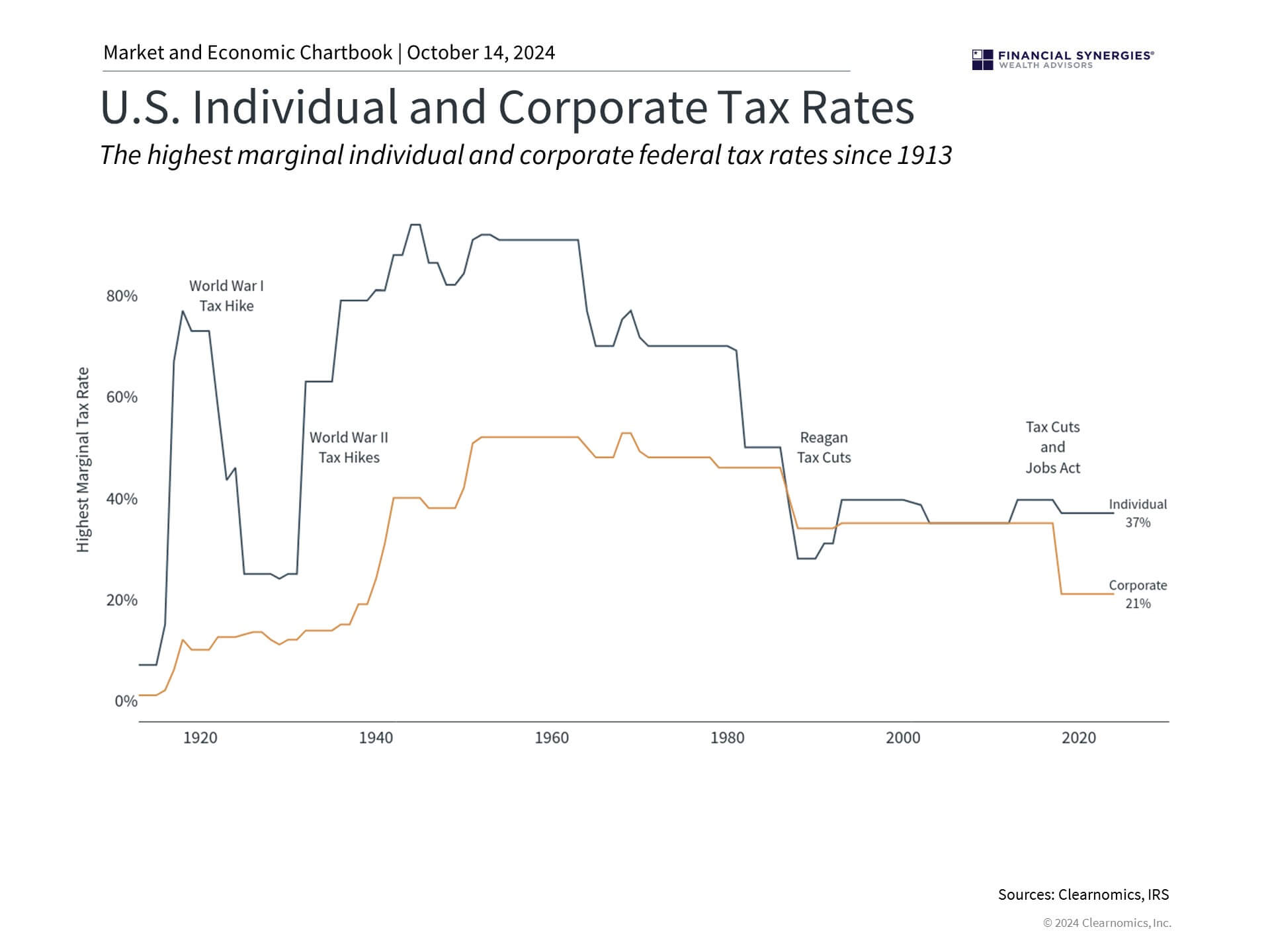

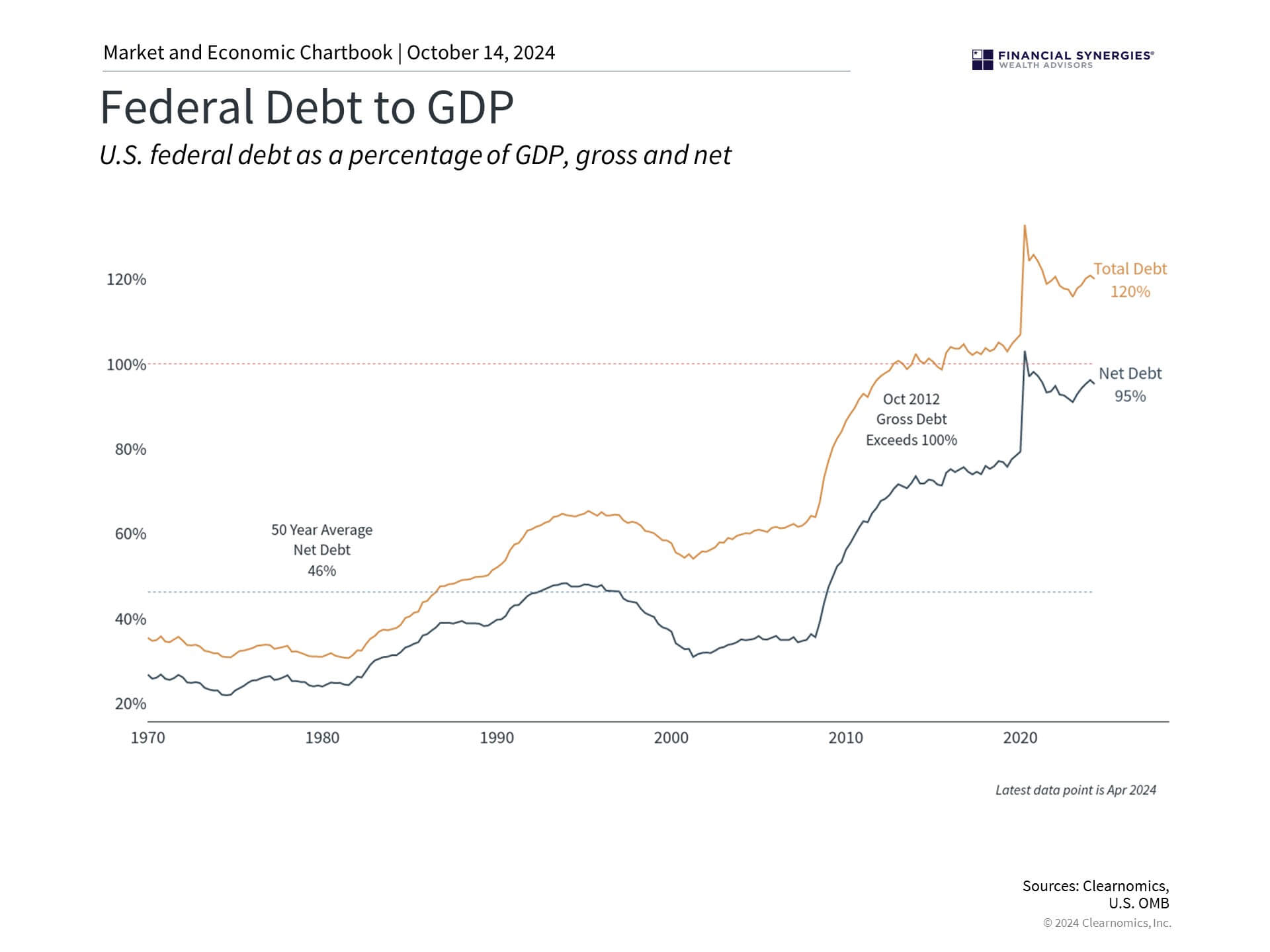

The truth is that tax rates have been quite low by historical standards for decades. Even if there are no changes in the next presidential term, with the federal debt continuing to expand, many economists worry that taxes will have to rise to close the gap in the future.

The TCJA took effect in 2018 and included reducing individual income tax rates with the highest rate declining from 39.6% to 37%, nearly doubling the standard deduction, dropping the corporate tax rate from 35% to 21%, and implementing a territorial tax system for corporations. The TCJA also lowered estate taxes, eliminated personal exemptions, and adjusted several other deductions and credits.

As discussed above, the Inflation Reduction Act of 2022 introduced a 15% minimum tax on large corporations with annual profits over $1 billion. It also implemented a 1% excise tax on stock buybacks for publicly traded companies.

Unless action is taken by the president and Congress, many provisions of the TCJA will expire for the 2026 tax season, creating a so-called “tax cliff.” This makes taxes especially contentious this election season. Here are some of the items the candidates are discussing:

- Trump proposes cutting corporate taxes further from 21% to 15% for some companies, including manufacturers who make their products domestically. Harris is in favor of increasing the corporate tax rate to 28%, in line with President Biden’s position.

- Trump has discussed extending the TCJA’s individual tax rates, but specifics are still unclear. Harris supports allowing the top marginal rate to revert to 39.6%.

- Harris proposes raising the capital gains rate from 20% to 28%. Along with an increase in the “net investment income tax” introduced with the Affordable Care Act, the top capital gains rate would rise to 33%, the highest since 1978.

- Both candidates propose new enhanced child tax credits and not taxing tips. Trump has discussed eliminating taxes on Social Security for seniors.

- Harris proposes expanding the startup expense deduction from $5,000 to $50,000 and $25,000 in support of first-time homebuyers making down payments.

- Harris proposes a new tax on unrealized capital gains for those worth $100 million or more. Such a tax would be historic. The recent Moore v. United States case in the Supreme Court loosely touched on this by allowing a provision in the TCJA that imposed a one-time tax on unrepatriated foreign earnings.

The economy has grown under both parties

Unfortunately, the annual budget deficit remains high and the national debt is likely to grow regardless of who occupies the White House. While studies on the matter differ and should be taken with a grain of salt, many suggest that either candidate would add trillions to the debt in the coming years.

However, it’s also the case that the economy has grown over history under both political parties. As discussed earlier, it’s important to remember that who occupies the White House is not the most important factor for the economy and markets, regardless of how counterintuitive that may seem. Policy changes tend to be gradual due to checks and balances in our political system. Perhaps more importantly, neither candidate is proposing a return to pre-Reagan era tax levels when the top marginal rates reached as high as 94%.

So, while taxes do play an important role in financial plans, they do not necessarily impact investment portfolios and economic growth the way some might imagine. By maintaining a balanced perspective and avoiding politically driven decisions, investors can better position themselves for success across the evolving political landscape.

Concerns or questions about how your investment portfolio will hold up in the current market environment? Contact Financial Synergies today.

We are a boutique, financial advisory and total wealth management firm with over 35 years helping clients navigate turbulent markets. To learn more about our approach to investment management please reach out to us. One of our seasoned advisors would be happy to help you build a custom financial plan to help ensure you accomplish your financial goals and objectives. Schedule a conversation with us today.

More relevant articles by Financial Synergies:

Blog Disclosures

This content, which may contain security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own financial advisors as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blogs, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Financial Synergies Wealth Advisors, Inc. employees providing such comments, and should not be regarded as the views of Financial Synergies Wealth Advisors, Inc. or its respective affiliates or as a description of advisory services provided by Financial Synergies Wealth Advisors, Inc. or performance returns of any Financial Synergies Wealth Advisors, Inc. client.

Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Financial Synergies Wealth Advisors, Inc. or its employees. The views reflected in the commentary are subject to change at any time without notice.

Nothing on this website or Blog constitutes investment or financial planning advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. It also should not be construed as an offer soliciting the purchase or sale of any security mentioned. Nor should it be construed as an offer to provide investment advisory services by Financial Synergies Wealth Advisors, Inc.

Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Financial Synergies Wealth Advisors, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Any charts provided here or on any related Financial Synergies Wealth Advisors, Inc. personnel content outlets are for informational purposes only, and should also not be relied upon when making any investment decision. Any indices referenced for comparison are unmanaged and cannot be invested into directly. As always please remember investing involves risk and possible loss of principal capital; please seek advice from a licensed professional. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Information in charts have been obtained from third-party sources and data, and may include those from portfolio securities of funds managed by Financial Synergies Wealth Advisors, Inc. While taken from sources believed to be reliable, Financial Synergies Wealth Advisors, Inc. has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. All content speaks only as of the date indicated.

Financial Synergies Wealth Advisors, Inc. is a registered investment adviser. Advisory services are only offered to clients or prospective clients where Financial Synergies Wealth Advisors, Inc. and its representatives are properly licensed or exempt from licensure. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

See Full Disclosures Page Here

The Impact of Tax Proposals and the Election

With a couple of weeks until the presidential election, the policy platforms for President Donald Trump and Vice President Kamala Harris are gradually forming. Through speeches and debates, each candidate is laying out what they stand for and how they would change existing policies.

For investors, perhaps the most scrutinized area is taxes, and there are concerns over how changes to tax rates could impact both Wall Street and Main Street. How can investors maintain perspective as we approach November 5?

Tax policy is an extremely complex subject, so it’s always important to work with a trusted advisor. In addition, both candidates’ platforms are still subject to change despite the short timeline until election day. While it’s impossible to cover all the details here, many of the key differences on taxes between the candidates and their parties come down to the future of the Tax Cuts and Jobs Act (TCJA).

It’s important to maintain perspective this election season

Before discussing the details, it’s important to maintain perspective around tax policy since these issues can be politically heated. Taxes are intertwined with politics and reflect our polarized political climate. Regardless of which side of the aisle we might be on and what our personal preferences may be, it’s important to stay objective so we can clearly focus on our financial goals.

While taxes have a direct impact on households and companies, they do not always have a straightforward effect on the overall economy and stock market. This is because taxes are only one of the factors that influence growth and returns, there are many deductions, credits, and strategies that can reduce the statutory tax rate, and spending and investment patterns often adjust to work around taxes. In other words, lower taxes do not automatically result in an economic boom and higher tax rates do not necessarily result in a crash.

Additionally, election rhetoric and actual policies can be quite different. Candidates often make promises based on their political leanings that may not fully materialize once in office. Even once a candidate is elected, Congressional partnership and approval is still required to pass new tax laws. Historically, the president’s party tends to lose seats in Congress in their second term, and their approval rating tends to decline. This process can alter or water down initial proposals.

For example, during the 2016 presidential campaign, President Trump promised a complete overhaul of the tax system. While the Tax Cuts and Jobs Act was a significant change to the tax code, it also retained many existing elements. Similarly, President Biden criticized the TCJA during the 2020 election cycle and discussed raising taxes on high income earners and corporations. While the Inflation Reduction Act of 2022 did impose a 15% minimum corporate tax rate, this is far from the sweeping changes discussed during the election.

The future of the Tax Cuts and Jobs Act and national debt is uncertain

The truth is that tax rates have been quite low by historical standards for decades. Even if there are no changes in the next presidential term, with the federal debt continuing to expand, many economists worry that taxes will have to rise to close the gap in the future.

The TCJA took effect in 2018 and included reducing individual income tax rates with the highest rate declining from 39.6% to 37%, nearly doubling the standard deduction, dropping the corporate tax rate from 35% to 21%, and implementing a territorial tax system for corporations. The TCJA also lowered estate taxes, eliminated personal exemptions, and adjusted several other deductions and credits.

As discussed above, the Inflation Reduction Act of 2022 introduced a 15% minimum tax on large corporations with annual profits over $1 billion. It also implemented a 1% excise tax on stock buybacks for publicly traded companies.

Unless action is taken by the president and Congress, many provisions of the TCJA will expire for the 2026 tax season, creating a so-called “tax cliff.” This makes taxes especially contentious this election season. Here are some of the items the candidates are discussing:

The economy has grown under both parties

Unfortunately, the annual budget deficit remains high and the national debt is likely to grow regardless of who occupies the White House. While studies on the matter differ and should be taken with a grain of salt, many suggest that either candidate would add trillions to the debt in the coming years.

However, it’s also the case that the economy has grown over history under both political parties. As discussed earlier, it’s important to remember that who occupies the White House is not the most important factor for the economy and markets, regardless of how counterintuitive that may seem. Policy changes tend to be gradual due to checks and balances in our political system. Perhaps more importantly, neither candidate is proposing a return to pre-Reagan era tax levels when the top marginal rates reached as high as 94%.

So, while taxes do play an important role in financial plans, they do not necessarily impact investment portfolios and economic growth the way some might imagine. By maintaining a balanced perspective and avoiding politically driven decisions, investors can better position themselves for success across the evolving political landscape.

Concerns or questions about how your investment portfolio will hold up in the current market environment? Contact Financial Synergies today.

We are a boutique, financial advisory and total wealth management firm with over 35 years helping clients navigate turbulent markets. To learn more about our approach to investment management please reach out to us. One of our seasoned advisors would be happy to help you build a custom financial plan to help ensure you accomplish your financial goals and objectives. Schedule a conversation with us today.

More relevant articles by Financial Synergies:

Blog Disclosures

This content, which may contain security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own financial advisors as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blogs, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Financial Synergies Wealth Advisors, Inc. employees providing such comments, and should not be regarded as the views of Financial Synergies Wealth Advisors, Inc. or its respective affiliates or as a description of advisory services provided by Financial Synergies Wealth Advisors, Inc. or performance returns of any Financial Synergies Wealth Advisors, Inc. client.

Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Financial Synergies Wealth Advisors, Inc. or its employees. The views reflected in the commentary are subject to change at any time without notice.

Nothing on this website or Blog constitutes investment or financial planning advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. It also should not be construed as an offer soliciting the purchase or sale of any security mentioned. Nor should it be construed as an offer to provide investment advisory services by Financial Synergies Wealth Advisors, Inc.

Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Financial Synergies Wealth Advisors, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Any charts provided here or on any related Financial Synergies Wealth Advisors, Inc. personnel content outlets are for informational purposes only, and should also not be relied upon when making any investment decision. Any indices referenced for comparison are unmanaged and cannot be invested into directly. As always please remember investing involves risk and possible loss of principal capital; please seek advice from a licensed professional. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Information in charts have been obtained from third-party sources and data, and may include those from portfolio securities of funds managed by Financial Synergies Wealth Advisors, Inc. While taken from sources believed to be reliable, Financial Synergies Wealth Advisors, Inc. has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. All content speaks only as of the date indicated.

Financial Synergies Wealth Advisors, Inc. is a registered investment adviser. Advisory services are only offered to clients or prospective clients where Financial Synergies Wealth Advisors, Inc. and its representatives are properly licensed or exempt from licensure. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

See Full Disclosures Page Here

Recent Posts

Monthly Market Update: Markets Digest the Path of Interest Rates & the Next Phase of the AI Cycle

Why Investors Can Be Thankful in 2025

Weekly Market Recap | Nov. 21, 2025

Subscribe to Our Blog

Shareholder | Chief Investment Officer