Why Are Rates Still Low?

Interest rates have been a conundrum for investors, economists and policymakers over the past ten years. Despite steady U.S. economic growth and an unemployment rate near historic lows, long-term interest rates have remained anchored.

2019 Planning: Changes to Retirement Plan Limits, Medicare, and Social Security

As 2019 is underway, it’s important to review changes that impact investors – both accumulators and retirees. For those who are still working, the IRS recently released contribution adjustments for retirement accounts, like 401(k) plans and IRAs.

4th Quarter 2018 Newsletter

Please find below our 4th Quarter 2018 Newsletter. This issue contains articles on financial planning, investing, and the markets. We hope you find the information helpful.

3rd Quarter 2018 Newsletter

Our 3rd Quarter 2018 Newsletter features articles on the markets, investing, and financial planning. We hope you find them helpful.

Medicare Open Enrollment – Coming Soon!

We are quickly approaching the annual Open Enrollment period for Medicare. Open Enrollment begins October 15th and ends December 7th. It is an important time to review both your current Medicare Part B supplement plan (i.e. “Medigap”) and Part D prescription drug coverage.

Will Goodson Earns Top Social Security Designation

As many of you know, Will Goodson is not only one of our lead financial advisors, but also our “Social Security Expert.” And recently he’s taken his knowledge of this complex subject to the next level by attaining the National Social Security Advisors (NSSA®) designation.

Can Financial Synergies Manage My 401(k) Plan?

Yes, indeed we can! We are pleased to announce an expansion of our service to manage your employer’s retirement plan. This includes 401(k), 403(b), 457 deferred compensation plans and more.

The Myth of the Income Portfolio

We’re sometimes asked by potential clients, looking to generate income in retirement, if we will construct for them an “income portfolio,” enabling them to live off the dividends and interest without dipping into principal.

The ABCs of Education Investing

With school back in session in most of the country, many parents are likely thinking about how best to prepare for their children’s future college expenses. Now is a good time to sharpen your pencil for a few important lessons before heading back into the investing classroom to tackle the issue.

What it Means to be a Fiduciary

Financial Synergies Wealth Advisors is an independent Registered Investment Advisor (RIA). More importantly, we are a Fiduciary – legally and ethically bound to act in the best interests of our clients. Most financial advisors are not fiduciaries.

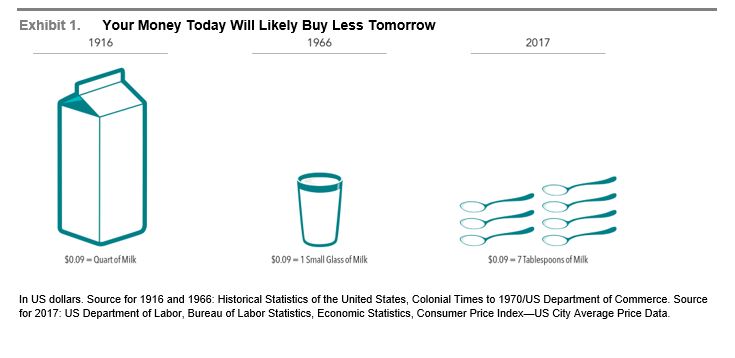

The Real Impact of Inflation

When the prices of goods and services increase over time, consumers can buy fewer of them with every dollar they have saved. This erosion of the real purchasing power of wealth is called inflation. Inflation is an important element of investing.

Social Security Part 6: When to File and Remaining Strategies

Over the last several months, we’ve covered the ins and outs of Social Security. In this final post for our blog series we’re discussing the decision on when to file for benefits.

Money Market Funds Attractive Again

For the better part of a decade, money market funds have simply not been attractive to investors at all. These cash funds maintain a $1/share price and provide daily liquidity. Historically, investors have used them as a reserve for living expenses, emergency funds, short-term needs, etc.

Social Security Part 5: How Your Benefits May Be Reduced

Up to this point in our Social Security blog series, we have covered the core components of Social Security, including eligibility, different benefits that are available, and how benefits are taxed.

Q1 2018 Newsletter

We hope you enjoy the 1st Quarter 2018 Newsletter. We’ve included articles on the markets, economy, and financial planning. Also, join us in welcoming Lottie Hensley to the Financial Synergies Team!