Markets have been very volatile lately.

What’s going on?

Let’s take a quick look at the factors that are influencing markets right now.

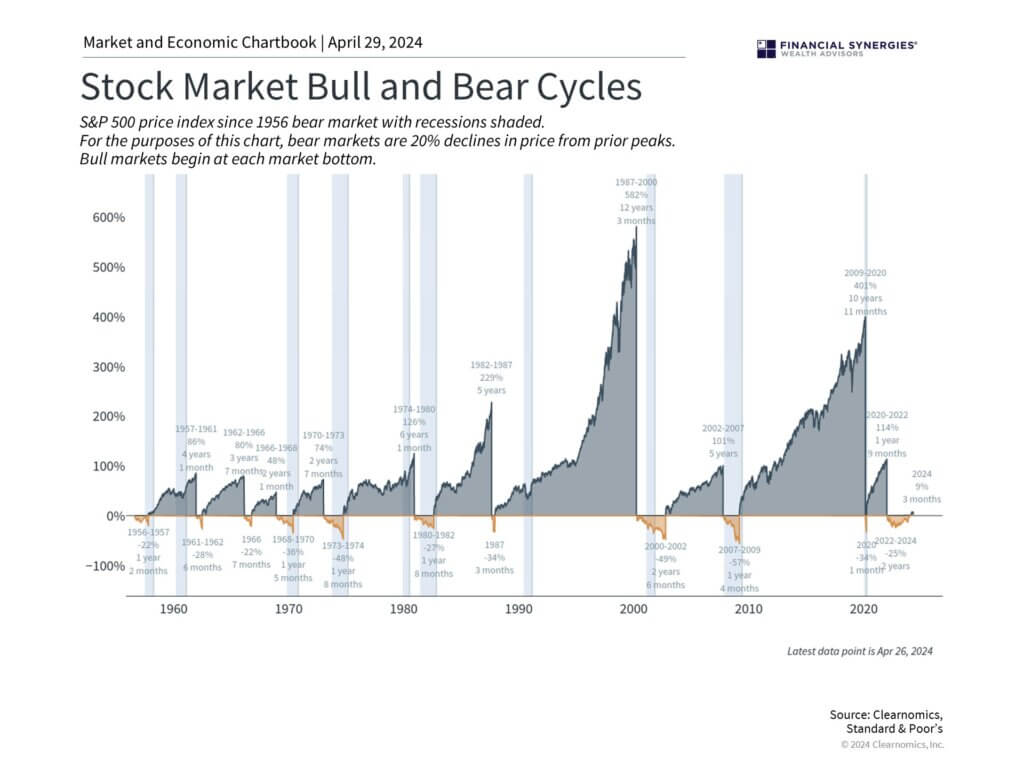

1. The bull market narrative has shifted

For months, investors have been told a “Goldilocks” story of a strong economy, tamed inflation, and interest rates that were soon to drop.

However, stronger-than-expected economic data and sticky inflation have now complicated the story, and investors have become wary.1

There are still plenty of reasons to be optimistic, but investors are being careful and taking in earnings data to gauge the upside potential of the next weeks and months.

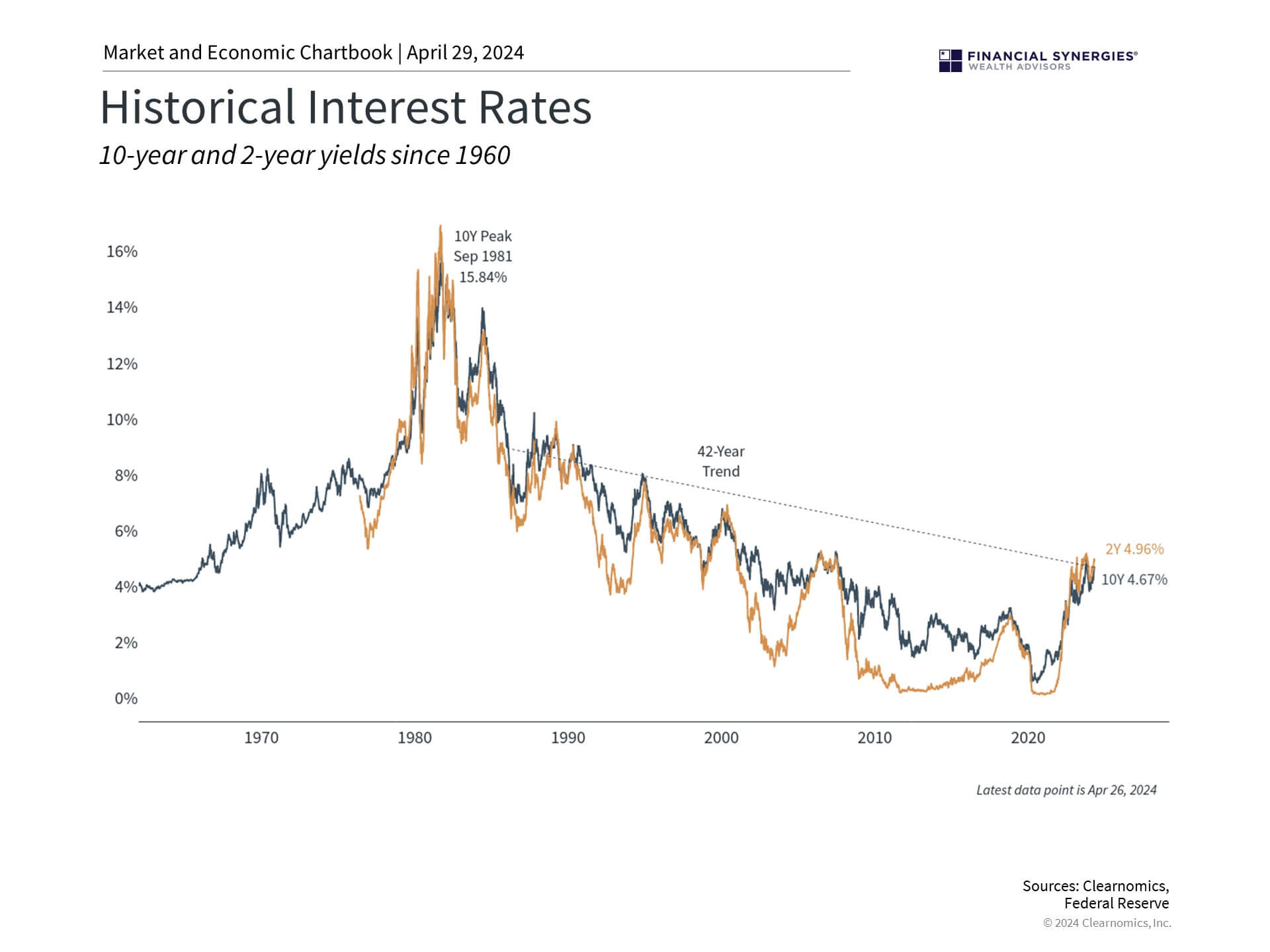

2. Interest rates could stay higher longer than we expected (or wanted)

A strong economy and hot inflation mean the Fed is now getting cold feet about cutting interest rates.2

Recent comments by Fed chair Jerome Powell suggest the Fed will keep rates high until economists are confident inflation is fully in reverse.

Some analysts are even pricing in the odds of another rate hike if inflation continues to remain high.3

Since investors have been banking on rate cuts coming soon, the new “higher for longer” reality is causing them to reevaluate their positions, further stoking volatility.

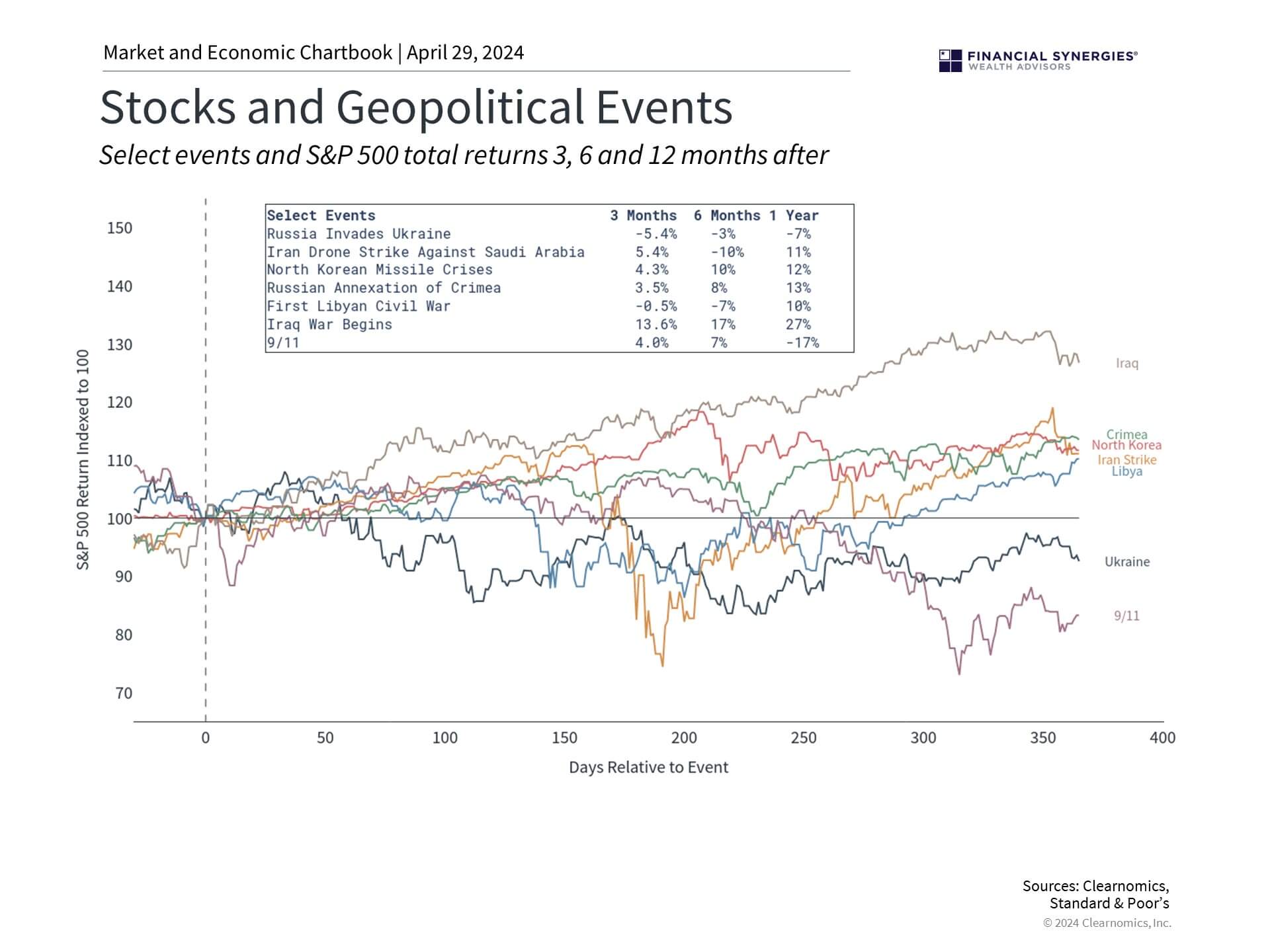

3. Geopolitical flare-ups are causing tensions to rise

With Israel and Iran trading attacks and a spring offensive gearing up in Ukraine, there are plenty of geopolitical worries, sadly.

Some good news (if there is any good news when so many lives are at stake) is that geopolitical shocks typically only have a temporary impact on markets.4

We don’t know what lies ahead, but we hope and pray for a peaceful end to the violence.

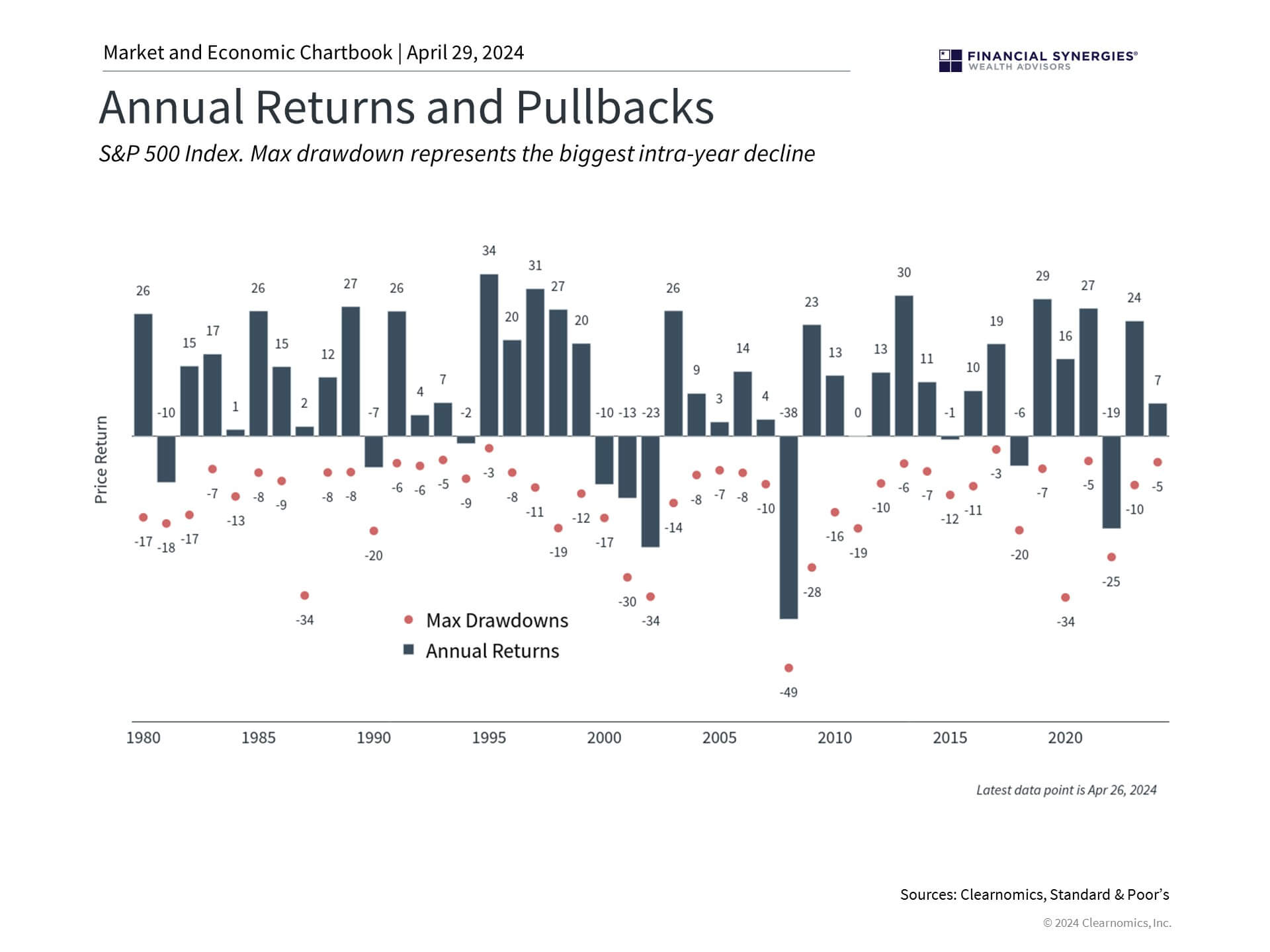

Volatility is normal after a prolonged rally

Here’s the bottom line: volatility after a strong rally is very common. It’s also perfectly normal to be nervous when markets feel uncertain.

Especially at the beginning of a new quarter when investors are digesting earnings reports from the previous quarter and reassessing company performance.

My crystal ball 🔮 is in the shop, so I can’t tell you with certainty what happens next.

However, given that the U.S. economy remains healthy, with a strong jobs market and robust consumer spending, there are still plenty of reasons to be optimistic.5 – even in spite of the inflation backdrop.

And remember, there are very rarely years where the market doesn’t dip into negative territory, at least a bit. In fact, the average annual max drawdown over the last 40+ years has been 14%!

Sources:

1. https://www.fanniemae.com/newsroom/fannie-mae-news/hot-economy-inflation-likely-keep-rates-higher-longer

2. https://apnews.com/article/inflation-interest-rates-federal-reserve-powell-cuts-c60436c5e719ce95fc487fdb98395d09

3. https://www.ft.com/content/8c5da64b-766e-4993-86f5-aac95342432a

4. https://www.morningstar.com/news/marketwatch/20240422136/history-says-stock-market-dips-caused-by-geopolitical-turmoil-should-be-bought-not-sold

5. https://www.usnews.com/news/economy/articles/2024-04-22/gdp-inflation-highlight-week-of-economic-data

Concerns or questions about how your investment portfolio will hold up in the current market environment? Contact Financial Synergies today.

We are a boutique, financial advisory and total wealth management firm with over 35 years helping clients navigate turbulent markets. To learn more about our approach to investment management please reach out to us. One of our seasoned advisors would be happy to help you build a custom financial plan to help ensure you accomplish your financial goals and objectives. Schedule a conversation with us today.

More relevant articles by Financial Synergies:

Why Are Markets So Volatile Recently?

Markets have been very volatile lately.

What’s going on?

Let’s take a quick look at the factors that are influencing markets right now.

1. The bull market narrative has shifted

For months, investors have been told a “Goldilocks” story of a strong economy, tamed inflation, and interest rates that were soon to drop.

However, stronger-than-expected economic data and sticky inflation have now complicated the story, and investors have become wary.1

There are still plenty of reasons to be optimistic, but investors are being careful and taking in earnings data to gauge the upside potential of the next weeks and months.

2. Interest rates could stay higher longer than we expected (or wanted)

A strong economy and hot inflation mean the Fed is now getting cold feet about cutting interest rates.2

Recent comments by Fed chair Jerome Powell suggest the Fed will keep rates high until economists are confident inflation is fully in reverse.

Some analysts are even pricing in the odds of another rate hike if inflation continues to remain high.3

Since investors have been banking on rate cuts coming soon, the new “higher for longer” reality is causing them to reevaluate their positions, further stoking volatility.

3. Geopolitical flare-ups are causing tensions to rise

With Israel and Iran trading attacks and a spring offensive gearing up in Ukraine, there are plenty of geopolitical worries, sadly.

Some good news (if there is any good news when so many lives are at stake) is that geopolitical shocks typically only have a temporary impact on markets.4

We don’t know what lies ahead, but we hope and pray for a peaceful end to the violence.

Volatility is normal after a prolonged rally

Here’s the bottom line: volatility after a strong rally is very common. It’s also perfectly normal to be nervous when markets feel uncertain.

Especially at the beginning of a new quarter when investors are digesting earnings reports from the previous quarter and reassessing company performance.

My crystal ball 🔮 is in the shop, so I can’t tell you with certainty what happens next.

However, given that the U.S. economy remains healthy, with a strong jobs market and robust consumer spending, there are still plenty of reasons to be optimistic.5 – even in spite of the inflation backdrop.

And remember, there are very rarely years where the market doesn’t dip into negative territory, at least a bit. In fact, the average annual max drawdown over the last 40+ years has been 14%!

Sources:

1. https://www.fanniemae.com/newsroom/fannie-mae-news/hot-economy-inflation-likely-keep-rates-higher-longer

2. https://apnews.com/article/inflation-interest-rates-federal-reserve-powell-cuts-c60436c5e719ce95fc487fdb98395d09

3. https://www.ft.com/content/8c5da64b-766e-4993-86f5-aac95342432a

4. https://www.morningstar.com/news/marketwatch/20240422136/history-says-stock-market-dips-caused-by-geopolitical-turmoil-should-be-bought-not-sold

5. https://www.usnews.com/news/economy/articles/2024-04-22/gdp-inflation-highlight-week-of-economic-data

Concerns or questions about how your investment portfolio will hold up in the current market environment? Contact Financial Synergies today.

We are a boutique, financial advisory and total wealth management firm with over 35 years helping clients navigate turbulent markets. To learn more about our approach to investment management please reach out to us. One of our seasoned advisors would be happy to help you build a custom financial plan to help ensure you accomplish your financial goals and objectives. Schedule a conversation with us today.

More relevant articles by Financial Synergies:

Recent Posts

Monthly Market Update: Markets Digest the Path of Interest Rates & the Next Phase of the AI Cycle

Why Investors Can Be Thankful in 2025

Weekly Market Recap | Nov. 21, 2025

Subscribe to Our Blog

Shareholder | Chief Investment Officer