As we near the end of January, it’s a good time to take stock of the market recovery so far. The S&P 500 is now flat compared to the beginning of 2018, regaining 13% over the past month. Over the past two years, the market has returned roughly 9% annually, a solid return by any measure. Sentiment has shifted as well – as many investors now believe a recession in 2019 is unlikely, and very few are using the term “bear market.” Of course sentiment and reality sometimes collide, so we can’t give this much importance. And volatility is likely to continue, especially as concerns over trade, the Fed, and economic growth persist.

It’s a good time for investors to remember that much of investing depends on our own behavior. While we may intellectually know that volatility is unavoidable and that shifts in market sentiment are normal, it’s difficult to maintain emotional composure in the midst of large market swings. Investors who have experienced periods of volatility such as the recent one may be in a better position to stay invested the next time turbulence hits.

In many ways, investing for long-term goals is like planning a cross-country road trip. First, it’s important to know where you want to go, to plan your route properly, and to tune up your car beforehand. Second, what matters more than anything else is that you take the right interstates and drive in the right direction. You may be able to save some time with clever navigation or by weaving in and out of traffic. But these benefits are secondary to staying on the right road, especially if they cause you to miss an exit.

We can expect detours, road construction, bad weather, and other complications. While these may slow you down, they won’t stop you from reaching your destination.

This may sound like common sense, but it takes discipline to apply the same principles to investing. Many investors fail to properly plan and thus don’t stick to an appropriate balanced portfolio. They may be tempted to trade in and out of markets, or invest in what’s exciting at the moment, at the expense of their long-term goals. Most critically, many investors are tempted to give up on their plans altogether when volatility strikes.

1. Stocks have rebounded from their December lows

Stock Market Returns in Perspective

Keeping market volatility in perspective requires seeing past short-term trends. While the stock market was down last year – and is still 9% from the all-time high – the market has since rebounded 13% from its Christmas Eve low.

Keeping market volatility in perspective requires seeing past short-term trends. While the stock market was down last year – and is still 9% from the all-time high – the market has since rebounded 13% from its Christmas Eve low.

At the moment, the S&P 500 is essentially flat since the beginning of 2018. However, over the past two years, the S&P 500 has risen 19% before dividends. Despite how investors may feel, this is a terrific return over this time-frame.

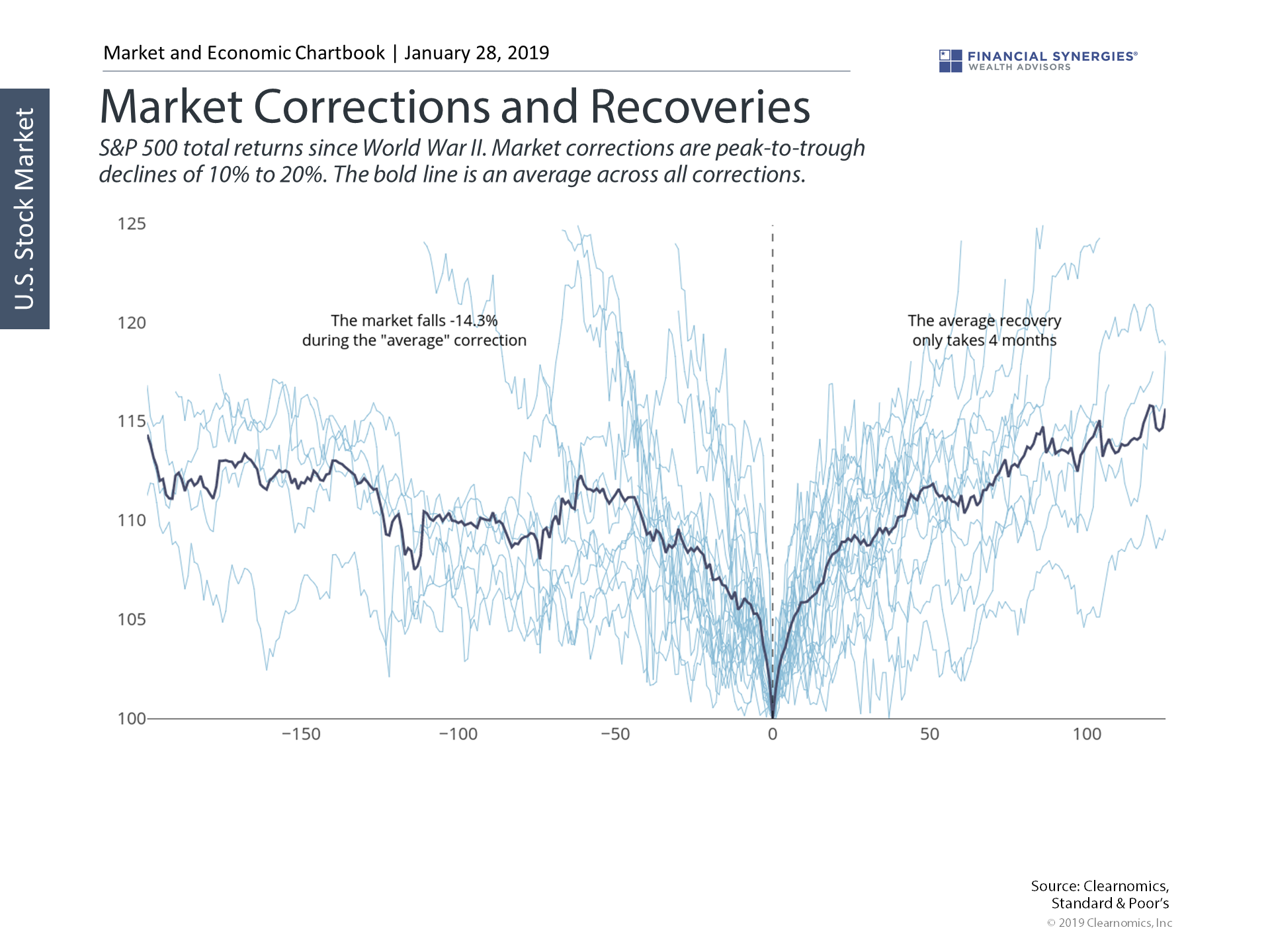

2. Market corrections and recoveries are normal

Market Corrections and Recoveries

Since World War II, there have been two dozen market corrections between -10% and -20%. The average market decline during these periods is -14%, resulting in investor nervousness all along the way.

Since World War II, there have been two dozen market corrections between -10% and -20%. The average market decline during these periods is -14%, resulting in investor nervousness all along the way.

However, if the market and economic conditions are right, markets can rebound swiftly as well. On average, the market fully recovers in four months. This most recently occurred during the market corrections of late 2015 and early 2016.

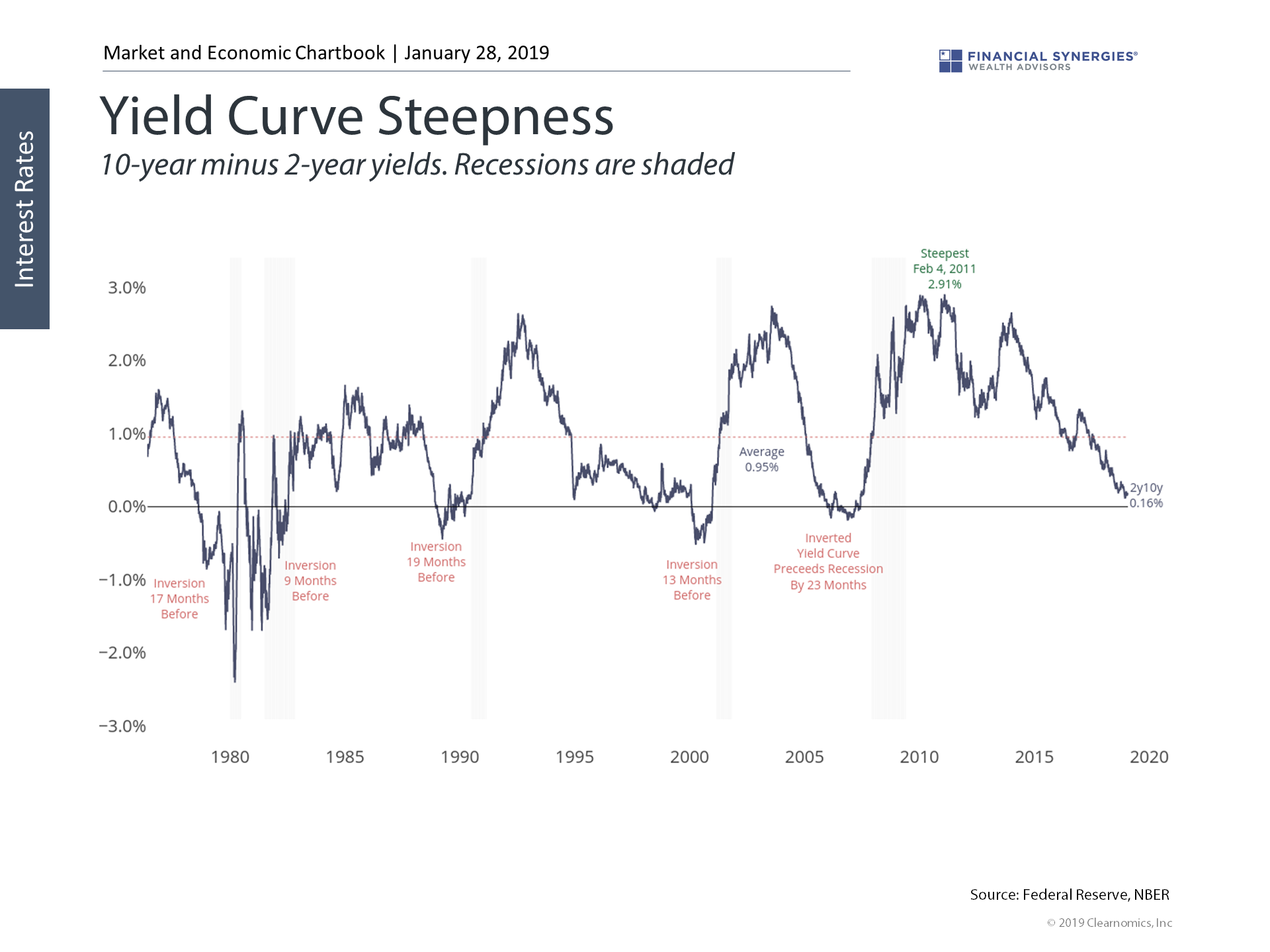

3. The yield curve is still flat, but it doesn’t mean a recession is imminent

Yield Curve Steepness

The yield curve is a traditional indicator of economic health and recessions, and a significant source of investor nervousness last year. However, it’s important to understand that this is primarily due to Fed tightening. At the moment, it’s expected that the Fed will slow or halt its path of rate hikes in 2019, which should mitigate this trend.

The yield curve is a traditional indicator of economic health and recessions, and a significant source of investor nervousness last year. However, it’s important to understand that this is primarily due to Fed tightening. At the moment, it’s expected that the Fed will slow or halt its path of rate hikes in 2019, which should mitigate this trend.

It’s also important to note that yield curve inversions leading up to recessions are a process, not something that happens overnight. Historically, as shown in the chart, there is often a 12-24 month lead time between the yield curve inverting and the onset of a recession. At this point the yield curve hasn’t yet inverted.

Investing is always a journey. Keeping the market and economic environment in perspective is critical in reaching one’s destination.

Source: Clearnomics

Taking Stock: 2018-2019

As we near the end of January, it’s a good time to take stock of the market recovery so far. The S&P 500 is now flat compared to the beginning of 2018, regaining 13% over the past month. Over the past two years, the market has returned roughly 9% annually, a solid return by any measure. Sentiment has shifted as well – as many investors now believe a recession in 2019 is unlikely, and very few are using the term “bear market.” Of course sentiment and reality sometimes collide, so we can’t give this much importance. And volatility is likely to continue, especially as concerns over trade, the Fed, and economic growth persist.

It’s a good time for investors to remember that much of investing depends on our own behavior. While we may intellectually know that volatility is unavoidable and that shifts in market sentiment are normal, it’s difficult to maintain emotional composure in the midst of large market swings. Investors who have experienced periods of volatility such as the recent one may be in a better position to stay invested the next time turbulence hits.

In many ways, investing for long-term goals is like planning a cross-country road trip. First, it’s important to know where you want to go, to plan your route properly, and to tune up your car beforehand. Second, what matters more than anything else is that you take the right interstates and drive in the right direction. You may be able to save some time with clever navigation or by weaving in and out of traffic. But these benefits are secondary to staying on the right road, especially if they cause you to miss an exit.

We can expect detours, road construction, bad weather, and other complications. While these may slow you down, they won’t stop you from reaching your destination.

This may sound like common sense, but it takes discipline to apply the same principles to investing. Many investors fail to properly plan and thus don’t stick to an appropriate balanced portfolio. They may be tempted to trade in and out of markets, or invest in what’s exciting at the moment, at the expense of their long-term goals. Most critically, many investors are tempted to give up on their plans altogether when volatility strikes.

1. Stocks have rebounded from their December lows

Stock Market Returns in Perspective

At the moment, the S&P 500 is essentially flat since the beginning of 2018. However, over the past two years, the S&P 500 has risen 19% before dividends. Despite how investors may feel, this is a terrific return over this time-frame.

2. Market corrections and recoveries are normal

Market Corrections and Recoveries

However, if the market and economic conditions are right, markets can rebound swiftly as well. On average, the market fully recovers in four months. This most recently occurred during the market corrections of late 2015 and early 2016.

3. The yield curve is still flat, but it doesn’t mean a recession is imminent

Yield Curve Steepness

It’s also important to note that yield curve inversions leading up to recessions are a process, not something that happens overnight. Historically, as shown in the chart, there is often a 12-24 month lead time between the yield curve inverting and the onset of a recession. At this point the yield curve hasn’t yet inverted.

Investing is always a journey. Keeping the market and economic environment in perspective is critical in reaching one’s destination.

Source: Clearnomics

Recent Posts

The Market Reaches All-Time Highs

Last Week on Wall Street: Broad-Based Market Rally [June 30-2025]

5 Key Market Insights for the Second Half of 2025

Subscribe to Our Blog

Shareholder | Chief Investment Officer