Trade war headlines continue to weigh on markets as new tariffs go into effect. As I write this, the market can’t decide which way it wants to go – 📈 wildly swinging up and down. 📉

President Trump recently confirmed tariffs on Canada, Mexico and China, dashing hopes of more extensions or last-minute deals. Additional tariffs are expected in the coming months, including reciprocal ones against countries that impose duties on U.S. goods.

Investors worry that a trade war could raise prices for consumers and businesses, slowing economic growth. As a result, the stock market has pulled back in recent days across major indices and sectors.

While market swings are never pleasant, it’s times like these that personalized, well-constructed portfolios and financial plans truly shine. Just as markets pulled back on trade war concerns in 2017 and 2018, investors have been on edge since the presidential inauguration. Markets will overcome these concerns in the long run, even if the day-to-day swings are uncomfortable.

Why tariffs are a concern for the market

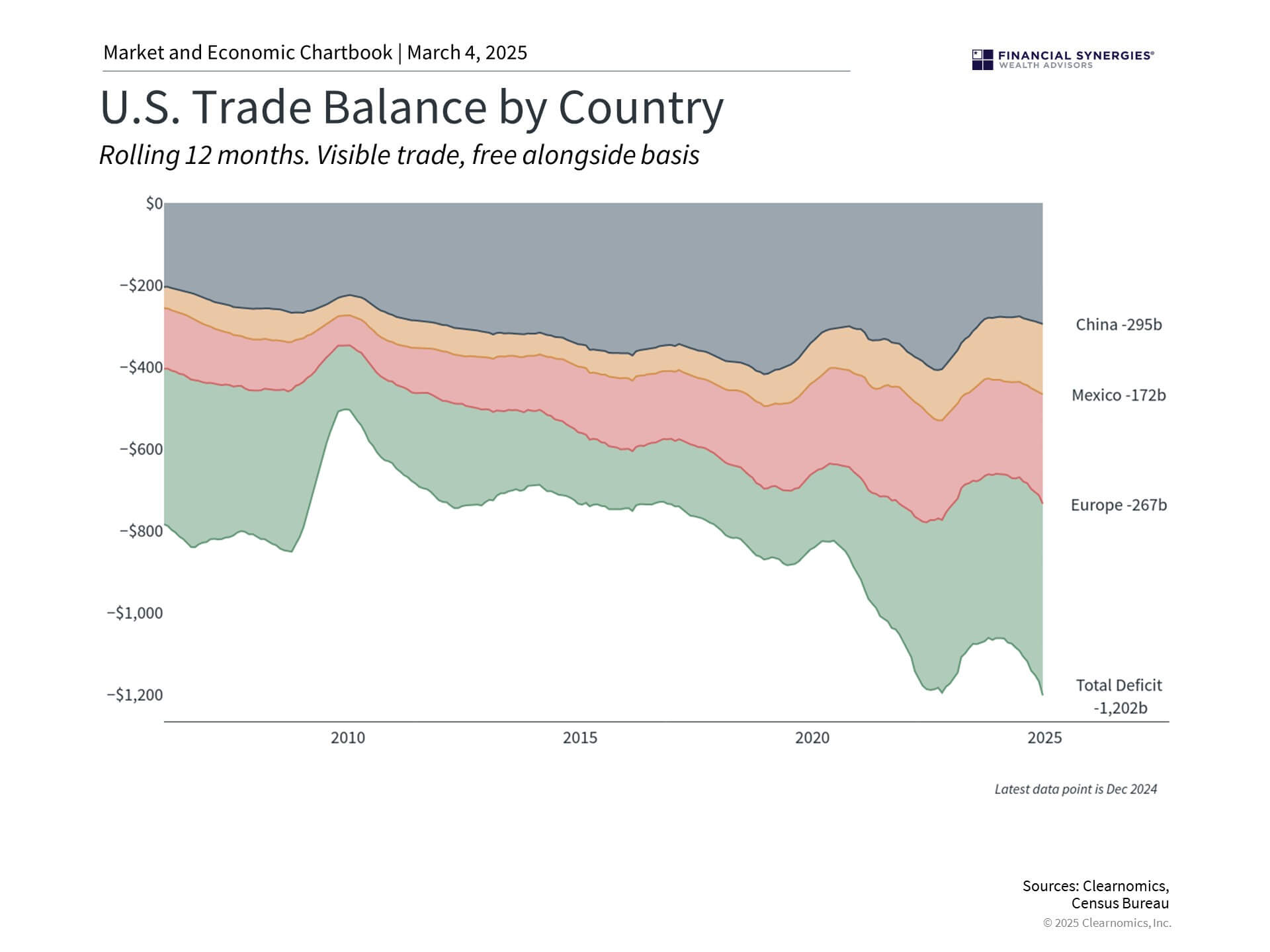

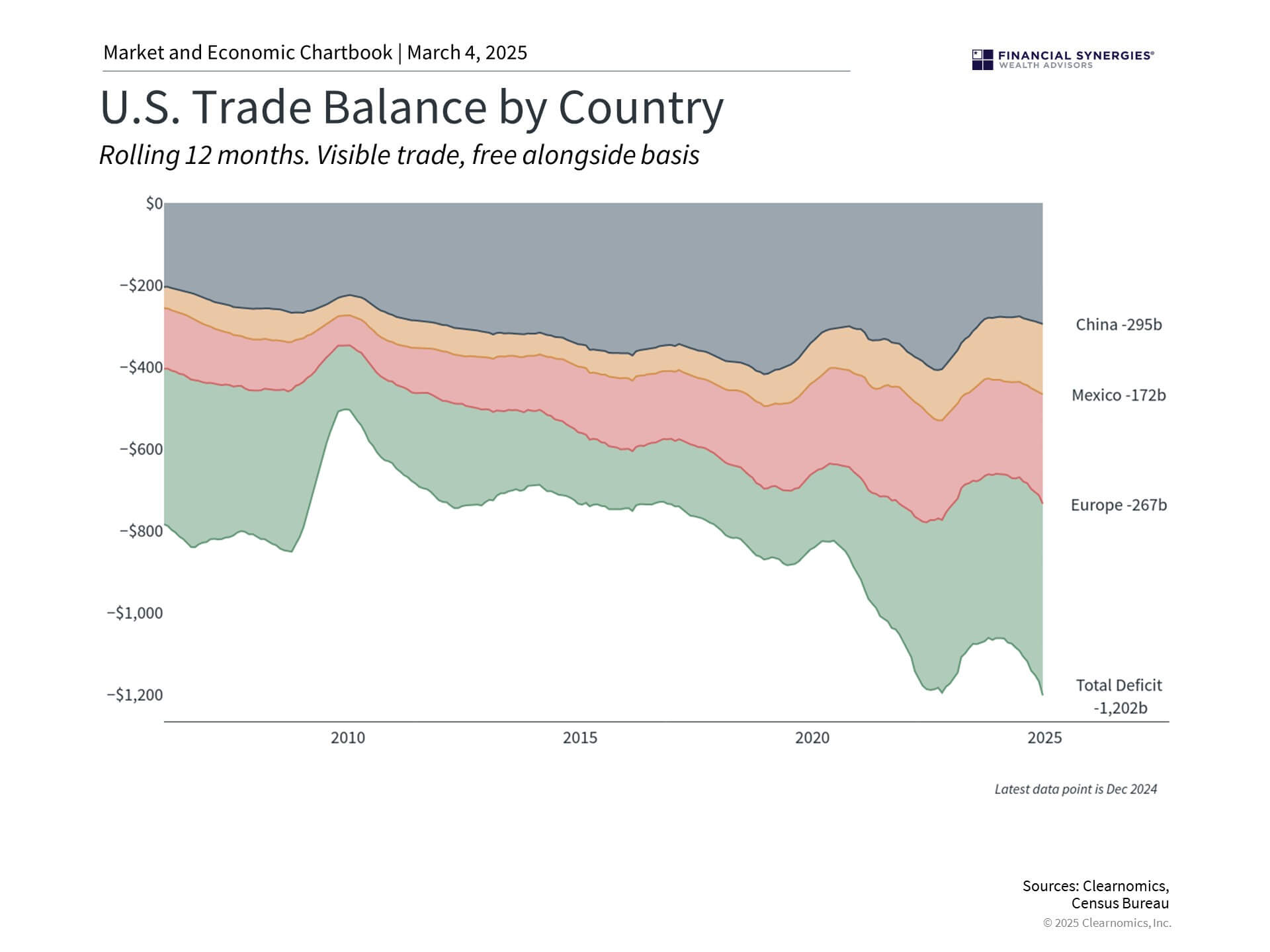

Tariffs can be concerning because they represent taxes on imported goods that can then be passed on to buyers. With inflation rates still hotter than many would like, tariffs could add further pressure to the prices of everyday necessities. This is made worse if other countries retaliate with their own tariffs, sparking an escalating trade war. As the accompanying chart shows, the U.S. runs a significant trade deficit with many major trading partners.

It’s important to keep this round of tariffs in perspective. First, the U.S. has a long history of using tariffs dating back to the Industrial Revolution and hitting a peak during the Great Depression. The goal of tariffs is often to protect domestic industries, especially when they involve important or sensitive sectors, such as technology and national security.

Second, the previous round of tariffs during President Trump’s first administration led to trade deals with Mexico, China, and others. For the administration, tariffs are often used as a negotiating tactic for other policy objectives, such as curbing illegal immigration or imports of illegal drugs.

Third, market reactions to tariff announcements often prove more dramatic than their actual economic impact. This is especially true if tariffs are short-lived or if deals are reached. While markets were choppy from 2017 to 2019 when trade wars were a concern, markets generally performed quite well.

While today’s trade war concerns differ in some ways from previous episodes, they are a reminder that market fears don’t always translate into reality.

Market pullbacks are a normal part of investing

Given the market’s recent swings and the constant news coverage, the S&P 500 has pulled back about 5% at the time of this writing. While this can be unpleasant, the reality is that market pullbacks of this magnitude occur on a regular basis. Pullbacks of this size or worse occurred twice in 2024, three times in 2023, and a dozen times during the 2022 bear market.

With markets reaching new all-time highs over the past few years, some investors may have grown accustomed to markets only moving in one direction. While the current year-to-date performance may not be what many hoped for at the beginning of the year, when much of the focus was pro-growth policies, many aspects of the market remain positive.

For example, corporate earnings grew at a strong pace this past earnings season. Unemployment is still historically low at 4.0%, wages are rising, and productivity growth remains steady. From a risk perspective, high yield credit spreads remain well below pre-pandemic levels. This suggests bond investors are less nervous about growth prospects than the stock market.

Staying invested is the best way to weather market volatility over time

While technology stocks have struggled, other sectors have performed well over the past several months. Other asset classes and regions have also performed well, reminding investors of the importance of a balanced portfolio. Bonds, for instance, have benefited as interest rates have fallen. As they often do in difficult market environments, positive bond returns have helped to offset stock market declines in diversified portfolios.

History shows that maintaining a long-term approach remains one of the most effective strategies for navigating market volatility. While short-term market swings can be unsettling, investors who stay consistently invested through market cycles have historically captured the benefits of compound returns.

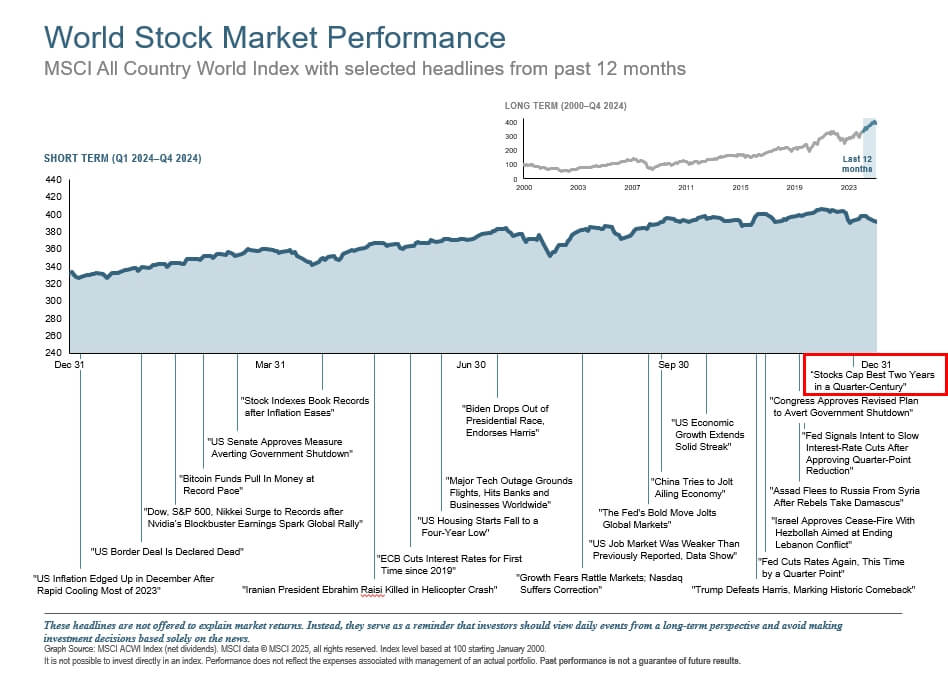

One only has to glance at the chart above (world stock market performance for 2024) to notice all the events that could have completely derailed the market. But 2024 capped off the best two years in a quarter-century.

So, although there will be more trade headlines in the coming days, it’s important to remember that investing is not about a single day, week, or month. Instead, building and holding a well-constructed portfolio is about achieving financial goals over years and decades.

Sources: Clearnomics, Dimensional Fund Advisors

Concerns or questions about how your investment portfolio will hold up in the current market environment? Contact Financial Synergies today.

We are a boutique, financial advisory and total wealth management firm with over 35 years helping clients navigate turbulent markets. To learn more about our approach to investment management please reach out to us. One of our seasoned advisors would be happy to help you build a custom financial plan to help ensure you accomplish your financial goals and objectives. Schedule a conversation with us today.

More relevant articles by Financial Synergies:

Blog Disclosures

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own financial advisors as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blogs, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Financial Synergies Wealth Advisors, Inc. employees providing such comments, and should not be regarded as the views of Financial Synergies Wealth Advisors, Inc. or its respective affiliates or as a description of advisory services provided by Financial Synergies Wealth Advisors, Inc. or performance returns of any Financial Synergies Wealth Advisors, Inc. client.

Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Financial Synergies Wealth Advisors, Inc. or its employees. The views reflected in the commentary are subject to change at any time without notice.

Nothing on this website constitutes investment or financial planning advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. It also should not be construed as an offer soliciting the purchase or sale of any security mentioned. Nor should it be construed as an offer to provide investment advisory services by Financial Synergies Wealth Advisors, Inc.

Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Financial Synergies Wealth Advisors, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Any charts provided here or on any related Financial Synergies Wealth Advisors, Inc. personnel content outlets are for informational purposes only, and should also not be relied upon when making any investment decision. Any indices referenced for comparison are unmanaged and cannot be invested into directly. As always please remember investing involves risk and possible loss of principal capital; please seek advice from a licensed professional. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Information in charts have been obtained from third-party sources and data, and may include those from portfolio securities of funds managed by Financial Synergies Wealth Advisors, Inc. While taken from sources believed to be reliable, Financial Synergies Wealth Advisors, Inc. has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. All content speaks only as of the date indicated.

Financial Synergies Wealth Advisors, Inc. is a registered investment adviser. Advisory services are only offered to clients or prospective clients where Financial Synergies Wealth Advisors, Inc. and its representatives are properly licensed or exempt from licensure. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

See Full Disclosures Page Here

Special Update: Trade Wars and Market Risk

Trade war headlines continue to weigh on markets as new tariffs go into effect. As I write this, the market can’t decide which way it wants to go – 📈 wildly swinging up and down. 📉

President Trump recently confirmed tariffs on Canada, Mexico and China, dashing hopes of more extensions or last-minute deals. Additional tariffs are expected in the coming months, including reciprocal ones against countries that impose duties on U.S. goods.

Investors worry that a trade war could raise prices for consumers and businesses, slowing economic growth. As a result, the stock market has pulled back in recent days across major indices and sectors.

While market swings are never pleasant, it’s times like these that personalized, well-constructed portfolios and financial plans truly shine. Just as markets pulled back on trade war concerns in 2017 and 2018, investors have been on edge since the presidential inauguration. Markets will overcome these concerns in the long run, even if the day-to-day swings are uncomfortable.

Why tariffs are a concern for the market

Tariffs can be concerning because they represent taxes on imported goods that can then be passed on to buyers. With inflation rates still hotter than many would like, tariffs could add further pressure to the prices of everyday necessities. This is made worse if other countries retaliate with their own tariffs, sparking an escalating trade war. As the accompanying chart shows, the U.S. runs a significant trade deficit with many major trading partners.

It’s important to keep this round of tariffs in perspective. First, the U.S. has a long history of using tariffs dating back to the Industrial Revolution and hitting a peak during the Great Depression. The goal of tariffs is often to protect domestic industries, especially when they involve important or sensitive sectors, such as technology and national security.

Second, the previous round of tariffs during President Trump’s first administration led to trade deals with Mexico, China, and others. For the administration, tariffs are often used as a negotiating tactic for other policy objectives, such as curbing illegal immigration or imports of illegal drugs.

Third, market reactions to tariff announcements often prove more dramatic than their actual economic impact. This is especially true if tariffs are short-lived or if deals are reached. While markets were choppy from 2017 to 2019 when trade wars were a concern, markets generally performed quite well.

While today’s trade war concerns differ in some ways from previous episodes, they are a reminder that market fears don’t always translate into reality.

Market pullbacks are a normal part of investing

Given the market’s recent swings and the constant news coverage, the S&P 500 has pulled back about 5% at the time of this writing. While this can be unpleasant, the reality is that market pullbacks of this magnitude occur on a regular basis. Pullbacks of this size or worse occurred twice in 2024, three times in 2023, and a dozen times during the 2022 bear market.

With markets reaching new all-time highs over the past few years, some investors may have grown accustomed to markets only moving in one direction. While the current year-to-date performance may not be what many hoped for at the beginning of the year, when much of the focus was pro-growth policies, many aspects of the market remain positive.

For example, corporate earnings grew at a strong pace this past earnings season. Unemployment is still historically low at 4.0%, wages are rising, and productivity growth remains steady. From a risk perspective, high yield credit spreads remain well below pre-pandemic levels. This suggests bond investors are less nervous about growth prospects than the stock market.

Staying invested is the best way to weather market volatility over time

While technology stocks have struggled, other sectors have performed well over the past several months. Other asset classes and regions have also performed well, reminding investors of the importance of a balanced portfolio. Bonds, for instance, have benefited as interest rates have fallen. As they often do in difficult market environments, positive bond returns have helped to offset stock market declines in diversified portfolios.

History shows that maintaining a long-term approach remains one of the most effective strategies for navigating market volatility. While short-term market swings can be unsettling, investors who stay consistently invested through market cycles have historically captured the benefits of compound returns.

One only has to glance at the chart above (world stock market performance for 2024) to notice all the events that could have completely derailed the market. But 2024 capped off the best two years in a quarter-century.

So, although there will be more trade headlines in the coming days, it’s important to remember that investing is not about a single day, week, or month. Instead, building and holding a well-constructed portfolio is about achieving financial goals over years and decades.

Sources: Clearnomics, Dimensional Fund Advisors

Concerns or questions about how your investment portfolio will hold up in the current market environment? Contact Financial Synergies today.

We are a boutique, financial advisory and total wealth management firm with over 35 years helping clients navigate turbulent markets. To learn more about our approach to investment management please reach out to us. One of our seasoned advisors would be happy to help you build a custom financial plan to help ensure you accomplish your financial goals and objectives. Schedule a conversation with us today.

More relevant articles by Financial Synergies:

Blog Disclosures

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own financial advisors as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blogs, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Financial Synergies Wealth Advisors, Inc. employees providing such comments, and should not be regarded as the views of Financial Synergies Wealth Advisors, Inc. or its respective affiliates or as a description of advisory services provided by Financial Synergies Wealth Advisors, Inc. or performance returns of any Financial Synergies Wealth Advisors, Inc. client.

Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Financial Synergies Wealth Advisors, Inc. or its employees. The views reflected in the commentary are subject to change at any time without notice.

Nothing on this website constitutes investment or financial planning advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. It also should not be construed as an offer soliciting the purchase or sale of any security mentioned. Nor should it be construed as an offer to provide investment advisory services by Financial Synergies Wealth Advisors, Inc.

Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Financial Synergies Wealth Advisors, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Any charts provided here or on any related Financial Synergies Wealth Advisors, Inc. personnel content outlets are for informational purposes only, and should also not be relied upon when making any investment decision. Any indices referenced for comparison are unmanaged and cannot be invested into directly. As always please remember investing involves risk and possible loss of principal capital; please seek advice from a licensed professional. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Information in charts have been obtained from third-party sources and data, and may include those from portfolio securities of funds managed by Financial Synergies Wealth Advisors, Inc. While taken from sources believed to be reliable, Financial Synergies Wealth Advisors, Inc. has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. All content speaks only as of the date indicated.

Financial Synergies Wealth Advisors, Inc. is a registered investment adviser. Advisory services are only offered to clients or prospective clients where Financial Synergies Wealth Advisors, Inc. and its representatives are properly licensed or exempt from licensure. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

See Full Disclosures Page Here

Recent Posts

Why Investors Can Be Thankful in 2025

Weekly Market Recap | Nov. 21, 2025

Chart of the Month | S&P 500 Sets More Than 35 New Highs for Second Consecutive Year

Subscribe to Our Blog

Shareholder | Chief Investment Officer