- May 20, 2019

- Skyler Denny

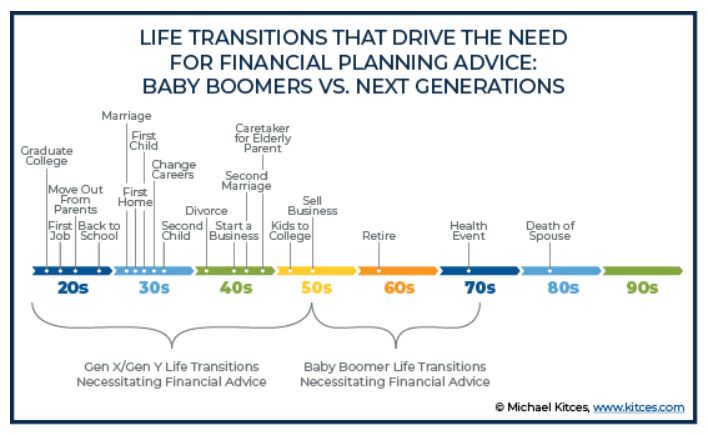

Pathway® is a financial planning and investment program focused on early and mid-career professionals. Planning for this demographic is crucial, given working professionals experience major life events so frequently.

From marriage, career changes, going back to school, buying their first home, starting or growing a family, time off after children, childcare expenses, private primary education, college funding, purchasing a new home or vacation home, student debt, divorce, employer benefits, inheritance, entrepreneurship, buying a business, selling a business, financial support of parents, grandparents, or other relatives, charitable giving; the list goes on and on.

Financial Synergies Pathway® was specifically designed with these life transitions in mind. To guide professionals through their life and provide high touch advice to the {future} wealthy. Traditionally, these individuals have not had access to this type of Wealth Management relationship, simply because they have not been in their career long enough to accumulate assets necessary to meet Wealth Management minimums.

Home Affordability

How much home can you afford? The internet is filled with articles and “advice” on this topic but how does it relate to your specific situation? Many people simply take the approach of, I was able to qualify for the mortgage, therefore I can afford it. To say it bluntly, this is WRONG. There are so many additional factors that should go into this major decision, for example; property taxes and insurance (are the somewhat obvious ones), but will this move affect your lifestyle, will you still be able to save enough to achieve all your other goals? If the move is going to elevate your lifestyle, are you saving enough to maintain that lifestyle for the long haul?

Alphabet Soup of Employee Benefits

401(k), Roth 401(k), 403(b), Roth 403(b), 457, TSP, TRS, ORP, ESOP, ESPP, RSUs, HSA, 401(a), Profit Sharing, Deferred Compensation, Pension; just to name a few…What do all these different plans offer and which should you take advantage of? Which plans are worth passing on? Should you save in a Traditional or Roth retirement plan? Should you focus savings in your retirement plan until you contribute the annual maximum, or should you build a balance of assets with different tax benefits? Just because you are maxing out your retirement plan, does that mean you are saving enough? How do you make these decisions without a financial plan?

Career Opportunities

Considering new employment opportunities? Weighing offers between employers accurately is critical, as there are many factors to consider when making a pivotal career decision. One job may have a higher base salary, but benefits may be drastically different. Accepting a new position based 100% on salary may quickly lead you in the wrong direction. Consider longer term career growth, opportunity for advancement, and stability of the company.

You’ve been an employee throughout your career and are now considering taking the leap to go out on your own and start a business, but are unsure how to fund the startup. Can you afford to take a pay cut while getting the business off the ground? Whether it’s the independence or potential income that drives you to entrepreneurship, we are here to assist you through that process. We’ll work together to maximize your income, while minimizing your tax liability. Together we will build a plan to provide the long-term financial stability you and your family deserve.

Already own a business and looking for a way to add benefits for your employees to help ensure long-term stability of your company and keep key employees? We’ll advise you on the many different company retirement plan options, so you can make an informed decision as to what’s best for your business and employees.

Conclusion

Financial Synergies Pathway® is the answer to all these questions. Through our advanced planning process, we incorporate financial planning and portfolio management to help clients achieve the peace of mind they are looking for. It’s important to have a trusted financial advisor to help guide you through life’s many inevitable transitions.

We are advocates of enjoying your life now, while also saving enough for the future. There is a fine line between the two, so we build intentional relationships with our clients to learn about their goals and aspirations, while having a thorough understanding of their concerns.

Contact us today to learn more about our services.

Sources: Michael Kitces at Nerd’s Eye View