Monthly Market Update: The Stock Market Experienced a Big Rotation in July

For your convenience, we’ve also provided a PDF copy of the Monthly Market Update: The Stock Market Experienced a Big Rotation in July.

Monthly Market Summary

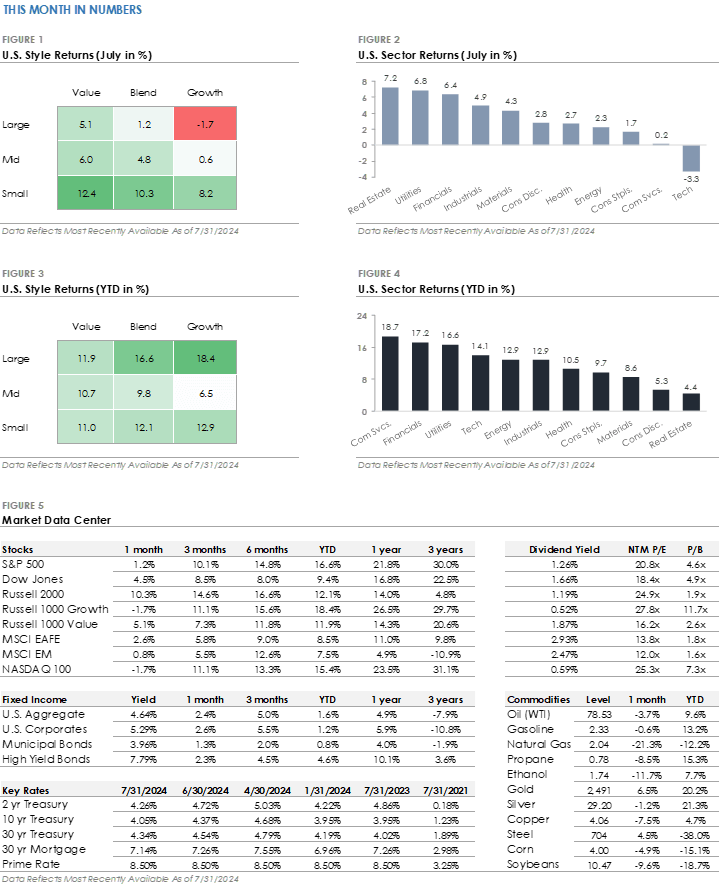

- The S&P 500 Index returned +1.2% in July, underperforming the Russell 2000 Index’s +10.3% return. Ten of the eleven S&P 500 sectors traded higher, led by Real Estate, Utilities, and Financials. Technology was the only sector to trade lower, reversing a portion of its rise in the first half of 2024.

- Corporate investment-grade bonds produced a +2.6% total return as Treasury yields declined. Corporate high-yield bonds gained +2.3% as credit spreads tightened.

- International stock performance was mixed. The MSCI EAFE developed market stock index returned +2.6%, while the MSCI Emerging Market Index returned +0.8%.

Stocks & Bonds End the Month Slightly Higher

The S&P 500 ended July slightly higher, its third consecutive monthly gain. The index initially traded higher and briefly surpassed 5,600 for the first time before it traded lower in late July and gave back some of the gains. The tech-heavy Nasdaq 100, which led markets higher in the first half of 2024, returned -1.7% as Nvidia, Microsoft, Google, and Facebook-parent Meta traded down after their strong 2024 start.

In contrast, the Russell 2000 Index of small-cap stocks posted its strongest monthly return since December 2023. In the bond market, Treasury yields fell. The U.S. Bond Aggregate Index, which tracks a wide array of investment-grade bonds, traded higher for a third consecutive month, the longest win streak since 2021. Despite the muted headline returns, the stock market experienced a seismic shift as expectations increased for a September interest rate cut.

Investors Rotate into Small Cap Stocks as Rate Cuts Come into View

Large-cap stocks dominated in the first half of 2024, with the S&P 500 outperforming the Russell 2000 by over +13%. The S&P 500’s strong first half return was influenced by two factors: (1) investor concerns about the impact of high interest rates on smaller companies and (2) large-cap stock indices’ exposure to the artificial intelligence (AI) industry. This combination of interest rate concerns and AI dominance led to crowded positioning as investors focused on a narrow group of large-cap stocks.

The investment narrative changed in July after the CPI inflation report showed continued progress. The better-than-expected inflation report raised expectations for a September interest rate cut, leading to a significant rotation within equity markets. Investors moved from large-cap stocks into small caps, with the Russell 2000 outperforming the S&P 500 by over +9%. This year’s high-flying mega-caps bore the brunt of the large-cap sell-off as investors questioned when billions of dollars in AI investments will pay off.

As investors rotated, the year-to-date return gap between the Nasdaq 100 and Russell 2000 shrank from nearly +16% at the end of June to now only +3.3%. It’s uncommon for the stock market to experience such a large shift in such a short amount of time. There could be some residual volatility in the near term as markets weigh the prospects for corporate earnings and interest rate cuts, but the market isn’t expecting a repeat in August.

Disclosures

Past performance does not guarantee future results. The performance information shown herein is based on total returns with dividends reinvested and does not reflect the deduction of advisory and/or other fees normally incurred in the management of a portfolio.

Stock performance and fundamental data is based on the following instruments: SPDR S&P 500 ETF (SPY), SPDR Dow Jones ETF (DIA), iShares Russell 2000 ETF (IWM), iShares Russell 1000 Growth ETF (IWF), iShares Russell 1000 Value ETF (IWD), iShares MSCI EAFE ETF (EFA), iShares MSCI Emerging Markets ETF (EEM), Invesco QQQ Trust (QQQ).

Fixed Income performance is based on the following instruments: iShares Core U.S. Aggregate Bond ETF (AGG), iShares Investment Grade Corporate ETF (LQD), iShares National Muni Bond ETF (MUB), iShares High Yield Corporate ETF (HYG).

Fixed Income yields and key rates are based on the following instruments: Bloomberg US Aggregate, ICE BofA US Corporate, ICE BofA US Municipal Securities, ICE BofA US High Yield, 2 Year US Benchmark Bond, 10 Year US Benchmark Bond, 30 Year US Benchmark Bond, 30 Year US Fixed Mortgage Rate, US Prime Rate.

Commodity prices are based on the following instruments: Crude Oil WTI (NYM $/bbl), Gasoline Regular U.S. Gulf Coast ($/gal), Natural Gas (NYM $/mmbtu), Propane (NYM $/gal), Ethanol (CRB $/gallon), Gold (NYM $/ozt), Silver (NYM $/ozt), Copper NYMEX ($/lb), U.S. Midwest Domestic Hot-Rolled Coil Steel (NYM $/st), Corn (CBT $/bu), Soybeans (Chicago $/bu).

U.S. Style performance is based on the following instruments: iShares Russell 1000 Value ETF (IWD), SPDR S&P 500 ETF Trust (SPY), iShares Russell 1000 Growth ETF (IWF), iShares Russell Mid-Cap Value ETF (IWS), iShares Russell Midcap ETF (IWR), iShares Russell Mid-Cap Growth ETF (IWP), iShares Russell 2000 Value ETF (IWN), iShares Russell 2000 ETF (IWM), iShares Russell 2000 Growth ETF (IWO).

U.S. Sector performance is based on the following instruments: Consumer Discretionary Sector SPDR ETF (XLY), Consumer Staples Sector SPDR ETF (XLP), Energy Sector SPDR ETF (XLE), Financial Sector SPDR ETF (XLF), Health Care Sector SPDR ETF (XLV), Industrial Sector SPDR ETF (XLI), Materials Sector SPDR ETF (XLB), Technology Sector SPDR ETF (XLK), Communication Services Sector SPDR ETF (XLC), Utilities Sector SPDR ETF (XLU), Real Estate Sector SPDR ETF (XLRE).

Concerns or questions about how your investment portfolio will hold up in the current market environment? Contact Financial Synergies today.

We are a boutique, financial advisory and total wealth management firm with over 35 years helping clients navigate turbulent markets. To learn more about our approach to investment management please reach out to us. One of our seasoned advisors would be happy to help you build a custom financial plan to help ensure you accomplish your financial goals and objectives. Schedule a conversation with us today.

More relevant articles by Financial Synergies:

Monthly Market Update: The Stock Market Experienced a Big Rotation in July

Monthly Market Update: The Stock Market Experienced a Big Rotation in July

For your convenience, we’ve also provided a PDF copy of the Monthly Market Update: The Stock Market Experienced a Big Rotation in July.

Monthly Market Summary

Stocks & Bonds End the Month Slightly Higher

The S&P 500 ended July slightly higher, its third consecutive monthly gain. The index initially traded higher and briefly surpassed 5,600 for the first time before it traded lower in late July and gave back some of the gains. The tech-heavy Nasdaq 100, which led markets higher in the first half of 2024, returned -1.7% as Nvidia, Microsoft, Google, and Facebook-parent Meta traded down after their strong 2024 start.

In contrast, the Russell 2000 Index of small-cap stocks posted its strongest monthly return since December 2023. In the bond market, Treasury yields fell. The U.S. Bond Aggregate Index, which tracks a wide array of investment-grade bonds, traded higher for a third consecutive month, the longest win streak since 2021. Despite the muted headline returns, the stock market experienced a seismic shift as expectations increased for a September interest rate cut.

Investors Rotate into Small Cap Stocks as Rate Cuts Come into View

Large-cap stocks dominated in the first half of 2024, with the S&P 500 outperforming the Russell 2000 by over +13%. The S&P 500’s strong first half return was influenced by two factors: (1) investor concerns about the impact of high interest rates on smaller companies and (2) large-cap stock indices’ exposure to the artificial intelligence (AI) industry. This combination of interest rate concerns and AI dominance led to crowded positioning as investors focused on a narrow group of large-cap stocks.

The investment narrative changed in July after the CPI inflation report showed continued progress. The better-than-expected inflation report raised expectations for a September interest rate cut, leading to a significant rotation within equity markets. Investors moved from large-cap stocks into small caps, with the Russell 2000 outperforming the S&P 500 by over +9%. This year’s high-flying mega-caps bore the brunt of the large-cap sell-off as investors questioned when billions of dollars in AI investments will pay off.

As investors rotated, the year-to-date return gap between the Nasdaq 100 and Russell 2000 shrank from nearly +16% at the end of June to now only +3.3%. It’s uncommon for the stock market to experience such a large shift in such a short amount of time. There could be some residual volatility in the near term as markets weigh the prospects for corporate earnings and interest rate cuts, but the market isn’t expecting a repeat in August.

Disclosures

Past performance does not guarantee future results. The performance information shown herein is based on total returns with dividends reinvested and does not reflect the deduction of advisory and/or other fees normally incurred in the management of a portfolio.

Stock performance and fundamental data is based on the following instruments: SPDR S&P 500 ETF (SPY), SPDR Dow Jones ETF (DIA), iShares Russell 2000 ETF (IWM), iShares Russell 1000 Growth ETF (IWF), iShares Russell 1000 Value ETF (IWD), iShares MSCI EAFE ETF (EFA), iShares MSCI Emerging Markets ETF (EEM), Invesco QQQ Trust (QQQ).

Fixed Income performance is based on the following instruments: iShares Core U.S. Aggregate Bond ETF (AGG), iShares Investment Grade Corporate ETF (LQD), iShares National Muni Bond ETF (MUB), iShares High Yield Corporate ETF (HYG).

Fixed Income yields and key rates are based on the following instruments: Bloomberg US Aggregate, ICE BofA US Corporate, ICE BofA US Municipal Securities, ICE BofA US High Yield, 2 Year US Benchmark Bond, 10 Year US Benchmark Bond, 30 Year US Benchmark Bond, 30 Year US Fixed Mortgage Rate, US Prime Rate.

Commodity prices are based on the following instruments: Crude Oil WTI (NYM $/bbl), Gasoline Regular U.S. Gulf Coast ($/gal), Natural Gas (NYM $/mmbtu), Propane (NYM $/gal), Ethanol (CRB $/gallon), Gold (NYM $/ozt), Silver (NYM $/ozt), Copper NYMEX ($/lb), U.S. Midwest Domestic Hot-Rolled Coil Steel (NYM $/st), Corn (CBT $/bu), Soybeans (Chicago $/bu).

U.S. Style performance is based on the following instruments: iShares Russell 1000 Value ETF (IWD), SPDR S&P 500 ETF Trust (SPY), iShares Russell 1000 Growth ETF (IWF), iShares Russell Mid-Cap Value ETF (IWS), iShares Russell Midcap ETF (IWR), iShares Russell Mid-Cap Growth ETF (IWP), iShares Russell 2000 Value ETF (IWN), iShares Russell 2000 ETF (IWM), iShares Russell 2000 Growth ETF (IWO).

U.S. Sector performance is based on the following instruments: Consumer Discretionary Sector SPDR ETF (XLY), Consumer Staples Sector SPDR ETF (XLP), Energy Sector SPDR ETF (XLE), Financial Sector SPDR ETF (XLF), Health Care Sector SPDR ETF (XLV), Industrial Sector SPDR ETF (XLI), Materials Sector SPDR ETF (XLB), Technology Sector SPDR ETF (XLK), Communication Services Sector SPDR ETF (XLC), Utilities Sector SPDR ETF (XLU), Real Estate Sector SPDR ETF (XLRE).

Concerns or questions about how your investment portfolio will hold up in the current market environment? Contact Financial Synergies today.

We are a boutique, financial advisory and total wealth management firm with over 35 years helping clients navigate turbulent markets. To learn more about our approach to investment management please reach out to us. One of our seasoned advisors would be happy to help you build a custom financial plan to help ensure you accomplish your financial goals and objectives. Schedule a conversation with us today.

More relevant articles by Financial Synergies:

Recent Posts

Bond Markets Are Quietly Pulling Their Weight in 2025

Your 2025 Year End Tax Planning Checklist

Monthly Market Update: Markets Digest the Path of Interest Rates & the Next Phase of the AI Cycle

Subscribe to Our Blog

Shareholder | Chief Investment Officer