From President Biden’s announcement that he will not be seeking re-election, a rotation out of tech stocks and into small caps, and a massive one-day market sell-off, recent events have added to market uncertainty. The S&P 500 recently declined 2.9% from its all-time high, while the Nasdaq pulled back nearly 5%. The market has broadly recovered since.

So, it’s only natural to be concerned about where the market is headed, especially as the presidential election season heats up and the Fed prepares for its first rate cut this cycle. However, history shows that it’s important to stay focused on the long run and not overreact to every news headline. More than ever, staying levelheaded is the best way to achieve long-term financial goals.

This is especially true when it comes to saving for retirement. For those with decades until retirement, it’s critical to start early and hold the right mix of assets that can generate sufficient growth. For those in or near retirement, sticking to an asset allocation that supports income needs while providing growth for longer retirement periods has never been more important. In both cases, investors today need an understanding of the retirement landscape and why they may need to take action to grow and protect their retirement savings.

Investors are increasingly responsible for their own retirements

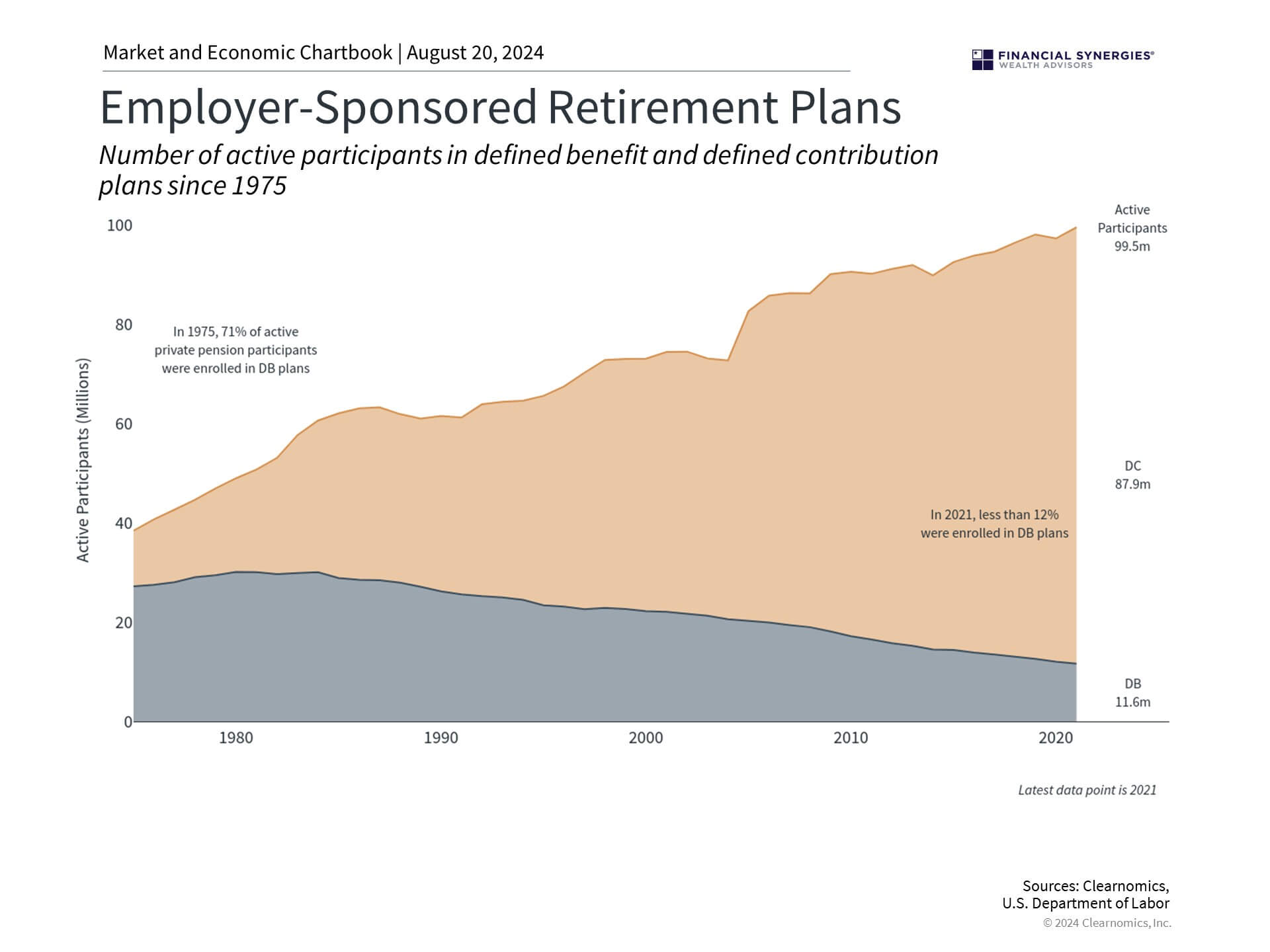

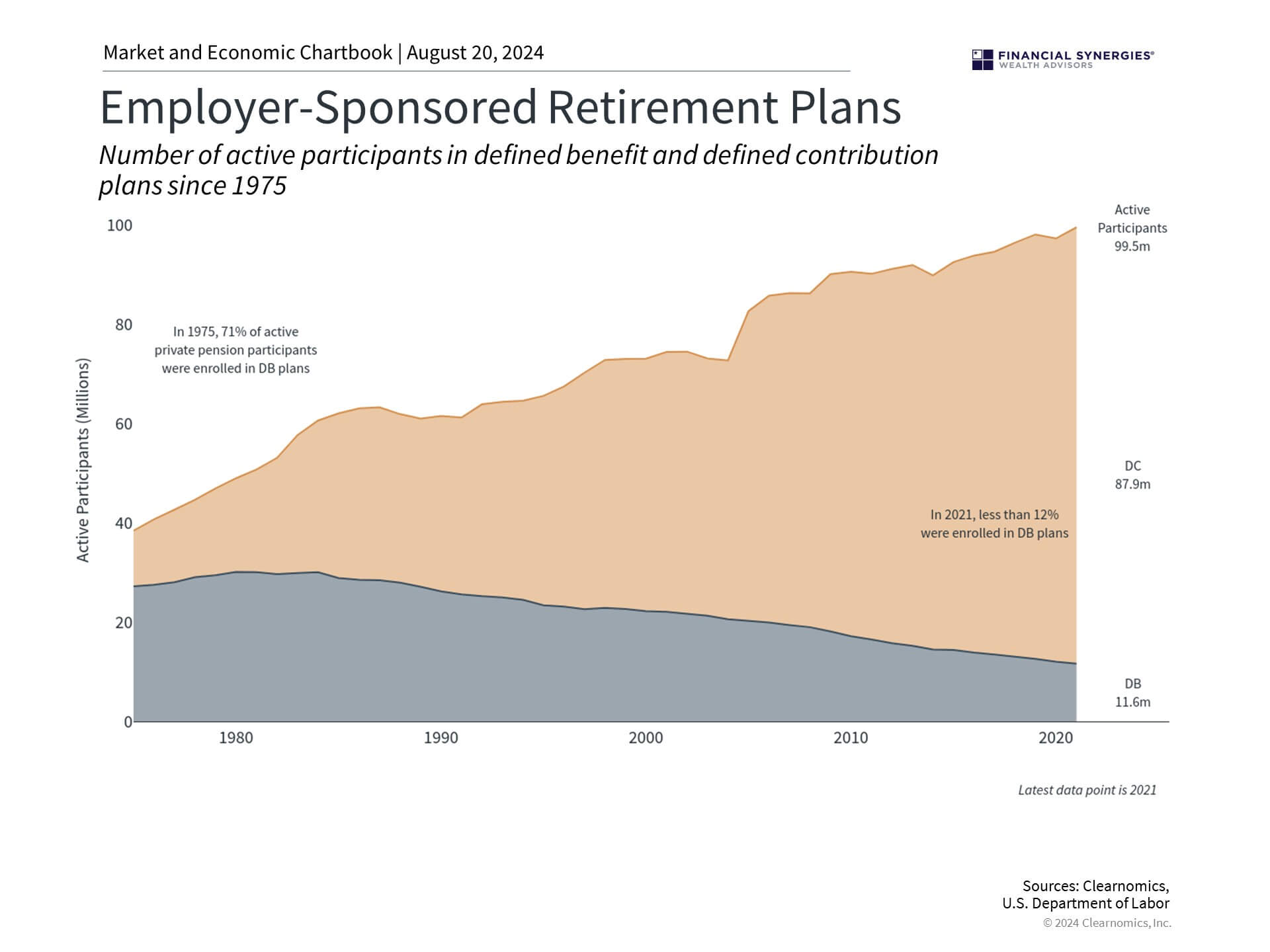

Over the past 50 years, the burden of planning for retirement has shifted from corporations and the government to individuals. Understanding the labyrinth of investment vehicles, tax consequences, how to construct an appropriate portfolio, as well as what to do in times of market volatility can be challenging for even the most sophisticated investors. This is one reason to always seek professional advice to ensure that you’re on track to achieve your financial goals. In fact, most companies also use financial advisors to set up and manage their employer-sponsored retirement plans.

How has the retirement landscape shifted? Looking back, the American Express Company (a railroad business at the time) introduced the first pension plan in 1875. This kicked off a trend of employers providing benefits for employees in retirement. For much of the next century, these were largely “defined benefit” plans, meaning employers contributed to a shared fund and eligible employees would receive benefits in a set amount once they became eligible. Defined benefit plan participants would have the assurance that if they met the qualifications, they would be able to count on regular paychecks in retirement.

Of course, when most people think of receiving checks in retirement, government programs such as Social Security are what come to mind. Social Security was introduced in 1935 when the Great Depression caused unemployment to soar to over 25%. It began providing income to workers once they turned 65 and was responsible for mainstreaming the idea of a retirement age and providing a safety net for older Americans.

However, it’s widely known that shifting demographics and longer life expectancies have put the future of the program in jeopardy. According to the latest report by the Trustees of the Social Security and Medicare trust funds, Social Security reserves are expected to be depleted in 2035 unless Congress acts, at which point fund income will be sufficient to cover only 83% of scheduled benefits. It’s been the case for decades that individuals cannot simply rely on Social Security for their retirement needs.

Investors must determine the most appropriate asset allocation for their goals

Today, the investing journey for most individuals begins with their company’s defined contribution plans, such as a 401(k) or 403(b). The key difference is that defined contribution plan participants must select and manage investments themselves. As a result, they receive benefits in retirement from only what they have saved and invested, unlike under a traditional defined benefit pension plan. The same is true for other retirement vehicles that individuals can open on their own, such as IRAs.

Given this broad shift over the past half-century, the burden of investing properly now falls squarely on the shoulders of individuals. For this reason, it is essential to understand the key principles of investing, especially because they are not typically taught in school.

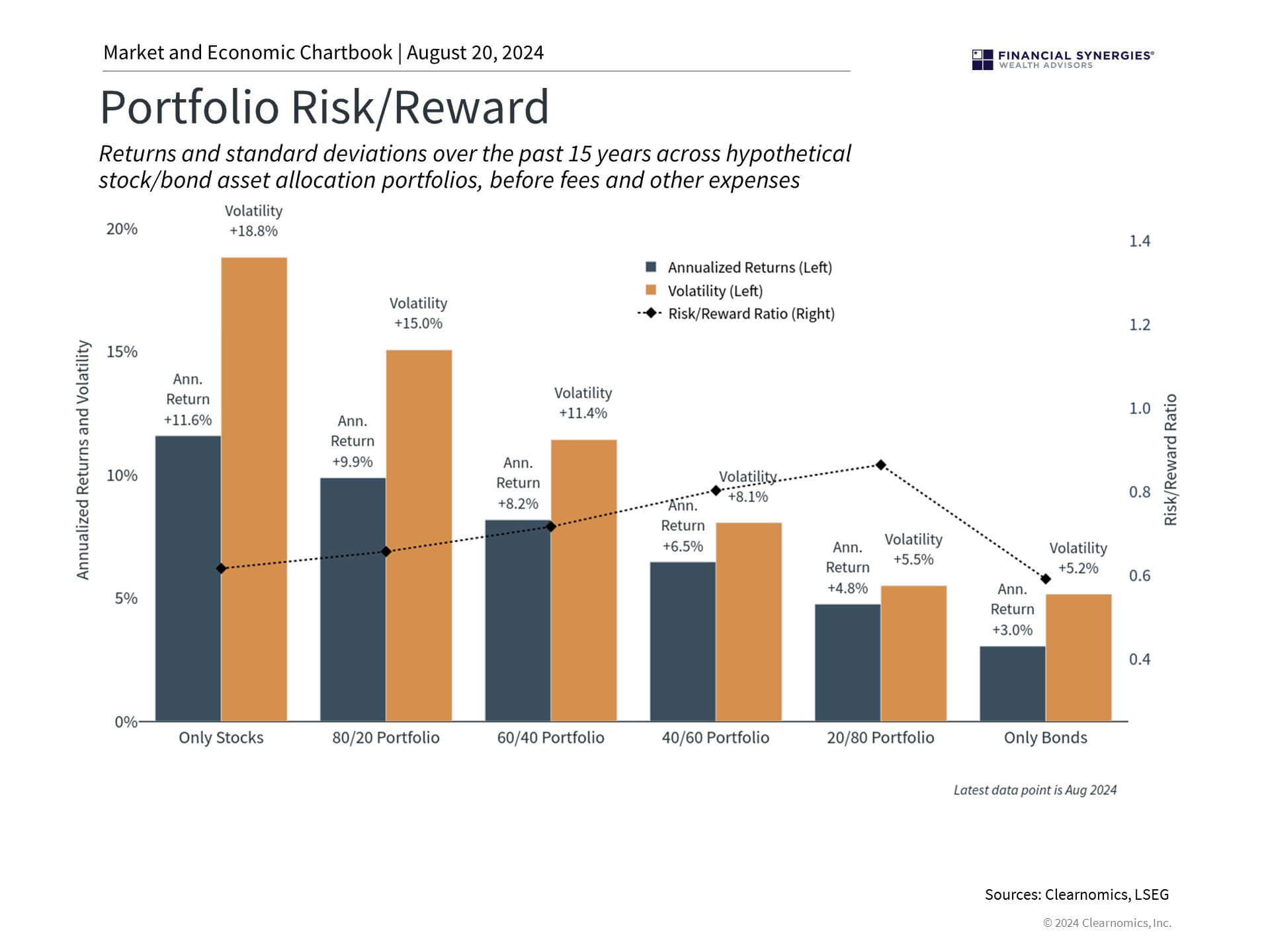

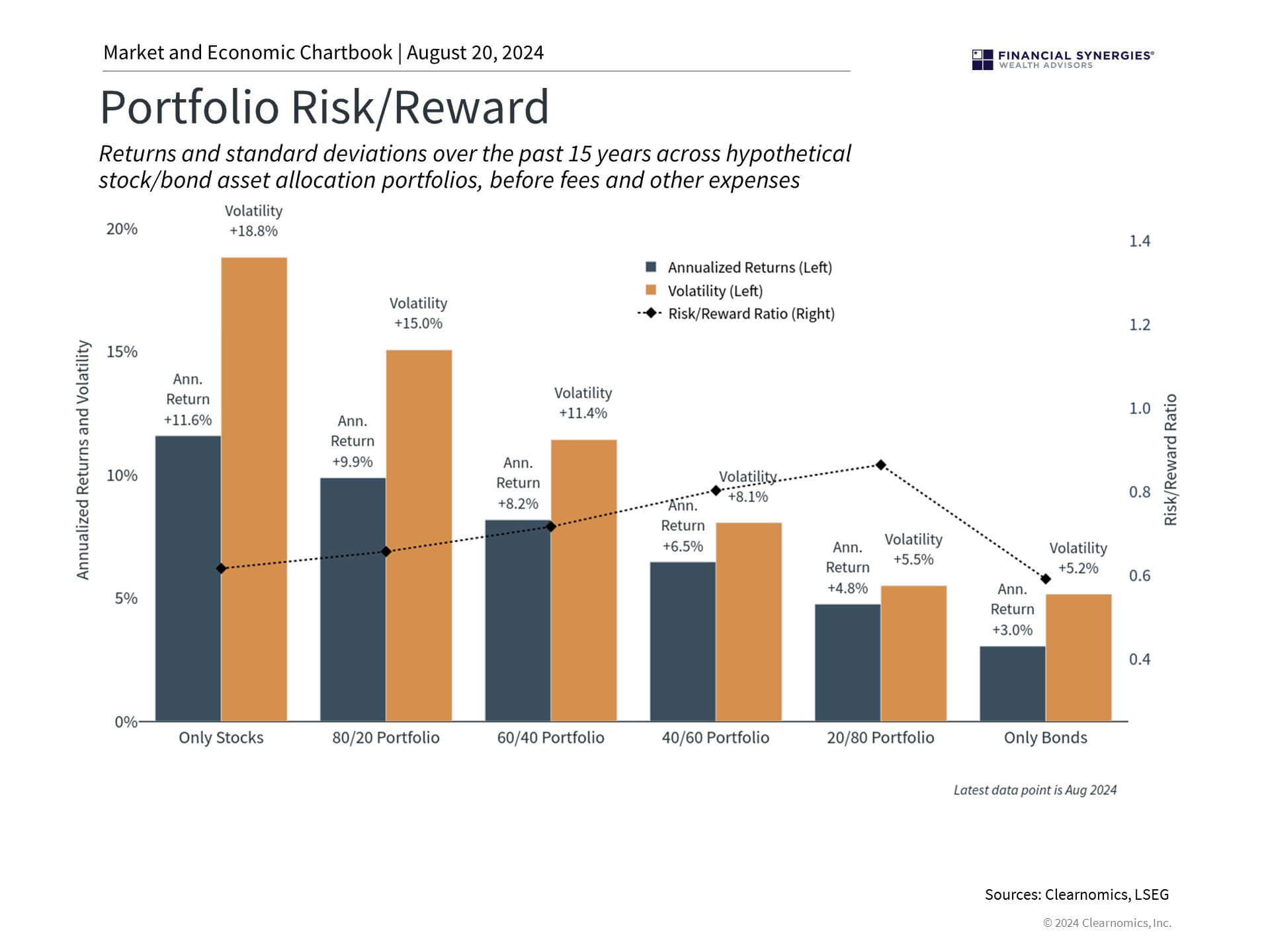

First, investors should hold a properly constructed portfolio tailored to their specific needs, including their life stage, risk tolerance, and more. In the short run, choosing the right mix of assets can help investors to weather the inevitable market swings that occur quite often, such as during the market pullbacks that have occurred throughout this year.

For example, stocks tend to generate larger returns but are also more volatile, as shown in the accompanying chart. In contrast, bonds are typically more stable but also have less potential upside. An appropriate asset allocation allows investors to take advantage of the positive attributes of both asset classes to create a portfolio that is more than the sum of its parts. Investors can then adjust this asset allocation throughout the various stages of their lives and as they approach retirement, in addition to making strategic shifts based on market conditions or life circumstances.

Starting early and staying invested are critical for retirement

Second, saving early can help investors build wealth due to the power of compounding. The earlier an individual begins investing, the more time their money has to grow before withdrawals are needed. This is true even during periods of market turbulence such as over the past few years. While staying out of the market or keeping cash in a checking account may feel safe, the true opportunity cost is the forgone gains that could have helped to provide a more secure retirement.

Finally, it’s important to always stay focused on the long run rather than worrying about day-to-day market fluctuations. Investing early and staying invested through the ups-and-downs of market cycles are the best ways to achieve financial goals. Trying to time the market or make sudden changes to a portfolio is not only difficult but can be counterproductive since it derails investors from their true objectives.

It can often feel as if there is always another crisis on the horizon whether due to politics, the Fed, interest rates, or tech stocks. However, while there are no guarantees when it comes to investing, history shows that investors who save steadily and follow these key principles will be in a better position to grow their retirement savings.

Concerns or questions about how your investment portfolio will hold up in the current market environment? Contact Financial Synergies today.

We are a boutique, financial advisory and total wealth management firm with over 35 years helping clients navigate turbulent markets. To learn more about our approach to investment management please reach out to us. One of our seasoned advisors would be happy to help you build a custom financial plan to help ensure you accomplish your financial goals and objectives. Schedule a conversation with us today.

More relevant articles by Financial Synergies:

Disclosures

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own financial advisors as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blogs, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Financial Synergies Wealth Advisors, Inc. employees providing such comments, and should not be regarded as the views of Financial Synergies Wealth Advisors, Inc. or its respective affiliates or as a description of advisory services provided by Financial Synergies Wealth Advisors, Inc. or performance returns of any Financial Synergies Wealth Advisors, Inc. client.

Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Financial Synergies Wealth Advisors, Inc. or its employees. The views reflected in the commentary are subject to change at any time without notice.

Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. It also should not be construed as an offer soliciting the purchase or sale of any security mentioned. Nor should it be construed as an offer to provide investment advisory services by Financial Synergies Wealth Advisors, Inc.

Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Financial Synergies Wealth Advisors, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Any charts provided here or on any related Financial Synergies Wealth Advisors, Inc. personnel content outlets are for informational purposes only, and should also not be relied upon when making any investment decision. Any indices referenced for comparison are unmanaged and cannot be invested into directly. As always please remember investing involves risk and possible loss of principal capital; please seek advice from a licensed professional. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Information in charts have been obtained from third-party sources and data, and may include those from portfolio securities of funds managed by Financial Synergies Wealth Advisors, Inc. While taken from sources believed to be reliable, Financial Synergies Wealth Advisors, Inc. has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. All content speaks only as of the date indicated.

Financial Synergies Wealth Advisors, Inc. is a registered investment adviser. Advisory services are only offered to clients or prospective clients where Financial Synergies Wealth Advisors, Inc. and its representatives are properly licensed or exempt from licensure. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

See Full Disclosures Page Here

Investing for Retirement Amid Market Uncertainty

From President Biden’s announcement that he will not be seeking re-election, a rotation out of tech stocks and into small caps, and a massive one-day market sell-off, recent events have added to market uncertainty. The S&P 500 recently declined 2.9% from its all-time high, while the Nasdaq pulled back nearly 5%. The market has broadly recovered since.

So, it’s only natural to be concerned about where the market is headed, especially as the presidential election season heats up and the Fed prepares for its first rate cut this cycle. However, history shows that it’s important to stay focused on the long run and not overreact to every news headline. More than ever, staying levelheaded is the best way to achieve long-term financial goals.

This is especially true when it comes to saving for retirement. For those with decades until retirement, it’s critical to start early and hold the right mix of assets that can generate sufficient growth. For those in or near retirement, sticking to an asset allocation that supports income needs while providing growth for longer retirement periods has never been more important. In both cases, investors today need an understanding of the retirement landscape and why they may need to take action to grow and protect their retirement savings.

Investors are increasingly responsible for their own retirements

Over the past 50 years, the burden of planning for retirement has shifted from corporations and the government to individuals. Understanding the labyrinth of investment vehicles, tax consequences, how to construct an appropriate portfolio, as well as what to do in times of market volatility can be challenging for even the most sophisticated investors. This is one reason to always seek professional advice to ensure that you’re on track to achieve your financial goals. In fact, most companies also use financial advisors to set up and manage their employer-sponsored retirement plans.

How has the retirement landscape shifted? Looking back, the American Express Company (a railroad business at the time) introduced the first pension plan in 1875. This kicked off a trend of employers providing benefits for employees in retirement. For much of the next century, these were largely “defined benefit” plans, meaning employers contributed to a shared fund and eligible employees would receive benefits in a set amount once they became eligible. Defined benefit plan participants would have the assurance that if they met the qualifications, they would be able to count on regular paychecks in retirement.

Of course, when most people think of receiving checks in retirement, government programs such as Social Security are what come to mind. Social Security was introduced in 1935 when the Great Depression caused unemployment to soar to over 25%. It began providing income to workers once they turned 65 and was responsible for mainstreaming the idea of a retirement age and providing a safety net for older Americans.

However, it’s widely known that shifting demographics and longer life expectancies have put the future of the program in jeopardy. According to the latest report by the Trustees of the Social Security and Medicare trust funds, Social Security reserves are expected to be depleted in 2035 unless Congress acts, at which point fund income will be sufficient to cover only 83% of scheduled benefits. It’s been the case for decades that individuals cannot simply rely on Social Security for their retirement needs.

Investors must determine the most appropriate asset allocation for their goals

Today, the investing journey for most individuals begins with their company’s defined contribution plans, such as a 401(k) or 403(b). The key difference is that defined contribution plan participants must select and manage investments themselves. As a result, they receive benefits in retirement from only what they have saved and invested, unlike under a traditional defined benefit pension plan. The same is true for other retirement vehicles that individuals can open on their own, such as IRAs.

Given this broad shift over the past half-century, the burden of investing properly now falls squarely on the shoulders of individuals. For this reason, it is essential to understand the key principles of investing, especially because they are not typically taught in school.

First, investors should hold a properly constructed portfolio tailored to their specific needs, including their life stage, risk tolerance, and more. In the short run, choosing the right mix of assets can help investors to weather the inevitable market swings that occur quite often, such as during the market pullbacks that have occurred throughout this year.

For example, stocks tend to generate larger returns but are also more volatile, as shown in the accompanying chart. In contrast, bonds are typically more stable but also have less potential upside. An appropriate asset allocation allows investors to take advantage of the positive attributes of both asset classes to create a portfolio that is more than the sum of its parts. Investors can then adjust this asset allocation throughout the various stages of their lives and as they approach retirement, in addition to making strategic shifts based on market conditions or life circumstances.

Starting early and staying invested are critical for retirement

Second, saving early can help investors build wealth due to the power of compounding. The earlier an individual begins investing, the more time their money has to grow before withdrawals are needed. This is true even during periods of market turbulence such as over the past few years. While staying out of the market or keeping cash in a checking account may feel safe, the true opportunity cost is the forgone gains that could have helped to provide a more secure retirement.

Finally, it’s important to always stay focused on the long run rather than worrying about day-to-day market fluctuations. Investing early and staying invested through the ups-and-downs of market cycles are the best ways to achieve financial goals. Trying to time the market or make sudden changes to a portfolio is not only difficult but can be counterproductive since it derails investors from their true objectives.

It can often feel as if there is always another crisis on the horizon whether due to politics, the Fed, interest rates, or tech stocks. However, while there are no guarantees when it comes to investing, history shows that investors who save steadily and follow these key principles will be in a better position to grow their retirement savings.

Concerns or questions about how your investment portfolio will hold up in the current market environment? Contact Financial Synergies today.

We are a boutique, financial advisory and total wealth management firm with over 35 years helping clients navigate turbulent markets. To learn more about our approach to investment management please reach out to us. One of our seasoned advisors would be happy to help you build a custom financial plan to help ensure you accomplish your financial goals and objectives. Schedule a conversation with us today.

More relevant articles by Financial Synergies:

Disclosures

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own financial advisors as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blogs, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Financial Synergies Wealth Advisors, Inc. employees providing such comments, and should not be regarded as the views of Financial Synergies Wealth Advisors, Inc. or its respective affiliates or as a description of advisory services provided by Financial Synergies Wealth Advisors, Inc. or performance returns of any Financial Synergies Wealth Advisors, Inc. client.

Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Financial Synergies Wealth Advisors, Inc. or its employees. The views reflected in the commentary are subject to change at any time without notice.

Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. It also should not be construed as an offer soliciting the purchase or sale of any security mentioned. Nor should it be construed as an offer to provide investment advisory services by Financial Synergies Wealth Advisors, Inc.

Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Financial Synergies Wealth Advisors, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Any charts provided here or on any related Financial Synergies Wealth Advisors, Inc. personnel content outlets are for informational purposes only, and should also not be relied upon when making any investment decision. Any indices referenced for comparison are unmanaged and cannot be invested into directly. As always please remember investing involves risk and possible loss of principal capital; please seek advice from a licensed professional. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Information in charts have been obtained from third-party sources and data, and may include those from portfolio securities of funds managed by Financial Synergies Wealth Advisors, Inc. While taken from sources believed to be reliable, Financial Synergies Wealth Advisors, Inc. has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. All content speaks only as of the date indicated.

Financial Synergies Wealth Advisors, Inc. is a registered investment adviser. Advisory services are only offered to clients or prospective clients where Financial Synergies Wealth Advisors, Inc. and its representatives are properly licensed or exempt from licensure. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

See Full Disclosures Page Here

Recent Posts

Last Week on Wall Street: T For Tariffs, T For Trillion [July 14-2025]

Should You Fear Market All-Time Highs?

Last Week on Wall Street: Trade and Jobs Cheer Markets [July 7-2025]

Subscribe to Our Blog

Financial Synergies Editorial Board