- December 13, 2021

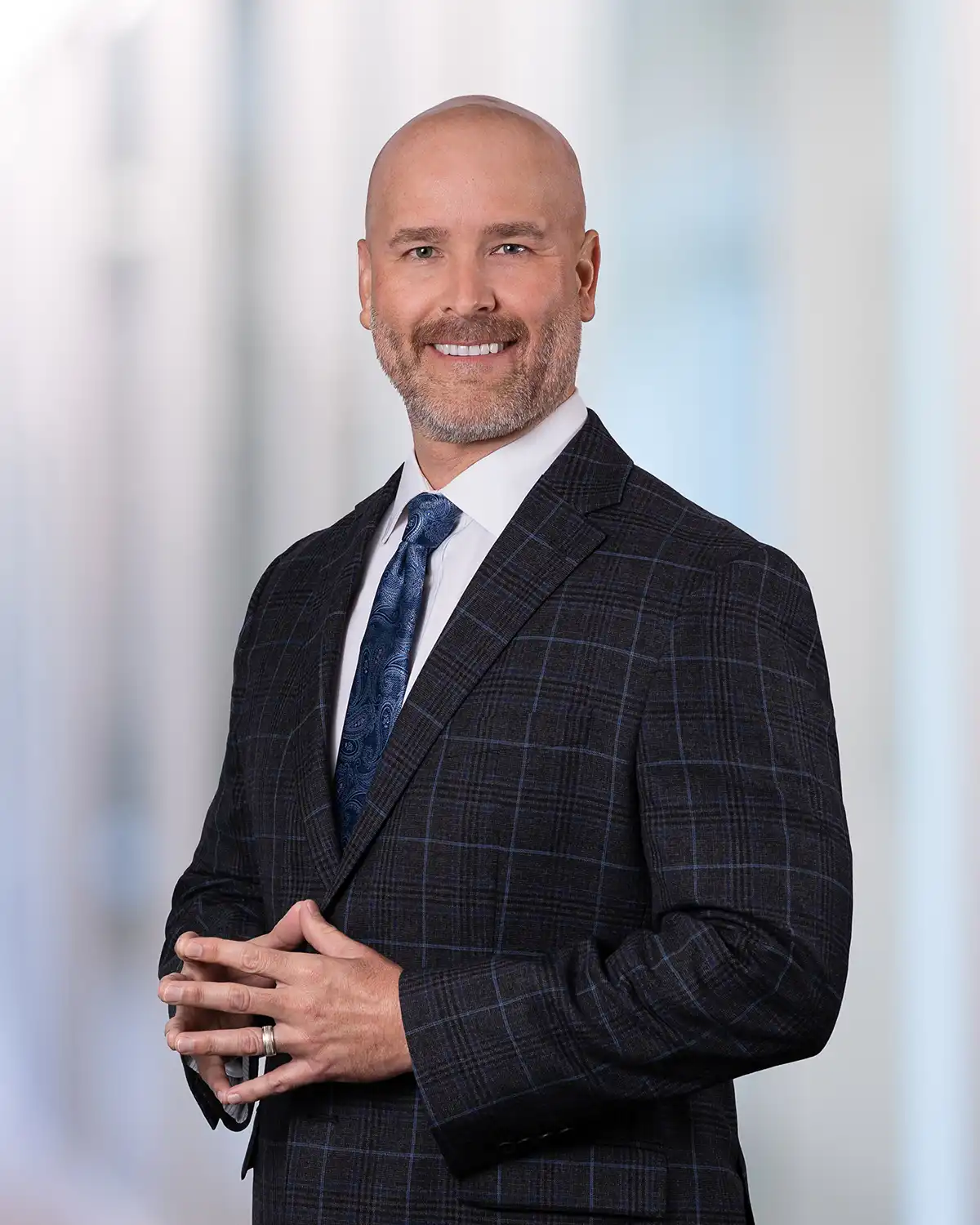

- Mike Minter

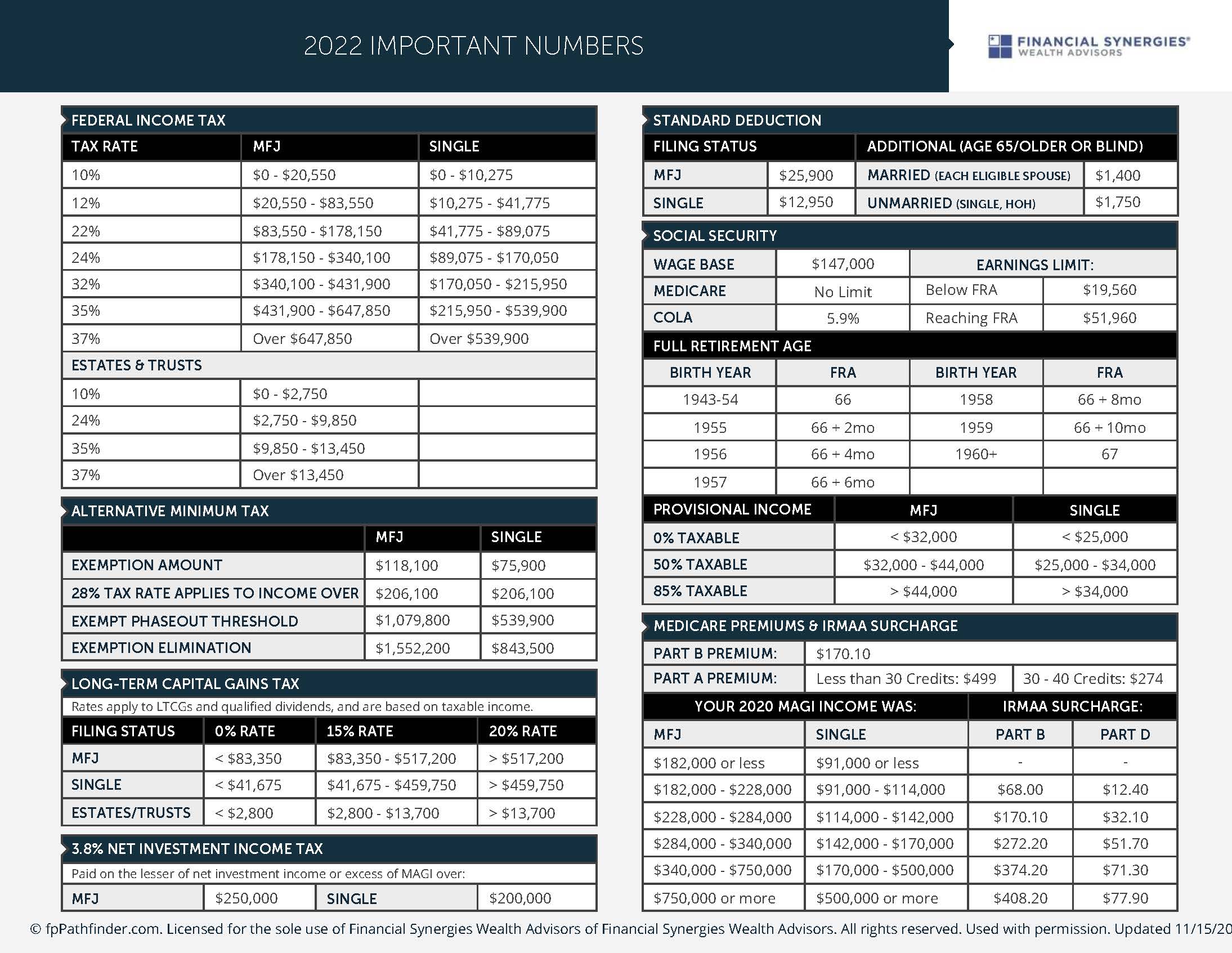

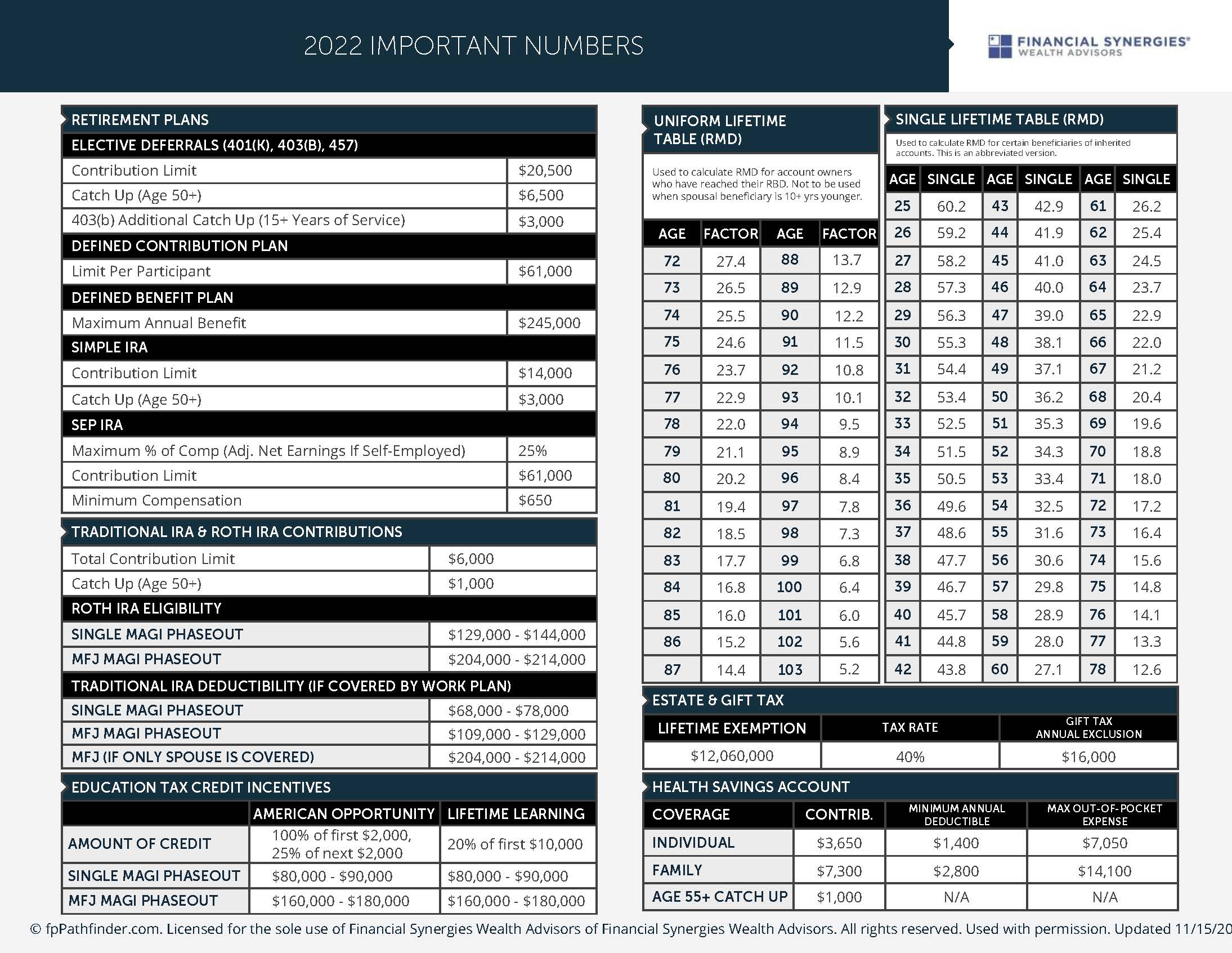

With the new year right around the corner, we thought we’d go ahead and provide you with some important tax numbers for 2022. Some of these numbers are subject to change if Congress acts, but for now the data is accurate.

This quick reference guide below covers the most important annual limits as well as figures that are commonly referred to during the year. It includes:

- Tax rates for MFJ, Single, and Estates/Trusts

- AMT annual limits

- LTCG rates for MFJ, Single, and Estates/Trusts

- Standard deductions for MFJ and Single

- Social Security annual limits (including earning limits)

- Full Retirement Age chart

- Social Security taxation summary for MFJ and Single

- IRMAA surcharges

- Retirement plan annual limits

- Traditional and Roth IRA annual limits

- Education tax credits

- Uniform Lifetime Table (abbreviated version)

- Single Lifetime Table (abbreviated version)

- Estate and gift tax annual limits

- HSA annual limits

If you’d like to download this guide as a PDF, click here.