S&P 500 Sets More Than 35 New Highs for Second Consecutive Year

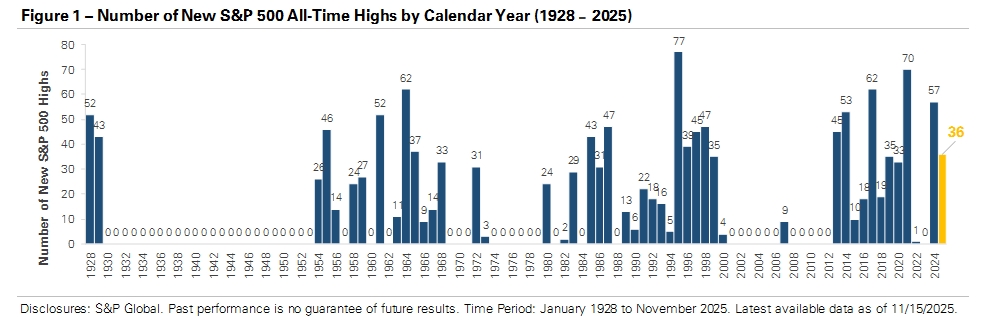

The stock market is having another record-setting year. The chart below shows the S&P 500 has set 36 new highs since the start of the year.

For your convenience, we’ve also provided a PDF copy of the Chart of the Month | S&P 500 Sets More Than 35 New Highs for Second Consecutive Year

While it’s a decline from last year’s pace, the number of new highs in 2025 ranks 18th compared to the past 98 years. The S&P 500’s strong performance this year is part of a broader equity market trend, with multiple other major equity indices also setting new highs. The Nasdaq has logged 36 new highs, the Dow Jones has posted 17, and the small-cap Russell 2000 has recorded six new highs after finally surpassing its 2021 peak.

A combination of themes is contributing to the stock market’s lengthy list of new highs, with the most notable being the artificial intelligence boom. Companies are spending hundreds of billions on infrastructure to train AI models, build data centers, and source the energy to run it all. Nvidia recently became the first company to surpass a $5 trillion market cap, and leading technology firms like Microsoft, Amazon, Alphabet, and Meta are reporting strong growth tied directly to demand for their cloud computing services.

The industry’s momentum and forecasts for continued strong growth are driving AI stocks higher, and their large index weights are helping to push the broader markets to all-time highs despite narrow market leadership. To put the rally into perspective, the market-cap-weighted Russell 1000 Index is up +14% year-to-date. The equal-weight version of the index is up +6%, and the median stock has gained just +2%. Beneath the surface, nearly half the index is in the red, with 462 companies down year-to-date.

While AI is getting the most attention, several other catalysts have contributed to the market’s strength. After a 9-month pause, the Federal Reserve restarted its rate-cutting cycle in September, lowering interest rates by -0.50% over the past two months. Lower borrowing costs and expectations for additional rate cuts have provided a tailwind for stocks.

At the same time, the U.S. economy has remained resilient in the face of multiple headwinds, including trade policy and tariffs, geopolitical tensions, and a government shutdown. Corporate earnings growth remains strong, and Q3 earnings exceeded expectations.

This year has shown the value of staying invested through uncertainty. Trade tensions and policy uncertainty have created periods of market volatility, and if investors had known the headlines before the year began, they may have been tempted to sell. However, doing so would have meant missing out on the S&P 500’s nearly +15% return and long list of new highs.

Timing the market is difficult and often costly, and it can lead to missed opportunities that make it difficult to meet your financial goals. Each year brings its own reminders of core financial planning principles. If 2025 underscored the importance of staying invested, 2026 may highlight the importance of portfolio diversification.

Disclosure

The information and opinions provided herein are provided as general market commentary only – not financial advice – and are subject to change at any time without notice. This commentary may contain forward-looking statements that are subject to various risks and uncertainties. None of the events or outcomes mentioned here may come to pass, and actual results may differ materially from those expressed or implied in these statements. No mention of a particular security, index, or other instrument in this report constitutes a recommendation to buy, sell, or hold that or any other security, nor does it constitute an opinion on the suitability of any security or index. The report is strictly an informational publication and has been prepared without regard to the particular investments and circumstances of the recipient.

Past performance does not guarantee or indicate future results. Any index performance mentioned is for illustrative purposes only and does not reflect any management fees, transaction costs, or expenses. Indexes are unmanaged, and one cannot invest directly in an index. Index performance does not represent the actual performance that would be achieved by investing in a fund.

See Full Disclosures Page

Concerns or questions about how your investment portfolio will hold up in the current market environment? Contact Financial Synergies today.

We are a boutique, financial advisory and total wealth management firm with over 35 years helping clients navigate turbulent markets. To learn more about our approach to investment management please reach out to us. One of our seasoned advisors would be happy to help you build a custom financial plan to help ensure you accomplish your financial goals and objectives. Schedule a conversation with us today.

More relevant articles by Financial Synergies:

Blog Disclosures

This content, which may contain security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own financial advisors as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blogs, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Financial Synergies Wealth Advisors, Inc. employees providing such comments, and should not be regarded as the views of Financial Synergies Wealth Advisors, Inc. or its respective affiliates or as a description of advisory services provided by Financial Synergies Wealth Advisors, Inc. or performance returns of any Financial Synergies Wealth Advisors, Inc. client.

Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Financial Synergies Wealth Advisors, Inc. or its employees. The views reflected in the commentary are subject to change at any time without notice.

Nothing on this website or Blog constitutes investment or financial planning advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. It also should not be construed as an offer soliciting the purchase or sale of any security mentioned. Nor should it be construed as an offer to provide investment advisory services by Financial Synergies Wealth Advisors, Inc.

Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Financial Synergies Wealth Advisors, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Any charts provided here or on any related Financial Synergies Wealth Advisors, Inc. personnel content outlets are for informational purposes only, and should also not be relied upon when making any investment decision. Any indices referenced for comparison are unmanaged and cannot be invested into directly. As always please remember investing involves risk and possible loss of principal capital; please seek advice from a licensed professional. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Information in charts have been obtained from third-party sources and data, and may include those from portfolio securities of funds managed by Financial Synergies Wealth Advisors, Inc. While taken from sources believed to be reliable, Financial Synergies Wealth Advisors, Inc. has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. All content speaks only as of the date indicated.

Financial Synergies Wealth Advisors, Inc. is a registered investment adviser. Advisory services are only offered to clients or prospective clients where Financial Synergies Wealth Advisors, Inc. and its representatives are properly licensed or exempt from licensure. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

See Full Disclosures Page Here

Chart of the Month | S&P 500 Sets More Than 35 New Highs for Second Consecutive Year

S&P 500 Sets More Than 35 New Highs for Second Consecutive Year

The stock market is having another record-setting year. The chart below shows the S&P 500 has set 36 new highs since the start of the year.

For your convenience, we’ve also provided a PDF copy of the Chart of the Month | S&P 500 Sets More Than 35 New Highs for Second Consecutive Year

While it’s a decline from last year’s pace, the number of new highs in 2025 ranks 18th compared to the past 98 years. The S&P 500’s strong performance this year is part of a broader equity market trend, with multiple other major equity indices also setting new highs. The Nasdaq has logged 36 new highs, the Dow Jones has posted 17, and the small-cap Russell 2000 has recorded six new highs after finally surpassing its 2021 peak.

A combination of themes is contributing to the stock market’s lengthy list of new highs, with the most notable being the artificial intelligence boom. Companies are spending hundreds of billions on infrastructure to train AI models, build data centers, and source the energy to run it all. Nvidia recently became the first company to surpass a $5 trillion market cap, and leading technology firms like Microsoft, Amazon, Alphabet, and Meta are reporting strong growth tied directly to demand for their cloud computing services.

The industry’s momentum and forecasts for continued strong growth are driving AI stocks higher, and their large index weights are helping to push the broader markets to all-time highs despite narrow market leadership. To put the rally into perspective, the market-cap-weighted Russell 1000 Index is up +14% year-to-date. The equal-weight version of the index is up +6%, and the median stock has gained just +2%. Beneath the surface, nearly half the index is in the red, with 462 companies down year-to-date.

While AI is getting the most attention, several other catalysts have contributed to the market’s strength. After a 9-month pause, the Federal Reserve restarted its rate-cutting cycle in September, lowering interest rates by -0.50% over the past two months. Lower borrowing costs and expectations for additional rate cuts have provided a tailwind for stocks.

At the same time, the U.S. economy has remained resilient in the face of multiple headwinds, including trade policy and tariffs, geopolitical tensions, and a government shutdown. Corporate earnings growth remains strong, and Q3 earnings exceeded expectations.

This year has shown the value of staying invested through uncertainty. Trade tensions and policy uncertainty have created periods of market volatility, and if investors had known the headlines before the year began, they may have been tempted to sell. However, doing so would have meant missing out on the S&P 500’s nearly +15% return and long list of new highs.

Timing the market is difficult and often costly, and it can lead to missed opportunities that make it difficult to meet your financial goals. Each year brings its own reminders of core financial planning principles. If 2025 underscored the importance of staying invested, 2026 may highlight the importance of portfolio diversification.

Disclosure

The information and opinions provided herein are provided as general market commentary only – not financial advice – and are subject to change at any time without notice. This commentary may contain forward-looking statements that are subject to various risks and uncertainties. None of the events or outcomes mentioned here may come to pass, and actual results may differ materially from those expressed or implied in these statements. No mention of a particular security, index, or other instrument in this report constitutes a recommendation to buy, sell, or hold that or any other security, nor does it constitute an opinion on the suitability of any security or index. The report is strictly an informational publication and has been prepared without regard to the particular investments and circumstances of the recipient.

Past performance does not guarantee or indicate future results. Any index performance mentioned is for illustrative purposes only and does not reflect any management fees, transaction costs, or expenses. Indexes are unmanaged, and one cannot invest directly in an index. Index performance does not represent the actual performance that would be achieved by investing in a fund.

See Full Disclosures Page

Concerns or questions about how your investment portfolio will hold up in the current market environment? Contact Financial Synergies today.

We are a boutique, financial advisory and total wealth management firm with over 35 years helping clients navigate turbulent markets. To learn more about our approach to investment management please reach out to us. One of our seasoned advisors would be happy to help you build a custom financial plan to help ensure you accomplish your financial goals and objectives. Schedule a conversation with us today.

More relevant articles by Financial Synergies:

Blog Disclosures

This content, which may contain security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own financial advisors as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blogs, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Financial Synergies Wealth Advisors, Inc. employees providing such comments, and should not be regarded as the views of Financial Synergies Wealth Advisors, Inc. or its respective affiliates or as a description of advisory services provided by Financial Synergies Wealth Advisors, Inc. or performance returns of any Financial Synergies Wealth Advisors, Inc. client.

Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Financial Synergies Wealth Advisors, Inc. or its employees. The views reflected in the commentary are subject to change at any time without notice.

Nothing on this website or Blog constitutes investment or financial planning advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. It also should not be construed as an offer soliciting the purchase or sale of any security mentioned. Nor should it be construed as an offer to provide investment advisory services by Financial Synergies Wealth Advisors, Inc.

Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Financial Synergies Wealth Advisors, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Any charts provided here or on any related Financial Synergies Wealth Advisors, Inc. personnel content outlets are for informational purposes only, and should also not be relied upon when making any investment decision. Any indices referenced for comparison are unmanaged and cannot be invested into directly. As always please remember investing involves risk and possible loss of principal capital; please seek advice from a licensed professional. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Information in charts have been obtained from third-party sources and data, and may include those from portfolio securities of funds managed by Financial Synergies Wealth Advisors, Inc. While taken from sources believed to be reliable, Financial Synergies Wealth Advisors, Inc. has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. All content speaks only as of the date indicated.

Financial Synergies Wealth Advisors, Inc. is a registered investment adviser. Advisory services are only offered to clients or prospective clients where Financial Synergies Wealth Advisors, Inc. and its representatives are properly licensed or exempt from licensure. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

See Full Disclosures Page Here

Recent Posts

Chart of the Month | S&P 500 Sets More Than 35 New Highs for Second Consecutive Year

Using Structured Notes for Enhanced Income, Protection, and Better Planning

Webinar: What Are Structured Notes?

Subscribe to Our Blog

Shareholder | Chief Investment Officer