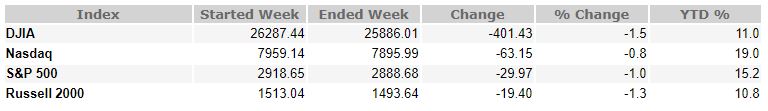

The stock market finished lower this week in another wild ride on Wall Street. The S&P 500 (-1.0%), Dow Jones Industrial Average (-1.5%), and Russell 2000 (-1.3%) lost at least 1.0%, while the Nasdaq Composite (-0.8%) fared slightly better.

Eight of the 11 S&P 500 sectors finished lower. The energy sector (-3.9%) led the retreat, followed by the financials sector (-2.2%) amid another steep drop in U.S. Treasury yields. The lower yields, however, benefited the utilities (+0.5%) and real estate (+0.3%) sectors, while the consumer staples sector (+1.6%) showed some strength. The Philadelphia Semiconductor Index (+1.0%) also finished higher amid some hope that the U.S. and China could still work out a trade deal.

Eight of the 11 S&P 500 sectors finished lower. The energy sector (-3.9%) led the retreat, followed by the financials sector (-2.2%) amid another steep drop in U.S. Treasury yields. The lower yields, however, benefited the utilities (+0.5%) and real estate (+0.3%) sectors, while the consumer staples sector (+1.6%) showed some strength. The Philadelphia Semiconductor Index (+1.0%) also finished higher amid some hope that the U.S. and China could still work out a trade deal.

The week began with investors continuing to seek safety in U.S. Treasuries and gold. Growth concerns, however, were temporarily set aside after the White House announced that it will delay the 10% tariff rate for some items imported from China, including cell phones and laptops, until Dec. 15. The news sparked a relief rally that quickly evaporated following another round of disappointing data from China and Germany.

The rush back to safety briefly sent the yield on the 10-yr note below the yield on the 2-yr note for the first time since 2007, which is an inversion that has preceded each recession since 1980. The average length of time between the first inversion and the start of each recession since 1980 has averaged 18 months, with the range being as little as ten months to as many as two years.

The 2-yr yield fell 16 basis points to 1.47%, and the 10-yr yield fell 19 basis points to 1.54%. The U.S. Dollar Index increased 0.7% to 98.18. WTI crude increased 0.5% to $54.89/bbl.

Understandably, the 2yr-10yr spread inversion spooked some investors, but the resiliency of the U.S. consumer, whose spending accounts for approximately 70% of GDP, helped ease some nerves. This sentiment flowed from a 0.7% m/m increase in retail sales for July and solid earnings results and higher guidance from Walmart (WMT).

On a related note, President Trump said he delayed some tariffs (most will still go into effect on Sept. 1) to ensure consumer spending isn’t hurt during the Christmas shopping season.

Separately, many institutions around the world, including the ECB, China, and Germany, were reportedly taking steps to stimulate growth if need be. This support helped foster some risk sentiment late in the week.

Source: Briefing Investors

August 16, 2019 Weekly Market Recap

The stock market finished lower this week in another wild ride on Wall Street. The S&P 500 (-1.0%), Dow Jones Industrial Average (-1.5%), and Russell 2000 (-1.3%) lost at least 1.0%, while the Nasdaq Composite (-0.8%) fared slightly better.

The week began with investors continuing to seek safety in U.S. Treasuries and gold. Growth concerns, however, were temporarily set aside after the White House announced that it will delay the 10% tariff rate for some items imported from China, including cell phones and laptops, until Dec. 15. The news sparked a relief rally that quickly evaporated following another round of disappointing data from China and Germany.

The rush back to safety briefly sent the yield on the 10-yr note below the yield on the 2-yr note for the first time since 2007, which is an inversion that has preceded each recession since 1980. The average length of time between the first inversion and the start of each recession since 1980 has averaged 18 months, with the range being as little as ten months to as many as two years.

The 2-yr yield fell 16 basis points to 1.47%, and the 10-yr yield fell 19 basis points to 1.54%. The U.S. Dollar Index increased 0.7% to 98.18. WTI crude increased 0.5% to $54.89/bbl.

Understandably, the 2yr-10yr spread inversion spooked some investors, but the resiliency of the U.S. consumer, whose spending accounts for approximately 70% of GDP, helped ease some nerves. This sentiment flowed from a 0.7% m/m increase in retail sales for July and solid earnings results and higher guidance from Walmart (WMT).

On a related note, President Trump said he delayed some tariffs (most will still go into effect on Sept. 1) to ensure consumer spending isn’t hurt during the Christmas shopping season.

Separately, many institutions around the world, including the ECB, China, and Germany, were reportedly taking steps to stimulate growth if need be. This support helped foster some risk sentiment late in the week.

Source: Briefing Investors

Recent Posts

Last Week on Wall Street: Stocks Boost on Strong Q3 Results

Quarterly Webinar: Q4 2025 Market and Economic Themes

Are You Holding Too Much Cash?

Subscribe to Our Blog

Shareholder | Chief Investment Officer