After a historic year, investors have much to be thankful for this holiday season. Despite periods of uncertainty around the Federal Reserve, the presidential election, and geopolitical conflicts, the stock market has delivered exceptional returns in 2024.

With only a few weeks left in the year, the S&P 500 has gained 26.7% with dividends year-to-date, the Dow 19.5%, and the Nasdaq 27.4%. International stocks have also performed well, with emerging markets advancing 9.0% and developed markets 4.8%. Economic growth has exceeded expectations, with inflation returning to pre-pandemic levels, unemployment still low, and GDP growing steadily.

Just as many express gratitude in their personal lives, the holidays are a good time to do so in our investing and financial lives. This is important because investors sometimes have a tendency to focus only on what can go wrong. Even after two strong market years, there is no shortage of concerns on issues such as market fundamentals, the direction of the economy, the size of the national debt, global instability, and more.

While past performance is no guarantee of future success, staying focused on the long run is the best way to achieve financial goals. Over the course of days, weeks and months, markets can fluctuate significantly just as they did in April and August, or in 2020 and 2022. However, over longer time horizons, markets have tended to rise due to the strength of economic growth. Here are 3 reasons investors can be thankful this holiday season.

Financial markets have performed well this year

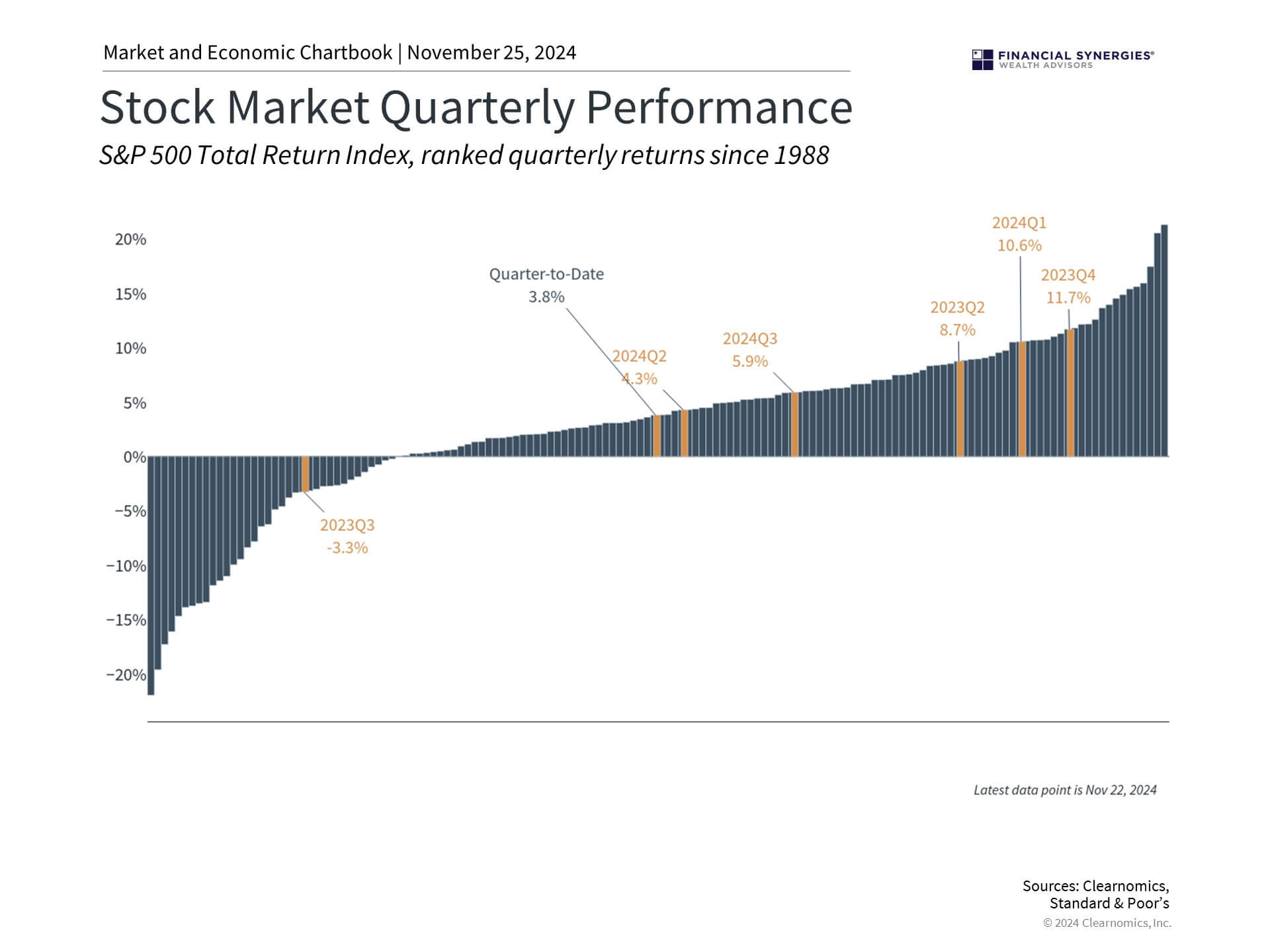

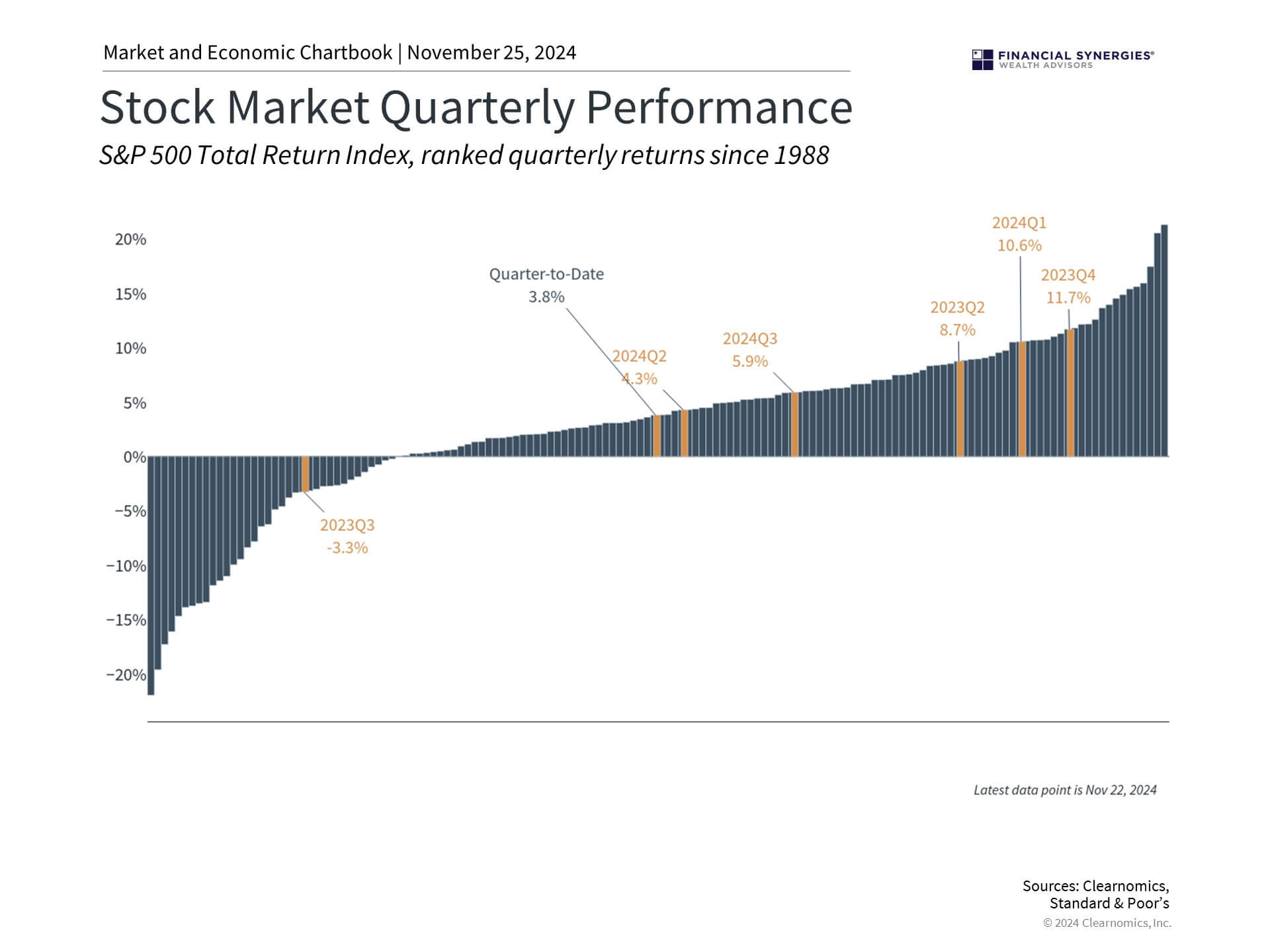

First, the U.S. stock market has demonstrated impressive strength in 2024. This is due to robust corporate earnings, better-than-expected economic conditions, and improving investor confidence. The accompanying chart shows that except for one quarter, the last two years have experienced steady market returns. While technology and AI stocks have led the way, many other sectors have contributed this year. In fact, most parts of the market are positive year-to-date, and eight of the eleven S&P 500 sectors have generated double-digit returns.

The strong bull market since the end of 2022 does mean that valuations are no longer as attractive. The price-to-earnings ratio for the S&P 500 is now 22.3, nearing both recent highs and the dot-com peak of 24.5.

Rather than a reason to avoid the stock market, stretched valuations are a reminder to hold a properly constructed portfolio. Owning stocks, or any risk asset, needs to be balanced with asset classes such as bonds to achieve portfolio goals.

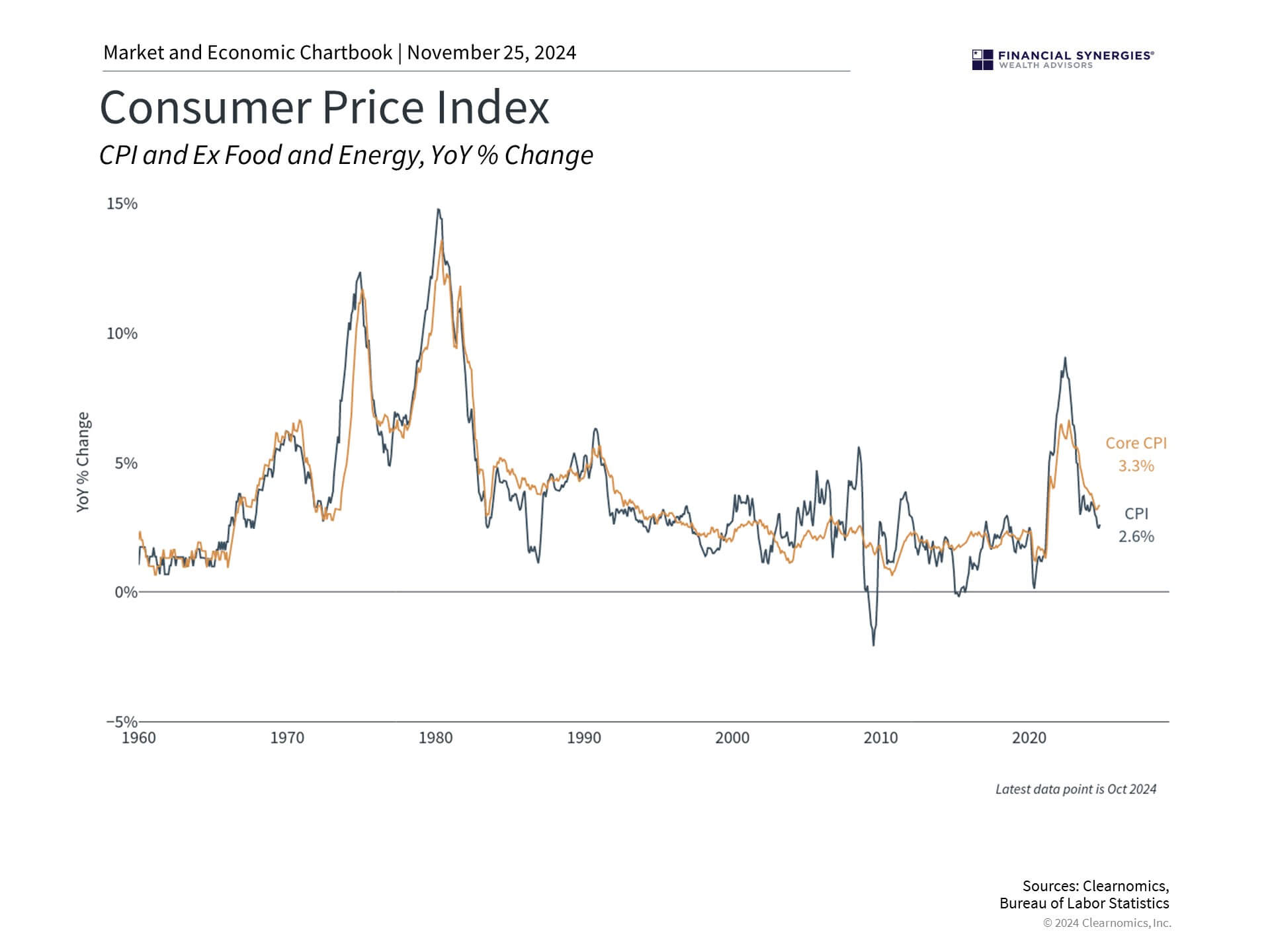

Inflation is returning to normal levels

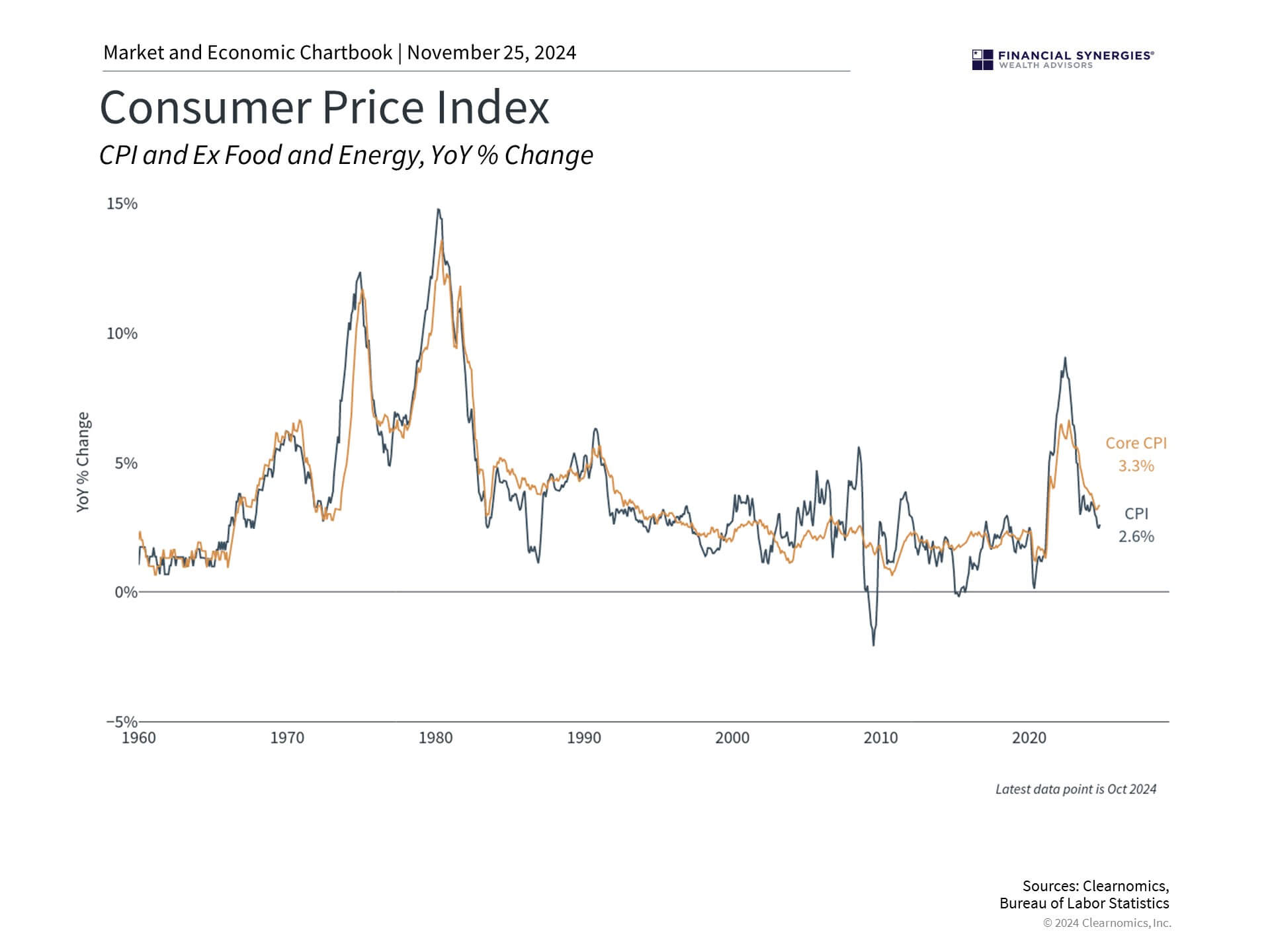

Second, investors can be thankful that inflation rates have slowed to pre-pandemic levels. While this does not mean that prices will fall for most everyday necessities, including food and rent, it is a positive sign, nonetheless. This is especially true for investment portfolios since they are sensitive to interest rates, which are directly affected by inflation.

Normalizing inflation has allowed the Federal Reserve to begin cutting policy rates for the first time since early 2022. Much of this year’s stock market volatility was the result of investors guessing when and by how much the Fed would do so.

In the end, trying to determine the exact timing was far less important than understanding the general trend of lower short-term interest rates. Thus, for investors with long time horizons, constructing a portfolio based on these factors, rather than the trends that have driven markets over the past several years, is more important than ever.

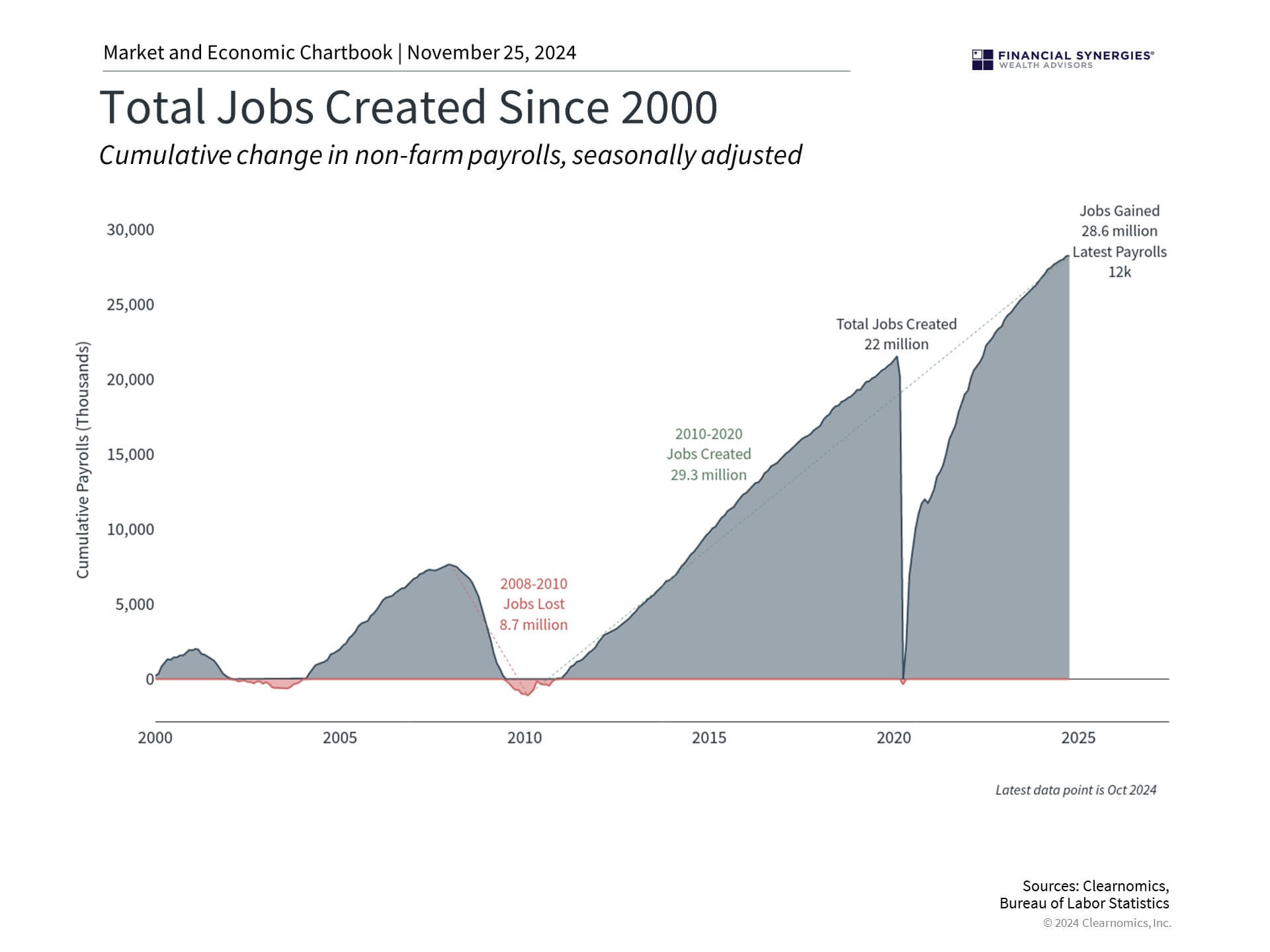

The economy and job market remain strong

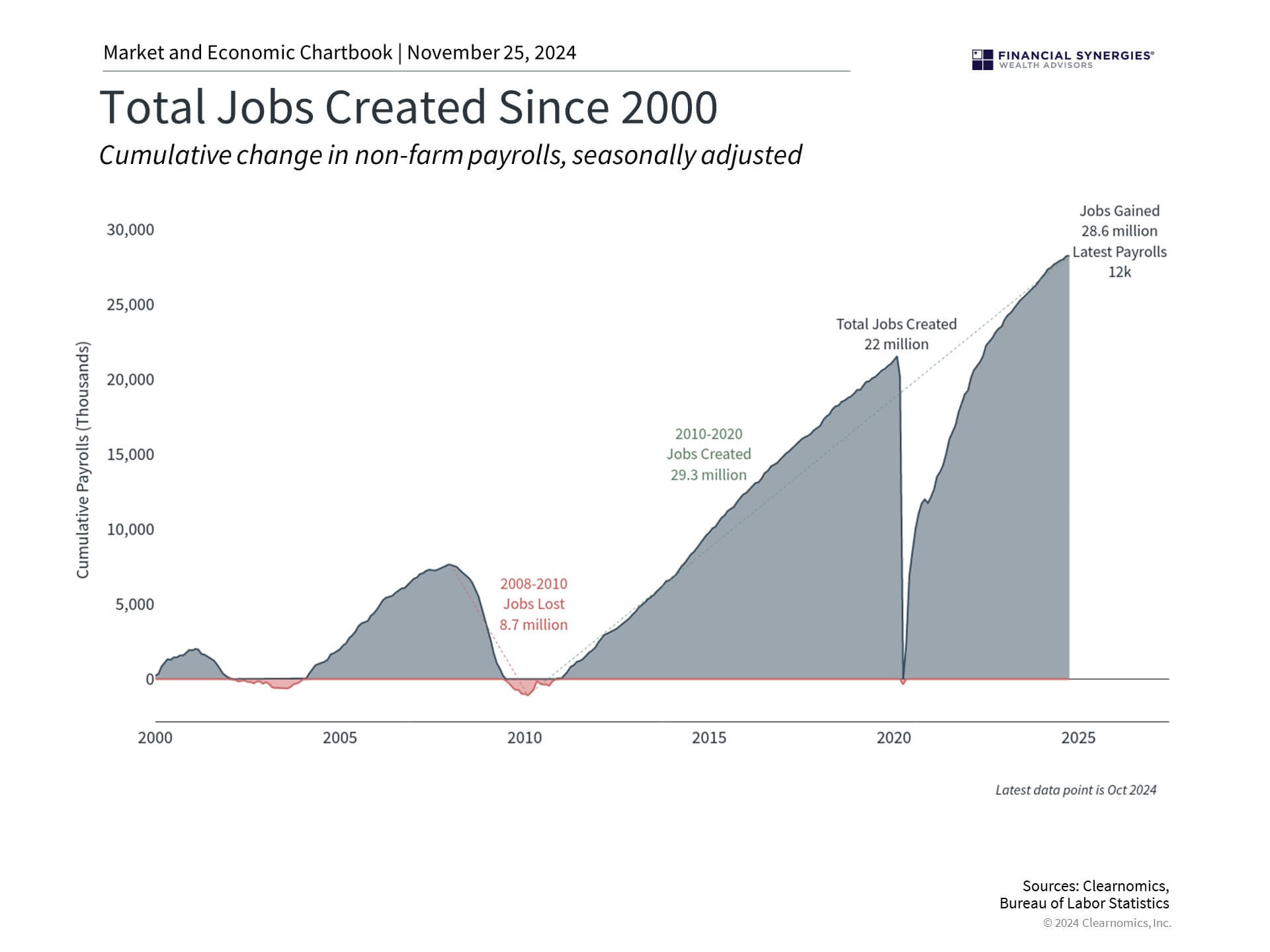

Finally, for everyday individuals, there is perhaps nothing more important from an economic standpoint than the strength of the job market. The fear as the Fed raised rates was that the economy would face a “hard landing” – i.e., bringing inflation down would cause a collapse in hiring.

Fortunately, this did not occur. Unemployment is still near historically low levels and job gains have been steady. Wages have also risen, although not as fast as overall inflation. The accompanying chart shows that the economy has created 28.6 million new jobs since the pandemic, far eclipsing the previous level. While job gains differ from sector to sector, this means that many consumers are in a healthy financial position.

More broadly, the U.S. economy continues to demonstrate remarkable resilience, with real GDP growing at an annualized rate of 2.8% in the most recent quarter. This is largely due to the strength of consumer spending, which has contributed greatly to overall growth. While this can’t last forever – consumers have largely spent their excess savings from the past few years and debt levels are rising – the hope is that lower rates, clarity around tax policy, and increased business investment will continue to support the economy.

Markets never move up in a straight line, and this year was no exception. Still, returns have been historically strong despite periods of volatility. This holiday season, try and focus on the positives and ensure your portfolio is aligned with long-term financial goals.

Concerns or questions about how your investment portfolio will hold up in the current market environment? Contact Financial Synergies today.

We are a boutique, financial advisory and total wealth management firm with over 35 years helping clients navigate turbulent markets. To learn more about our approach to investment management please reach out to us. One of our seasoned advisors would be happy to help you build a custom financial plan to help ensure you accomplish your financial goals and objectives. Schedule a conversation with us today.

More relevant articles by Financial Synergies:

Blog Disclosures

This content, which may contain security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own financial advisors as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blogs, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Financial Synergies Wealth Advisors, Inc. employees providing such comments, and should not be regarded as the views of Financial Synergies Wealth Advisors, Inc. or its respective affiliates or as a description of advisory services provided by Financial Synergies Wealth Advisors, Inc. or performance returns of any Financial Synergies Wealth Advisors, Inc. client.

Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Financial Synergies Wealth Advisors, Inc. or its employees. The views reflected in the commentary are subject to change at any time without notice.

Nothing on this website or Blog constitutes investment or financial planning advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. It also should not be construed as an offer soliciting the purchase or sale of any security mentioned. Nor should it be construed as an offer to provide investment advisory services by Financial Synergies Wealth Advisors, Inc.

Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Financial Synergies Wealth Advisors, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Any charts provided here or on any related Financial Synergies Wealth Advisors, Inc. personnel content outlets are for informational purposes only, and should also not be relied upon when making any investment decision. Any indices referenced for comparison are unmanaged and cannot be invested into directly. As always please remember investing involves risk and possible loss of principal capital; please seek advice from a licensed professional. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Information in charts have been obtained from third-party sources and data, and may include those from portfolio securities of funds managed by Financial Synergies Wealth Advisors, Inc. While taken from sources believed to be reliable, Financial Synergies Wealth Advisors, Inc. has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. All content speaks only as of the date indicated.

Financial Synergies Wealth Advisors, Inc. is a registered investment adviser. Advisory services are only offered to clients or prospective clients where Financial Synergies Wealth Advisors, Inc. and its representatives are properly licensed or exempt from licensure. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

See Full Disclosures Page Here

3 Reasons Investors Can Be Thankful This Holiday Season

After a historic year, investors have much to be thankful for this holiday season. Despite periods of uncertainty around the Federal Reserve, the presidential election, and geopolitical conflicts, the stock market has delivered exceptional returns in 2024.

With only a few weeks left in the year, the S&P 500 has gained 26.7% with dividends year-to-date, the Dow 19.5%, and the Nasdaq 27.4%. International stocks have also performed well, with emerging markets advancing 9.0% and developed markets 4.8%. Economic growth has exceeded expectations, with inflation returning to pre-pandemic levels, unemployment still low, and GDP growing steadily.

Just as many express gratitude in their personal lives, the holidays are a good time to do so in our investing and financial lives. This is important because investors sometimes have a tendency to focus only on what can go wrong. Even after two strong market years, there is no shortage of concerns on issues such as market fundamentals, the direction of the economy, the size of the national debt, global instability, and more.

While past performance is no guarantee of future success, staying focused on the long run is the best way to achieve financial goals. Over the course of days, weeks and months, markets can fluctuate significantly just as they did in April and August, or in 2020 and 2022. However, over longer time horizons, markets have tended to rise due to the strength of economic growth. Here are 3 reasons investors can be thankful this holiday season.

Financial markets have performed well this year

First, the U.S. stock market has demonstrated impressive strength in 2024. This is due to robust corporate earnings, better-than-expected economic conditions, and improving investor confidence. The accompanying chart shows that except for one quarter, the last two years have experienced steady market returns. While technology and AI stocks have led the way, many other sectors have contributed this year. In fact, most parts of the market are positive year-to-date, and eight of the eleven S&P 500 sectors have generated double-digit returns.

The strong bull market since the end of 2022 does mean that valuations are no longer as attractive. The price-to-earnings ratio for the S&P 500 is now 22.3, nearing both recent highs and the dot-com peak of 24.5.

Rather than a reason to avoid the stock market, stretched valuations are a reminder to hold a properly constructed portfolio. Owning stocks, or any risk asset, needs to be balanced with asset classes such as bonds to achieve portfolio goals.

Inflation is returning to normal levels

Second, investors can be thankful that inflation rates have slowed to pre-pandemic levels. While this does not mean that prices will fall for most everyday necessities, including food and rent, it is a positive sign, nonetheless. This is especially true for investment portfolios since they are sensitive to interest rates, which are directly affected by inflation.

Normalizing inflation has allowed the Federal Reserve to begin cutting policy rates for the first time since early 2022. Much of this year’s stock market volatility was the result of investors guessing when and by how much the Fed would do so.

In the end, trying to determine the exact timing was far less important than understanding the general trend of lower short-term interest rates. Thus, for investors with long time horizons, constructing a portfolio based on these factors, rather than the trends that have driven markets over the past several years, is more important than ever.

The economy and job market remain strong

Finally, for everyday individuals, there is perhaps nothing more important from an economic standpoint than the strength of the job market. The fear as the Fed raised rates was that the economy would face a “hard landing” – i.e., bringing inflation down would cause a collapse in hiring.

Fortunately, this did not occur. Unemployment is still near historically low levels and job gains have been steady. Wages have also risen, although not as fast as overall inflation. The accompanying chart shows that the economy has created 28.6 million new jobs since the pandemic, far eclipsing the previous level. While job gains differ from sector to sector, this means that many consumers are in a healthy financial position.

More broadly, the U.S. economy continues to demonstrate remarkable resilience, with real GDP growing at an annualized rate of 2.8% in the most recent quarter. This is largely due to the strength of consumer spending, which has contributed greatly to overall growth. While this can’t last forever – consumers have largely spent their excess savings from the past few years and debt levels are rising – the hope is that lower rates, clarity around tax policy, and increased business investment will continue to support the economy.

Markets never move up in a straight line, and this year was no exception. Still, returns have been historically strong despite periods of volatility. This holiday season, try and focus on the positives and ensure your portfolio is aligned with long-term financial goals.

Concerns or questions about how your investment portfolio will hold up in the current market environment? Contact Financial Synergies today.

We are a boutique, financial advisory and total wealth management firm with over 35 years helping clients navigate turbulent markets. To learn more about our approach to investment management please reach out to us. One of our seasoned advisors would be happy to help you build a custom financial plan to help ensure you accomplish your financial goals and objectives. Schedule a conversation with us today.

More relevant articles by Financial Synergies:

Blog Disclosures

This content, which may contain security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own financial advisors as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blogs, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Financial Synergies Wealth Advisors, Inc. employees providing such comments, and should not be regarded as the views of Financial Synergies Wealth Advisors, Inc. or its respective affiliates or as a description of advisory services provided by Financial Synergies Wealth Advisors, Inc. or performance returns of any Financial Synergies Wealth Advisors, Inc. client.

Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Financial Synergies Wealth Advisors, Inc. or its employees. The views reflected in the commentary are subject to change at any time without notice.

Nothing on this website or Blog constitutes investment or financial planning advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. It also should not be construed as an offer soliciting the purchase or sale of any security mentioned. Nor should it be construed as an offer to provide investment advisory services by Financial Synergies Wealth Advisors, Inc.

Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Financial Synergies Wealth Advisors, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Any charts provided here or on any related Financial Synergies Wealth Advisors, Inc. personnel content outlets are for informational purposes only, and should also not be relied upon when making any investment decision. Any indices referenced for comparison are unmanaged and cannot be invested into directly. As always please remember investing involves risk and possible loss of principal capital; please seek advice from a licensed professional. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Information in charts have been obtained from third-party sources and data, and may include those from portfolio securities of funds managed by Financial Synergies Wealth Advisors, Inc. While taken from sources believed to be reliable, Financial Synergies Wealth Advisors, Inc. has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. All content speaks only as of the date indicated.

Financial Synergies Wealth Advisors, Inc. is a registered investment adviser. Advisory services are only offered to clients or prospective clients where Financial Synergies Wealth Advisors, Inc. and its representatives are properly licensed or exempt from licensure. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

See Full Disclosures Page Here

Recent Posts

Credit Concerns and “Cockroaches”

Last Week on Wall Street: Tough Week for Tech Stocks [Nov. 10-2025]

Financial Synergies Wealth Advisors Named to Forbes’ List of America’s Top RIAs for Third Consecutive Year

Subscribe to Our Blog

Shareholder | Chief Investment Officer